US Commercial Banking Market Outlook

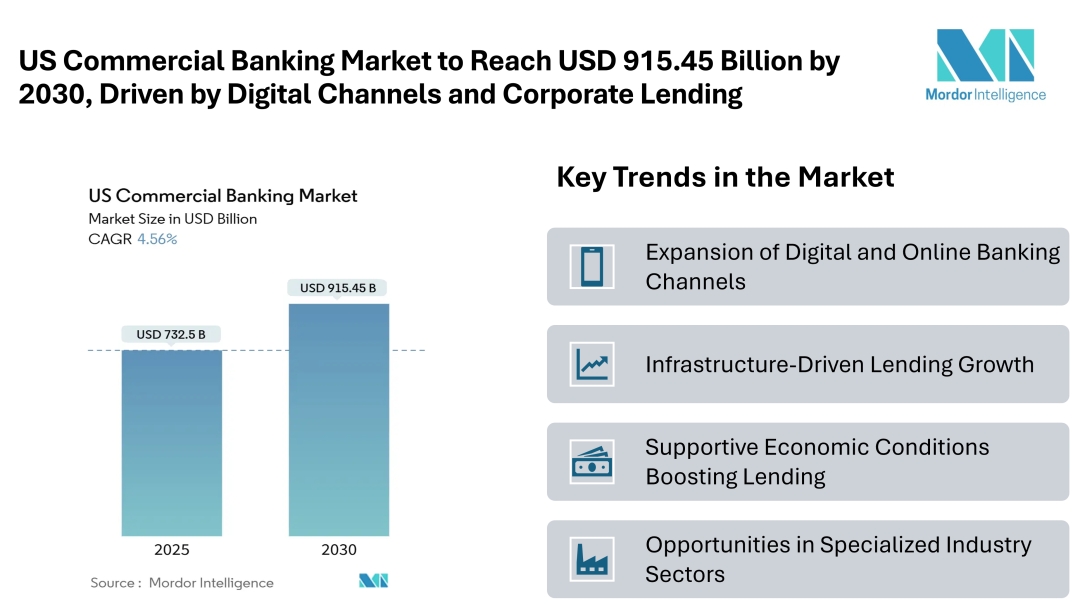

According to Mordor Intelligence, the US commercial banking market size stands at USD 732.5 billion in 2025 and is forecasted to reach USD 915.45 billion by 2030, reflecting a 4.56% CAGR. The expanding role of digital channels alongside traditional services is also contributing to the overall US commercial banking market size. In terms of market distribution, the United States commercial banking market share is spread across both large enterprises and SMEs, with digital banking gradually gaining prominence alongside offline operations.

Key Trends in the US Commercial Banking Market

1. Expansion of Digital and Online Banking Channels

Digital and online banking adoption is increasing rapidly, with banks leveraging APIs and automated treasury solutions. Even smaller community banks are using these tools to compete effectively with larger institutions.

2. Infrastructure-Driven Lending Growth

Federal and state infrastructure programs are creating steady demand for construction loans, equipment financing, and working-capital facilities, helping banks secure long-term revenue streams.

3. Supportive Economic Conditions Boosting Lending

A stable economy with steady GDP growth and strong corporate cash flows is enabling businesses to access credit more easily, supporting commercial lending and treasury management services.

4. Opportunities in Specialized Industry Sectors

Emerging sectors, including renewable energy and cannabis-related businesses, are opening new fee-based services. Regulatory changes in these areas provide banks opportunities to expand offerings and strengthen their market position.

Segmentation of the US Commercial Banking Market

By Product:

-

Commercial Lending

-

Treasury Management

-

Syndicated Loans

-

Capital Markets

-

Other Products

By Client Size:

-

Large Enterprises

-

Small & Medium Enterprises (SME)

By Channel:

-

Online Banking

-

Offline Banking

By End-User Industry Vertical:

-

IT & Telecommunication

-

Manufacturing

-

Retail and E-Commerce

-

Public Sector

-

Healthcare and Pharmaceuticals

-

Other Industry Verticals

Key Players in the US Commercial Banking Market

-

JPMorgan Chase & Co. – A leading US bank offering commercial lending, treasury management, and investment banking services.

-

Bank of America Corp. – Provides a wide range of banking solutions, including corporate finance, cash management, and digital banking.

-

Wells Fargo & Co. – Focuses on commercial banking, lending, and payment services for businesses of all sizes.

-

Citigroup Inc. – Offers global banking and treasury services, serving both large enterprises and SMEs.

-

U.S. Bancorp – Provides commercial banking and financial services with a focus on regional business clients.

Conclusion

The US Commercial Banking Market is expected to grow steadily, supported by strong economic conditions, rising digital banking adoption, and increased lending opportunities. Banks that combine digital and traditional services while focusing on high-growth client segments are likely to gain a competitive edge.

Get the latest industry insights on the US Commercial Banking Market: https://www.mordorintelligence.com/industry-reports/us-commercial-banking-market?utm_source=abnewswire

Industry Related Reports:

US Retail Banking Market

The United States retail banking market stands at USD 0.87 trillion in 2025 and is projected to reach USD 1.08 trillion by 2030, growing at a CAGR of 4.22% during the forecast period. Growth is driven by increasing adoption of digital banking services and expanding consumer demand for personalized financial products, enhancing accessibility and convenience across the retail banking sector.

Get more insights: https://www.mordorintelligence.com/industry-reports/us-retail-banking-market?utm_source=abnewswire

United States Private Banking Market

The United States private banking market is valued at USD 59.54 billion in 2025 and is expected to reach USD 94.89 billion by 2030, growing at a CAGR of 9.77% during the forecast period. Growth is supported by rising high-net-worth individuals, increasing demand for wealth management solutions, and a focus on personalized financial advisory and investment services.

Get more insights: https://www.mordorintelligence.com/industry-reports/united-states-private-banking-market?utm_source=abnewswire

US Investment Banking Market

The US investment banking market stands at USD 54.74 billion in 2025 and is projected to reach USD 66.15 billion by 2030, growing at a CAGR of 3.86%. Market growth is driven by increased corporate financing activities, mergers and acquisitions, and rising demand for advisory services in capital markets and structured financial solutions.

Get more insights: https://www.mordorintelligence.com/industry-reports/us-investment-banking-market?utm_source=abnewswire

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana – 500032, India.

Media Contact

Company Name: Mordor Intelligence Private Limited

Contact Person: Jignesh Thakkar

Email:Send Email

Phone: +1 617-765-2493

Address:11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli

City: Hyderabad

State: Telangana 500008

Country: India

Website: https://www.mordorintelligence.com/