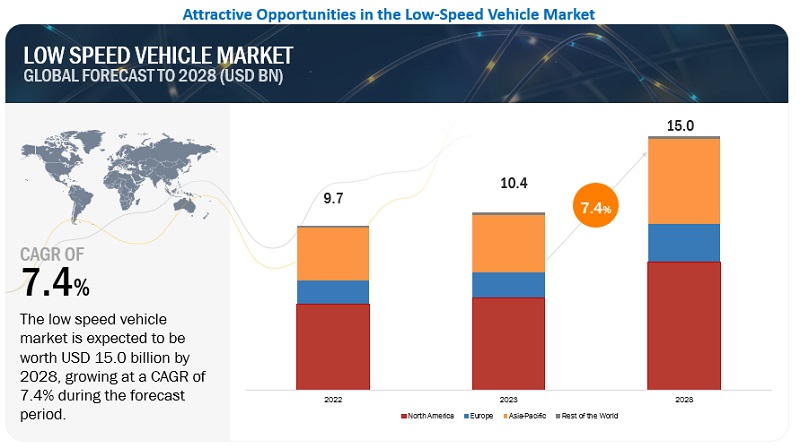

The low speed vehicle market size was valued at USD 0.4 billion in 2023 and is expected to reach USD 15.0 billion by 2028, at a CAGR of 7.4% during the forecast period 2022-2028. Low speed vehicles (LSVs) are 4-wheeled vehicles with a maximum capable speed of typically about 25 mph (40 km/h). These vehicles are used as industrial vehicles, neighborhood vehicles, turf utility vehicle, and golf carts. It is easy to maneuver and hence find applications in golf courses, school, college & university campuses. industrial areas, corporate offices, museums, and gated communities, among others. Low speed vehicles are currently available in conventional fuel models as well as electric models. According to MnM analysis, more than 60% of these vehicles electrically operated and expected to dominate at a global market under the review period.

Electric Low-speed vehicles are predicted to be the largest segment.

Electric Low-speed vehicles are estimated to dominate the market over the forecast period. The market growth mainly concerns lower production and operational costs with simple architecture and requires fewer spare parts and components than IC engine vehicles. With constantly declining battery costs, and lower after-sales maintenance costs; the electric LSVs are expected to provide better ROIs, which in turn would further drive their market demand. Further, improving charging infrastructure in major markets such as China, US, Germany, and France are supporting the growth of electric LSVs. Global players such as Club Car (US), The Toro Company (US), Textron Inc. (US), etc., are extending their electric offerings, which deliver performance par with ICE counterpart. Thus, favorable government norms and the development of necessary charging infrastructure will be growing factors for electric LSVs.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1965274

Golf courses are the largest application market for low-speed vehicles

Golf courses are estimated to be the leading LSV application in 2023. The paradigm shift is experienced towards golf events and sports post Covid-19 crisis across the world, and it has been considered an elite sport for leisure pastime for any age group. As per the National Golf Foundation (NGF) records, there was a 15% increase in the total count of golf rounds played in 2022 compared to 2019. North America leads the golf course count; adversely, the count is rapidly growing in Asian countries. The number of golf clubs has increased which gives benefits to the packaged family membership card holders with family-friendly environments, luxury rooms, fitness rooms, and advanced amenities for encouraging new members. This will drive the golf carts demand with 2 to 8-seater capacity. This would bring an ideal growth perspective for golf carts across these countries in the coming years.

North America is estimated to be the dominant low-speed vehicle market.

North America holds the largest share globally. This region has a higher demand for LSVs as US alone had 16,000 or 40% of the total golf courses worldwide which are used in various applications, such as golf courses, hotels and resorts, airports, industrial facilities, and others. This region has the highest LSV market share, accounting for more than 51.9 % of the total LSV sales.

US would hold the largest share, accounting for >90% of the market, followed by Canada & Mexico. Countries like US & Canada together hold nearly 50% of golf courses (19,000+) in the year 2022. The key players in this region are focused on providing luxury features where the key players like Club Car, Yamaha Motor Co., Ltd, and The Toro Company are investing high in R&D by providing the features like connected cars and autonomous drive for the people above 40 age group usually use for daily commutes to nearby places such as malls, gyms, restaurants, schools, etc. These LSVs are also used in last-mile delivery and for a rental purpose which is used for commuting to nearby places and visiting tourist spots.

Key Market Players:

The commercial turf utility vehicle has the largest share in the low-speed vehicle market as the number of warehouses and logistics sector has increased in North America which has propelled the sales of commercial turf utility vehicles. The OEMs are offering these vehicles in the electric version which finds its application is gate communities, the commercial sector, industrial sector. Some of the Leading LSV manufacturers in the region are Textron inc. (US), Deere & Company (US), The Toro Company (US), and Club Car (US).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=1965274

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email:Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/north-america-low-speed-vehicle-market-1965274.html