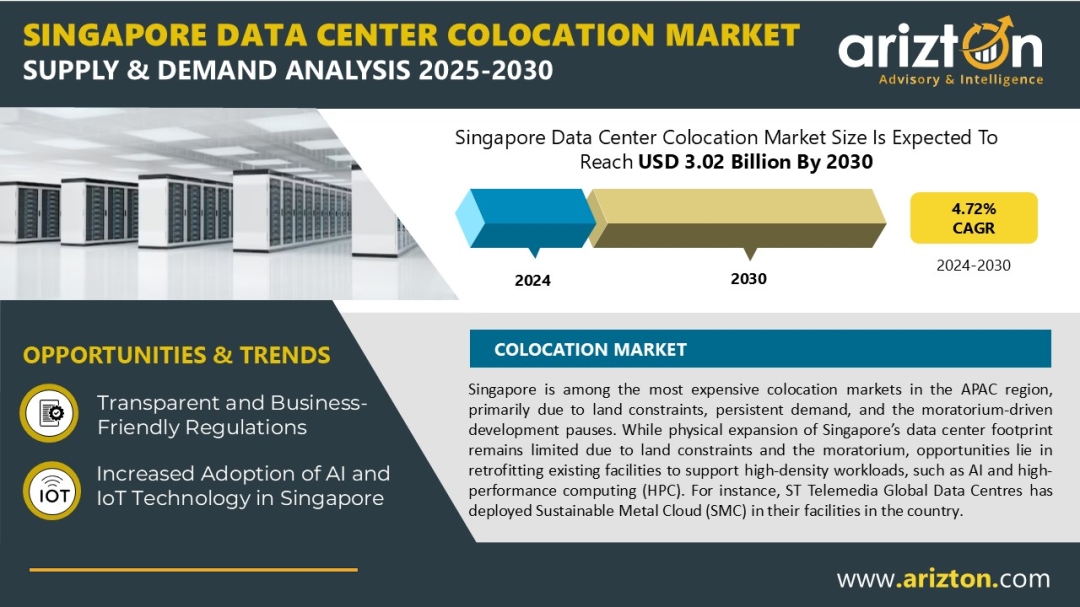

According to Arizton’s latest research report, the Singapore data center colocation market is projected to reach CAGR of 4.72% during 2024-2030.

Looking for More Information? Click: https://www.arizton.com/market-reports/singapore-data-center-colocation-market

Report Scope:

MARKET SIZE - COLOCATION REVENUE: USD 3.02 Billion (2030)

CAGR - COLOCATION REVENUE: 4.72% (2024-2030)

MARKET SIZE - UTILIZED WHITE FLOOR AREA: 5.62 million sq. feet (2030)

MARKET SIZE - UTILIZED RACKS: 149.7 thousand units (2030)

MARKET SIZE - UTILIZED IT POWER CAPACITY: 990 MW (2030)

BASE YEAR: 2024

FORECAST YEAR: 2025-2030

Singapore Data Center Colocation Market Outlook

The Singapore data center colocation market is most expensive colocation markets in APAC, driven by land constraints, strong demand, and a moratorium on new developments. With limited room for expansion, leading colocation operators are retrofitting existing data center facilities to handle high-density workloads like AI and HPC. For example, ST Telemedia is using Sustainable Metal Cloud with immersion cooling, reducing the energy use of AI cloud services by up to 50%.

Average retail colocation revenue in Singapore remains around USD 4–5 million per MW, while wholesale colocation generates about USD 2–3 million per MW. The country is also a major submarine cable hub, with over 25 active cables and 13 more under development to boost connectivity.

As supply tightens, operators like Keppel DC REIT, Equinix, Digital Realty, ST Telemedia, AirTrunk, Singtel, NTT DATA, and new entrant DayOne (GDS) are expanding capacity and looking to the Johor-Singapore Special Economic Zone (JS-SEZ) for growth opportunities. This is positioning Singapore as a key AI-ready data center hub, with new builds in Loyang, Serangoon, Tuas, and Jurong West designed for high-density racks supporting up to 100+ kW, such as Singtel’s Nxera built for NVIDIA H100 GPU clusters.

Singapore Leverages AI and IoT Technology to Boost Data Center Capacity and Smart Nation Goals

Singapore is strengthening its data center market by using AI and IoT to drive innovation and long-term economic growth. According to the e-Conomy SEA 2024 report, Singapore ranks among the world’s top countries for AI-related online searches, showing clear momentum for advanced tech adoption. The Singapore Economic Development Board (EDB) and Infocomm Media Development Authority (IMDA) are working with leading data center operators to add capacity and enhance connectivity infrastructure to build a competitive AI ecosystem.

For instance, in August 2024, IBM and the National University of Singapore (NUS) announced a strategic partnership to launch a new AI research and innovation center, which will help develop next-generation AI applications and boost local expertise. Through its Smart Nation Initiative, Singapore is also scaling up IoT integration, using connected devices and the Smart Nation Sensor Platform to accelerate smart city development and data generation. Together, these steps support Singapore position as a regional leader in AI-ready, future-focused digital infrastructure.

Recent Vendor Partnerships and Expansions Strengthen Singapore Data Center Market

- In December 2024, ST Telemedia Global Data Centres announced the start of its collaboration with Zenlayer, a hyperconnected cloud company, to bring private connectivity to its global data center platform

- In February 2024, Atlantic.Net, a cloud hosting company, announced the launch of a new data center in Singapore. The company announced to offer a year's free cloud server facility to all new customers.

- In May 2024, StarHub, a telecommunications service provider in Singapore, announced the start of a collaboration with Global Switch, a carrier and cloud-neutral data center operator, on Low Latency Data Center Connect in Singapore.

Singapore Leads Southeast Asia Data Center Market with Strong Digital Infrastructure

Singapore is strengthening its position as Southeast Asia’s key data center hub, connecting Asia to global markets with strong digital infrastructure and reliable connectivity. More than 80 of the world’s top 100 tech companies, including Google, IBM, Microsoft, Zoom, PayPal, Tencent, and Alibaba, trust Singapore to support their operations, highlighting its importance in the global data center market.

Singapore, stable power supply, advanced telecom networks, and solid transport links meet the growing demand for high-density, low-latency computing. Ranked first in the IMD World Digital Competitiveness Ranking 2024, Singapore is now driving 5G development and plans to roll out 6G by 2030, with speeds up to 100 times faster than 5G. This clear focus on faster networks and future-ready digital infrastructure keeps Singapore ahead as Southeast Asia’s top choice for next-generation data center investments.

Vendor Landscape

Existing Colocation Operators

- Equinix

- ST Engineering

- Airtrunk

- Nxera (Singtel)

- CapitaLand

- China Mobile International

- Digital Realty

- Mapletree

- Keppel DC REIT

- NTT Data

- Princeton Digital Group

- ST Telemedia Global Data Centres

- Telin Singapore

- Empyrion Digital

- Global Switch

- Others

New Operators

- GDS Services (DayOne)

Other Related Reports that Might be of Your Business Requirement

Singapore Data Center Market - Investment Analysis & Growth Opportunities 2025-2030

https://www.arizton.com/market-reports/singapore-data-center-market-size-analysis

Thailand Data Center Colocation Market - Supply & Demand Analysis 2025-2030

https://www.arizton.com/market-reports/thailand-data-center-colocation-market

Key Questions Answered in the Report:

- What factors are driving the Singapore data center colocation market?

- How much MW of IT power capacity is likely to be utilized in Singapore by 2025-2030?

- Who are the new entrants in the Singapore data center industry?

- What is the count of existing and upcoming colocation data center facilities in Singapore?

What’s Included Singapore Data Center Colocation Market Report? The report offers clear insights into Singapore’s data center colocation market, including demand and supply trends, market size by white floor area, IT power capacity, and racks. It covers retail and wholesale revenue forecasts (2024–2030), Core & Shell vs. Installed vs. Utilized capacity, 44 existing and 5 upcoming facilities across 4 regions, and the impact of AI, sustainability, cloud growth, and new submarine cables. It also details industry demand, cloud-on-ramps, and competitive share by operator capacity and location.

Why Arizton?

100% Customer Satisfaction

24x7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton's report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services. We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email:Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/singapore-data-center-colocation-market