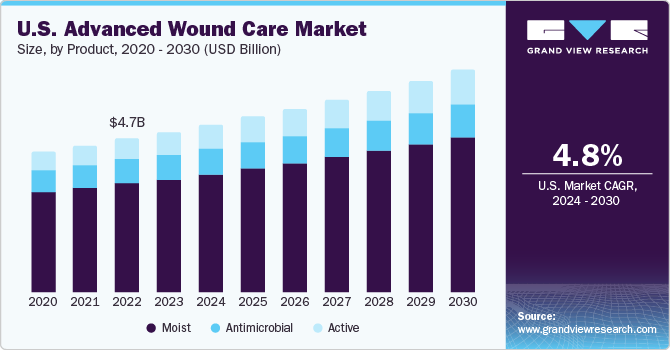

The U.S. advanced wound care market is projected to be worth USD 3.42 billion by the year 2026, advancing at a CAGR of 4.2% over the forecast period, as per a study by Grand View Research, Inc. The primary factor for the industry growth is the continued rise in the number of surgeries in the country, coupled with the high number of incidences of chronic wounds in the region. Wound care products can be broadly classified into traditional and advanced, the major difference being that the former is used to treat simple wounds, while the latter finds use in complex wound cases. Some of the common advanced wound care products include hydrocolloids, hydrogels, film and foam dressings, and alginates. Increasing incidences of surgeries have also helped in positively shaping the advanced wound care industry in the region.

Recent years have witnessed a rise in the number of surgical procedures in the U.S., with data from 2014 estimating that around 51.4 million surgeries were performed in the region. Rising prevalence of chronic diseases, such as cancer, diabetes, and autoimmune diseases, is one of the key factors leading to an increase in the number of surgeries being performed in the country. As per data offered by the CDC in 2020, around 34.2 million people, amounting to 10.5% of the country’s population, are suffering from diabetes. Diabetes leads to slower healing of wounds, which can cause infections and risky health issues; advanced wound care products are used to address this issue, thus driving market growth. Additionally, there has been a continued growth in the incidences of infectious and non-communicable diseases, caused majorly by an unhealthy lifestyle pattern followed by a large population, coupled with a rise in the number of food-borne diseases. On the whole, wound care treatment accounts for a significant proportion of the nation’s healthcare expenditure.

The advanced wound care market in the United States can be broadly classified on the basis of product, end-use, and application. Advanced wound care products comprise a wide variety of treatments and dressings involving hydrocolloid, hydrogel, alginate, collagen, and film and foam dressings, among others. Major end-use segments include hospitals, home care, and specialty clinics, among others. Application areas for advanced wound care products cover chronic wounds (diabetic foot ulcers, pressure ulcers, and venous leg ulcers, among others) and acute wounds (burns, and surgical & traumatic wounds). The United States has a large number of domestic players competing for market dominance, with some notable names being Smith & Nephew, Mölnlycke Health Care AB, Acelity (KCI Licensing, Inc.), ConvaTec Group PLC, and Baxter, among other regional competitors.

U.S. Advanced Wound Care Market Report Highlights

1 Wound care is a significant part of the healthcare infrastructure in the US, with a retrospective analysis of Medicare beneficiaries in 2018 finding that around 8.2 million people in the country had wounds, with or without infections

2 The estimates for Medicare costs involving chronic and acute wound treatments ranged from USD 28.1 billion to USD 96.8 billion, with surgical wounds and diabetic foot ulcers accounting for a significant portion of the spending

3 Type II diabetes is the most common type of diabetes, affecting 90% of the diabetic population. Diabetic foot ulcer, a common complication of diabetes, typically requires surgical intervention to prevent foot amputation

4 Cancer is a major cause for the presence of malignant or cancerous ulcers in a patient, which in many cases require appropriate dressings in order to treat them; this is a major factor driving growth of the advanced wound care industry

5 In terms of revenue, foam dressing segment held the largest share in 2018 owing to the rising incidence of chronic wounds in the region; these wounds affect 5.7 million patients in the country, accruing annual costs of around USD 20 billion

6 In the application segment, the chronic wound segment is expected to witness the fastest growth rate over the forecast period owing to the rising incidence of diabetes in the U.S.

7 Home healthcare segment is expected to witness fastest growth over the forecast period, as many surgeries require an elongated period of healing time, making the home setting a promising avenue for market players in the coming years

8 The global COVID-19 pandemic led to a drastic reduction in the number of physical visits for patients requiring wound care, with the US healthcare setup under huge stress owing to the exponential increase in coronavirus admissions

9 Home healthcare and telemedicine have been touted as effective measures to manage wound infections during the pandemic, with the system expected to witness wider application in the near future, thus driving market growth for advanced wound care

10Major industry players have implemented strategies such as mergers and acquisitions, as well as new product launches, in order to garner higher market share

11For instance, in January 2020, ConvaTec announced the release of ConvaMax superabsorber dressing to manage highly exuding wounds such as diabetic foot ulcers, leg ulcers, and pressure ulcers

12In October 2019, 3M completed the acquisition of Acelity, Inc. along with its KCI subsidiaries globally, thus expanding their presence in advanced and surgical wound care area

“Would you Like/Try a Sample Report” Click the link below:https://www.grandviewresearch.com/industry-analysis/us-advanced-wound-care-market/request/rs1

U.S. Advanced Wound Care Market Segmentation

Grand View Research has segmented the U.S. advanced wound care market on the basis of product, application, and end use:

U.S. Advanced Wound Care Product Outlook (Revenue, USD Million, 2015 - 2026)

-

Foam

-

Hydrocolloid

-

Film

-

Alginate

-

Hydrogel

-

Collagen

-

Others

U.S. Advanced Wound Care End-use Outlook (Revenue, USD Million, 2015 - 2026)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Others

U.S. Advanced Wound Care Application Outlook (Revenue, USD Million, 2015 - 2026)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Others

-

-

Acute Wounds

-

Surgical & Traumatic Wound

-

Burns

-

List of Key Players of U.S. Advanced Wound Care Market

- Smith & Nephew PLC

- Mölnlycke Health Care AB

- Acelity

- ConvaTec Group PLC

- Johnson & Johnson

- Baxter

- Coloplast Corp.

- Medtronic

- 3M

- Medline Industries Inc.

- Integra LifeSciences

Have Any Query? Ask Our Experts for More Details on Report:https://www.grandviewresearch.com/inquiry/6320/ibb

Browse Related Report @

Advanced Wound Care Market – https://www.grandviewresearch.com/industry-analysis/advanced-wound-care-market

Explore the BI enabled intuitive market research database, Navigate with Grand View Compass, by Grand View Research, Inc.

About Grand View Research

Grand View Research is a market research and consulting company that offers market research reports, syndicated and customized reports. The company is headquartered in San Francisco, California. It offers client engagement for business consulting and market intelligence from various domains. The clientele is based across various countries with queries coming from more than 50 industries worldwide.

Grand View Research helps its clients to make informed decisions by helping them understand current trends and scenarios. Every year Grand View Research accomplishes more than 300 multi-country market studies to optimize consulting for clients.

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist - U.S.A.

Email:Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/us-advanced-wound-care-market