Overview of the United States Property and Casualty Insurance Market

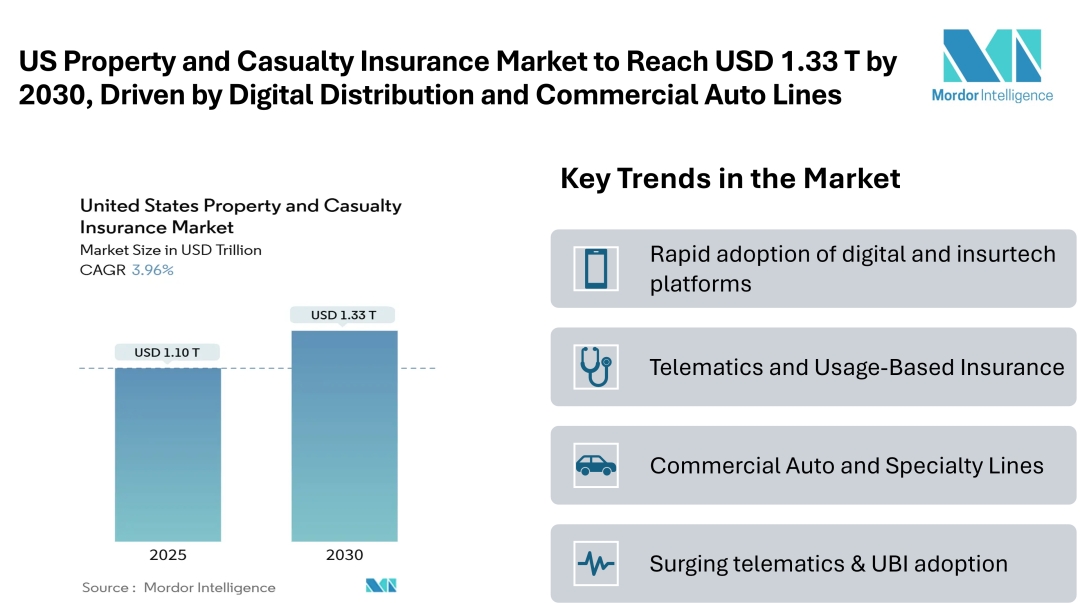

According to Mordor Intelligence, the US property and casualty insurance market is valued at USD 1.10 trillion in 2025 and is projected to reach USD 1.33 trillion by 2030, growing at a 3.96% CAGR. This steady expansion highlights the robustness of the United States Property and Casualty Insurance Market size, reflecting the sector’s capacity to adapt to changing economic and market conditions.

Additionally, higher fixed-income yields provide insurers with a buffer against short-term underwriting fluctuations, influencing the overall United States Property and Casualty Insurance Market share across personal and commercial lines.

Key Trends in the US Property and Casualty Insurance Market

1. Digital Platforms: Rapid adoption of digital and insurtech platforms is improving customer acquisition, claims processing, and personalized pricing.

2. Telematics and Usage-Based Insurance: Usage-based insurance, especially in auto lines, helps insurers assess risk more accurately and offer tailored premiums.

3. Commercial Auto and Specialty Lines: Commercial auto remains the largest segment, while specialty lines are seeing growing demand and premium increases.

4. Distribution Channels: Independent agents and brokers dominate, but hybrid models combining traditional and digital channels are gaining traction.

Segmentation of the US Property and Casualty Insurance Market

By Insurance Line:

-

Homeowners

-

Private Passenger Auto

-

Commercial Auto

-

Commercial Property

-

Workers' Compensation

-

General Liability

-

Specialty (Cyber, Marine, Inland, Surety)

By Distribution Channel:

-

Direct

-

Independent Agents / Brokers

-

Captive Agents

-

Bancassurance

-

Digital / Insurtech Platforms

-

Wholesale / MGAs

By Customer Segment:

-

Personal Lines

-

Small Commercial (SME)

-

Middle-Market Commercial

-

Large Commercial & Specialty

By Region:

-

California

-

Texas

-

Florida

-

New York

-

Others

Key Players in the US Property and Casualty Insurance Market

-

State Farm Mutual Automobile Insurance Co.: One of the largest personal and commercial insurers in the U.S., known for its extensive agent network and auto insurance offerings.

-

Berkshire Hathaway Inc. (GEICO, National Indemnity): Operates major insurance brands including GEICO, providing auto and specialty insurance with a strong market presence.

-

The Progressive Corp.: A leading auto insurer recognized for its innovative pricing models and usage-based insurance programs.

-

Allstate Corp.: Offers a wide range of personal and commercial insurance products, with a focus on customer service and claims efficiency.

-

Liberty Mutual Holding Co.: Provides comprehensive property and casualty coverage across personal and commercial lines, with a significant national footprint.

Conclusion

The United States Property aand Casualty Insurance Market is expected to maintain steady growth through the coming years, supported by technology adoption, strategic distribution, and consistent demand for both commercial and personal insurance lines. Market participants are concentrating on maintaining profitability through accurate underwriting and utilizing digital solutions to engage customers more efficiently.

Get the latest industry insights on United States Property and Casualty Insurance Market: https://www.mordorintelligence.com/industry-reports/property-and-casualty-insurance-market-in-usa?utm_source=abnewswire

Industry Related Reports:

India Property and Casualty Insurance Market

The India Property and Casualty Insurance Market is valued at USD 37.32 billion in 2025 and is expected to reach USD 49.43 billion by 2030, growing at a CAGR of 5.78%. The market is driven by rising insurance awareness, increasing adoption of digital distribution channels, and growing demand for both personal and commercial insurance lines across the country.

Get more insights: https://www.mordorintelligence.com/industry-reports/property-casualty-insurance-market-in-india?utm_source=abnewswire

Japan Property and Casualty Insurance Market

The Japan Property and Casualty Insurance Market reached USD 70.19 billion in 2025 and is projected to grow to USD 78.59 billion by 2030, at a CAGR of 2.29%. The market is supported by steady demand for auto and commercial insurance, along with increasing adoption of digital channels and advanced risk management solutions by insurers.

Get more insights: https://www.mordorintelligence.com/industry-reports/japan-property-casualty-insurance-market?utm_source=abnewswire

China Property and Casualty Insurance Market

The China Property and Casualty Insurance Market reached USD 302.71 billion in 2025 and is expected to grow to USD 499.61 billion by 2030, at a robust CAGR of 10.54%. Growth is driven by rising insurance penetration, increasing demand for commercial and auto coverage, and the adoption of digital platforms that enhance customer engagement and claims processing.

Get more insights: https://www.mordorintelligence.com/industry-reports/property-casualty-insurance-market-in-china?utm_source=abnewswire

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana – 500032, India.

Media Contact

Company Name: Mordor Intelligence Private Limited

Contact Person: Jignesh Thakkar

Email:Send Email

Phone: +1 617-765-2493

Address:11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli

City: Hyderabad

State: Telangana 500008

Country: India

Website: https://www.mordorintelligence.com/