TFSA options trading is exactly what it sounds like—using your Tax-Free Savings Account (TFSA) to buy and sell stock options. But before you start picturing high-stakes Wall Street drama, let’s break it down.

A TFSA is a registered account in Canada that allows your investments to grow completely tax-free. That means any gains you make—whether from stocks, ETFs, or yes, even options—won’t be taxed when you withdraw them. Now, combine that with options trading, which involves contracts that give you the right (but not the obligation) to buy or sell a stock at a specific price within a set timeframe. The result? A powerful investment tool with some serious potential—if used wisely.

For instance, if you buy a call option on Shopify and it skyrockets? Your profit stays entirely tax-free inside your TFSA. That’s not just convenient—it’s strategic.

Can You Trade Options in a TFSA?

Short answer? Yes, you absolutely can trade options in a TFSA—but with some fine print worth reading twice.

Under Canadian tax law, options are classified as “qualified investments,” which means they’re legally allowed inside a Tax-Free Savings Account (TFSA). So if you’ve been wondering whether tfsa options trading is even possible, rest assured—it’s not only permitted but also increasingly common among retail investors.

What You Can Do

Most Canadian brokerages like Moomoo allow tfsa options trading. That includes buying call or put options and writing covered calls—strategies considered relatively conservative by options standards. These moves are typically approved within the first two levels of options trading permissions, which many TFSA accounts can access with minimal barriers.

What You Can‘t Do

The Canada Revenue Agency (CRA) doesn’t mind TFSA options trading—until it starts looking like a business. If you're making dozens of trades each week, holding contracts for hours instead of weeks, or spending your evenings glued to your trading dashboard like its playoff season… well, now you're on CRA’s radar.

What Can help you

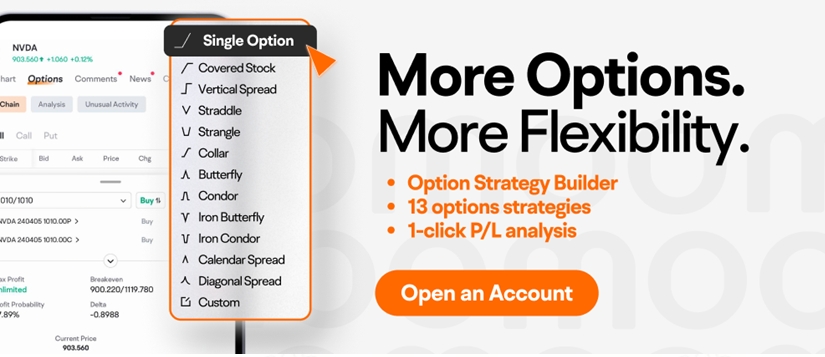

Options trading is inherently complex and can be intimidating. Moomoo simplifies this process with its Strategy Builder. This tool allows you to select your market outlook, set parameters like budget and expiration date, and get matched with intelligently designed options strategies tailored to your skill level. Whether you're a beginner or experienced investor, Moomoo’s one-click applications make it easy to execute trades efficiently and confidently.

Ready to start? Join Moomoo today to unlock your 6% Cash Back and experience the power of its Strategy Builder and options analysis tools. Optimize your TFSA options trading strategy and take control of your investments with ease.

How to Start Options Trading in Your TFSA

So, you're ready to give tfsa options trading a shot—smart move, but it’s not as simple as clicking “buy” on a call option. Because while yes, you can trade options in a TFSA, the process comes with a few hoops and some fine print you don’t want to ignore.

Step 1: Open a TFSA That Supports Options

Buying U.S. Options in a TFSA usually means converting Canadian dollars to U.S. dollars. And those currency exchange fees? They can quietly eat into your returns if you’re not careful. Many investors choose Moomoo, which charges a 0% currency exchange fee on CAD and USD exchanges.

One standout right now? moomoo Canada. Why? Because it checks all the boxes:

- U.S. listed options are tradable directly within your TFSA.

- No account maintenance fees.

- Ultra-low commissions at just $0.65 per contract.

- Zero exercise fees (yep, $0).

Plus, moomoo gives you access to free Level 1 market data as soon as you fund your account—and if you deposit more, you unlock free Level 2 data too. That’s real-time visibility into bid/ask flows without paying extra for data packages like on other platforms.

Step 2: Apply for Options Trading Approval

Once your TFSA is set up, you can’t just jump into selling covered calls or buying puts. You’ll need to apply for options trading privileges within your account. This usually involves answering questions about your investment experience, financial situation, and risk tolerance.

Most platforms categorize traders by levels (e.g., Level 1 to Level 4), each granting access to different strategies. For TFSA options trading, most providers will only approve basic strategies like covered calls or cash-secured puts—anything beyond that could trigger tax issues (more on that later).

Step 3: Fund Your Account and Do Your Homework

Before placing your first trade, fund your TFSA and take time to understand the mechanics of the options market—especially how it works inside a tax-sheltered account. Moomoo offers tools like real-time option chains and supports up to 13 different strategies, which is impressive for any retail trader.

Best Options Strategies for a TFSA

For many investors, diving into TFSA options trading can feel like navigating a maze of tax rules and strategy limitations. This is especially true for newcomers who may not fully understand the nuances of a Tax-Free Savings Account (TFSA). The high tax rates in Canada make TFSAs an attractive tool for growing investments tax-free, but understanding how to leverage this account effectively is crucial.

Moomoo excels at helping users explore and manage their TFSA accounts with ease. With 24/7 online support and 5x24 phone assistance, Moomoo ensures you’re never left in the dark. Whether you’re looking for guidance on strategy selection or need help understanding the tax implications of your trades, their professional support team is ready to assist. What’s more, Moomoo offers a unique in-person experience through its Moomoo store in Toronto, where you can receive face-to-face guidance and explore platform features. And if you prefer self-paced learning, Moomoo Learn provides access to over 3,000 free courses covering investment basics to advanced trading techniques.

Long Call: Betting on Upside, Cautiously

A long call is like buying a ticket to a potential rally. You pay a premium for the right (but not the obligation) to buy a stock at a set price before expiry. If the stock surges past that strike price—nice! You profit. If not, your loss is limited to the premium paid. It’s simple, directional, and fully compliant with TFSA rules.

This strategy works well if you believe in a company’s upside but don’t want to tie up all your contribution room buying shares outright.

Long Put: A Hedge Without Shorting

Short selling isn’t allowed in TFSAs, but here’s the workaround: buy a put option. This gives you downside exposure without violating CRA rules. Whether you're hedging an existing position or speculating on a drop—long puts provide flexibility while staying within legal bounds.

Covered Call: Income From Stocks You Already Own

This one’s a fan favorite among Canadian investors using TFSA options trading for income generation. If you hold shares of a stable stock or ETF and don’t expect much movement, selling covered calls can earn you extra cash via premiums—without giving up your long-term position.

Just remember: if the stock rises past your strike price, you may have to sell it.

Married Put: Peace of Mind in Volatile Markets

Think of this as portfolio insurance. You own the stock and buy a put option at the same time—so if things go south fast, your downside is capped. It’s especially useful during earnings season or when markets get jittery.

By combining Moomoo’s extensive learning resources, 24/7 support, and in-person services, you can confidently implement these strategies while maximizing the benefits of your TFSA. Ready to take the next step? Sign up for Moomoo now to access unparalleled support and resources that make TFSA options trading simpler and more effective. Start your journey toward smarter investing today!

Risks and Tax Implications to Know

When it comes to options inside a TFSA, the Canada Revenue Agency (CRA) isn’t exactly handing out free passes. There are real risks involved, both financially and from a tax perspective.

While TFSA options trading can be lucrative, it requires careful planning to avoid financial and tax pitfalls.

Conclusion: Should You Trade Options in a TFSA?

So—can you trade options in a TFSA? Technically, yes. But TFSA options trading is a bit like walking a tightrope: it’s legal, but one wrong move (like frequent trades or complex strategies) and the CRA could reclassify your account as a business, making your “tax-free” gains fully taxable. If you're using conservative strategies like covered calls or protective puts as part of a long-term plan, you're likely in safe territory. Just don’t treat your TFSA like a day trading playground—it wasn’t built for that kind of action.

Media Contact

Company Name: Moomoo Financial Canada Inc.

Contact Person: Michael Arbus

Email:Send Email

Country: Canada

Website: https://www.moomoo.com/ca/