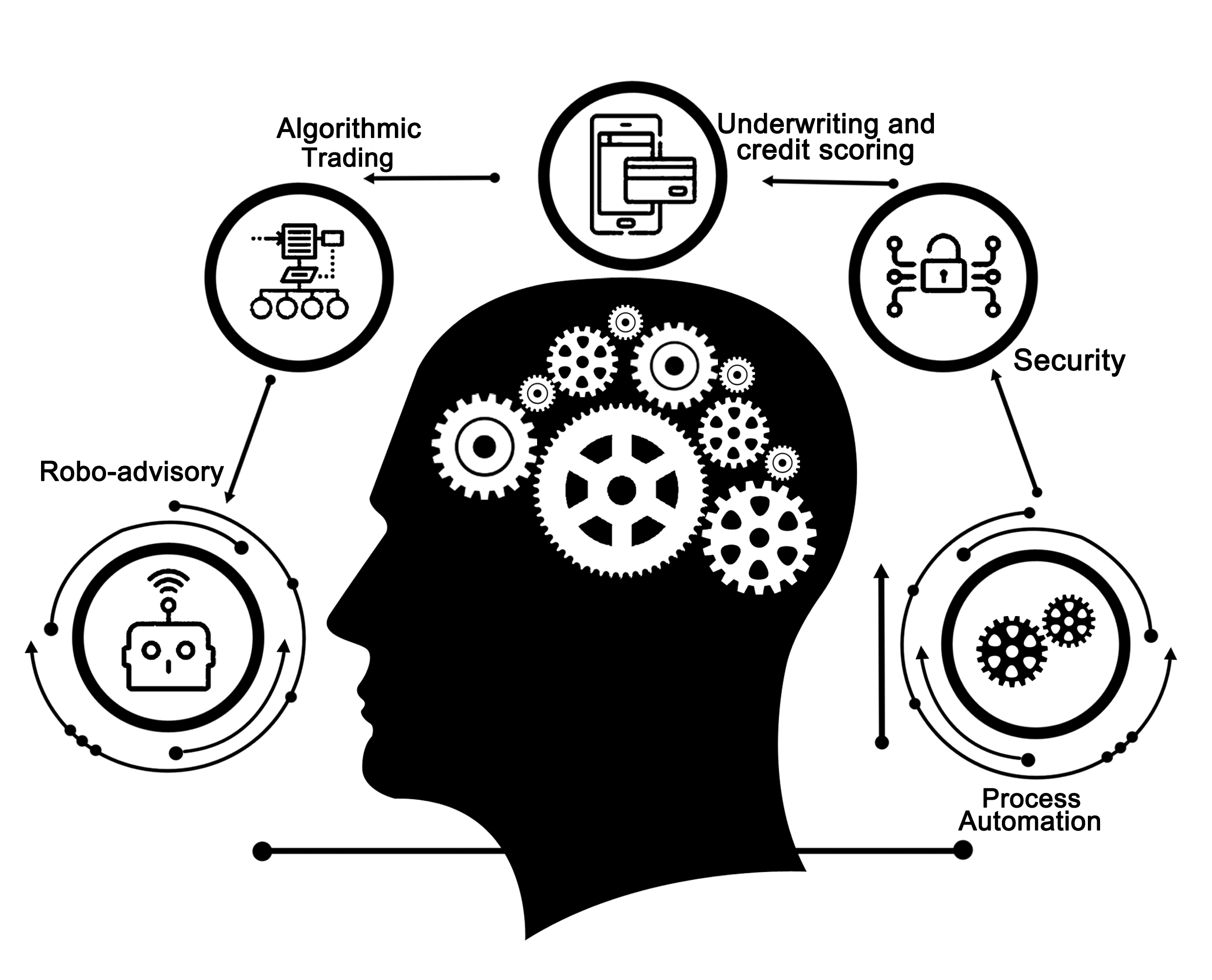

We all understand that artificial intelligence and data analytics are excellent teammates. Over the next several years, the banking sector will use the power of this combination to create and deliver essential products and strategies that can help consumers and businesses grow their wealth through new and unique methods. The success of this process depends on where the industry focuses its energy, and AI enables institutions to concentrate its initiatives on crucial tasks instead of bureaucratic responsibilities.

The banking sector already uses a standardized analytics report to understand the reasons why specific behaviors and actions happen. The data points offered through this information allow institutions to investigate why customers behave in particular ways. Artificial intelligence alters the analysis process because it shifts the perspective of the industry. Instead of forcing organizations to be reactive in their approach to customization, this technology enables the sector to become proactive.

Previous analytics provided answers when banks knew what questions to ask. With the presence of AI providing data analysis support, institutions can find insights that they didn’t even know existed before.

Artificial Intelligence Drives Benefits Across the Entire Institution

According to Deltec Bank, Bahamas - “The presence of AI produces several specific benefits that banks can use to generate new revenue streams through individualization.” It takes the data points that customers provide daily to develop opportunities that are based on an individual’s unique behaviors and decisions. Instead of presenting a series of potential products or transactions from which to choose, a consumer gets presented with tailored opportunities that artificial intelligence systems produced from the offered information.

According to information provided by the Capgemini Digital Transformation Institute, AI produces several crucial advantages that disperse throughout the entire organization. 75% of the individual firms that implement artificial intelligence capabilities increase their sales of new products and services by at least 10%. Another 78% mention that AI structures produce higher operational efficiencies of at least 10%. 79% reported that the implementation of this technology assisted in the development of additional insights or improved data analysis.

The banks that understand the role that artificial intelligence and machine learning play for improved analytics are the ones that experience the most success when implementing this technological approach. That’s why the development of core strategies must be a crucial part of the initial implementation of this technology.

Four Strategies That Improve Data Analysis Processes for the Banking Sector

Once the banking sector uses artificial intelligence and machine learning to improve its data analysis, it must implement specific strategies to ensure that the analytics can deliver ever-increasing value to individual institutions and the overall industry. Four standardized approaches are useful for this process.

1. Descriptive Analytics

This analytics format is the most basic of the strategies that banks can implement to understand their collected information better. AI summarizes and reports on behaviors and actions that previously happened with this approach, looking at key performance indicators to create a historical context that can be useful for future decision-making needs. It discovers prompts that can ask questions of individual consumers or demographics so that the correct touchpoints get included in future marketing efforts.

2. Diagnostic Analytics

This strategy drills down on the descriptive data that artificial intelligence and machine learning generate. It filters through what happened in the analytics to determine why specific actions took place and how those activities happened. This approach works to investigate a particular outcome by comparing the information to different data sets to find answers. When AI performs the data analysis, it can work through multiple comparisons simultaneously to provide accurate answers quickly.

3. Predictive Analytics

According to a study published by Narrative Science, over 25% of organizations in 2018 were already using this strategy to take advantage of the benefits that artificial intelligence and machine learning provide. This option includes pattern recognition to the banking sector so that it can match customer events to previously established behaviors. Then it takes the information to predict what the most likely outcome will be for individual consumers. It has the power to recognize visitors from specific segments to offer customized results while improving outreach opportunities.

4. Prescriptive Analytics

This strategy applies the prediction mechanisms of artificial intelligence and machine learning to suggest the best course of action to take for the banking sector. It analyzes specific consumer behaviors to discover new methods that can help institutions find ways to encourage more interaction through individual customization. It explains thousands of data points from each customer to make alterations during real-time communications to promote a particular action.

How the Banking Sector Can Find Success with AI Performing Data Analysis

The banking sector and individual institutions don’t need to understand how artificial intelligence works to take advantage of the opportunities this technology provides. Organizations don’t even need to have an awareness of how to build useful algorithms that can lead to successful outcomes in this area. The firms that want to embrace the concepts that AI offers only need to consider a handful of ideas.

The most critical component is to ensure that the current analytics tool used by the institution includes artificial intelligence capabilities. If organizations continue to use platforms that don’t offer this access, then they’ll be at a competitive disadvantage in the coming months and years because the firm will be spending its time trying to react while others are taking proactive steps forward.

Artificial intelligence capabilities must also be usable across the entire institutions instead of only being available to specialists. The average employee should get actionable insights and useful data by themselves instead of relying on others to obtain this information. Opportunities happen quickly in the banking sector, which makes it necessary for every to have the power to find their needed insights.

Then there must be confidence in the process. It can be tempting for individual banks to abandon their AI and machine learning investments because it seems like the data analysis isn’t providing tangible, positive results. The banking sector stands poised on a growth precipice today. Those that embrace the benefits of data analysis and work hard to shift toward proactive outcomes will experience the most success.

Disclaimer: The author of this text, Robin Trehan, has an undergraduate degree in Economics, Masters in international business and finance and MBA in electronic business. Trehan is Senior VP at Deltec International www.deltecbank.com. The views, thoughts, and opinions expressed in this text are solely the views of the author, and not necessarily reflecting the views of Deltec International Group, its subsidiaries and/or employees.

About Deltec Bank

Headquartered in The Bahamas, Deltec is an independent financial services group that delivers bespoke solutions to meet clients’ unique needs. The Deltec group of companies includes Deltec Bank & Trust Limited, Deltec Fund Services Limited, and Deltec Investment Advisers Limited, Deltec Securities Ltd. and Long Cay Captive Management.

Media Contact

Company Name: Deltec International Group

Contact Person: Media Manager

Email:Send Email

Phone: 242 302 4100

Country: Bahamas

Website: https://www.deltecbank.com/