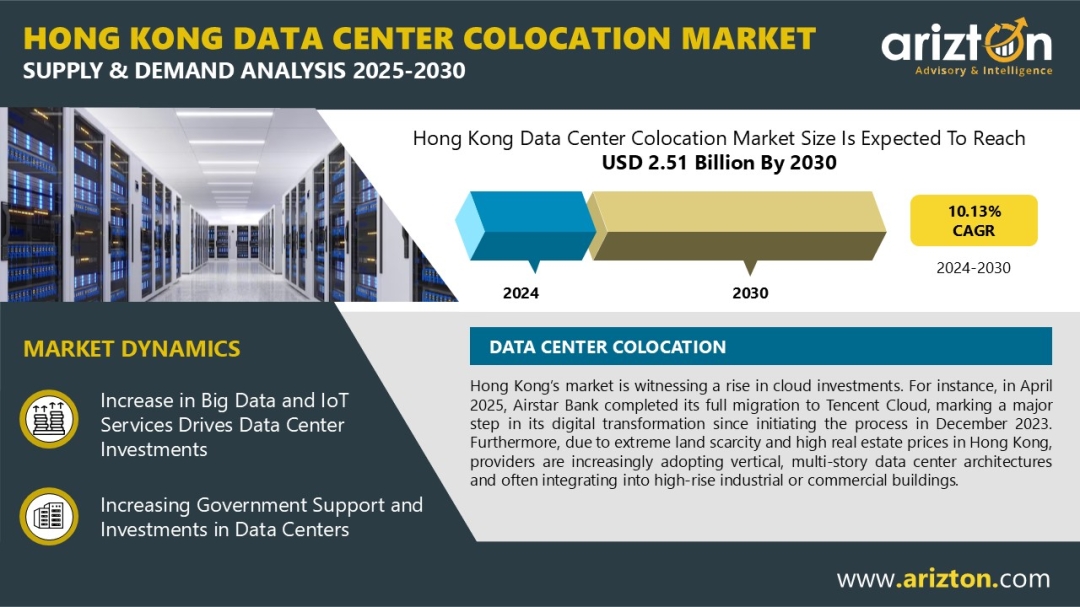

Arizton latest research shows Hong Kong data center colocation market is set to reach USD 2.51 billion by 2030, supported by rising cloud demand, AI workloads, and a strong digital infrastructure push.

Looking for More Information? Click: https://www.arizton.com/market-reports/hong-kong-data-center-colocation-market

Report Scope:

Market Size - Colocation Revenue: USD 2.51 Billion (2030)

CAGR - Colocation Revenue: 10.13% (2024-2030)

Market Size - Utilized White Floor Area: 5,951.1 Thousand Sq. Feet (2030)

Market Size - Utilized Racks: 147.3 Thousand Units (2030)

Market Size - Utilized It Power Capacity: 1,150 Mw (2030)

Base Year: 2024

Forecast Year: 2025-2030

Hong Kong Data Center Market Overview

Hong Kong is one of APAC’s most developed colocation markets, with around 54 active data centers concentrated in Tseung Kwan O, Tsuen Wan, Kwai Chung, and Fanling. Major players like SUNeVision (iAdvantage), NTT Data, Digital Realty, Equinix, and Global Switch dominate the landscape, with iAdvantage leading at a 24% market share.

Tseung Kwan O accounts for the highest installed power capacity, with 80% already utilized, highlighting strong demand and mature infrastructure for hyperscale colocation and cloud services. Rising cloud adoption, like Airstar Bank’s full shift to Tencent Cloud, shows local firms moving away from on-premises setups.

Limited land and high costs are driving taller, multi-story facilities inside high-rise industrial buildings, such as SUNeVision’s 30+ floor MEGA-i. new submarine cables keep strengthening Hong Kong’s position as a key data hub, boosting speed and reliability for cloud, telecom, and banking sectors as demand continues to grow.

Liquid Cooling Emerges as Key Strategy for High-Density Data Centers in Hong Kong

The surge in AI, high-performance computing, and cloud workloads is driving higher rack densities, pushing traditional air-cooling systems to their limits. In Hong Kong, where data centers are often vertical and space-constrained, operators are turning to liquid cooling as a practical, space-saving solution to manage densities above 20–30 kW per rack.

This shift is helping operators lower PUE and align with sustainability goals. For instance, Equinix piloted liquid cooling at its HK2 and HK3 sites, partnering with hardware vendors to deploy direct-to-chip cooling and cut cooling overhead by up to 30%. Similarly, Vantage Data Centers’ Kwai Chung site integrates a highly efficient chilled water loop and redundant CRAC units, supporting hot and cold aisle containment for improved thermal performance.

Power Capacity and Utilization Snapshot: Key Locations

- Tseung Kwan O: Leads with the largest capacity, 293.6 MW (Core & Shell), 287.2 MW (Installed), and 230.9 MW (Utilized). About 80% of installed power is in use, reflecting mature infrastructure and high demand from major operators.

- Tsuen Wan: Follows with 140.5 MW (Core & Shell), 131.5 MW (Installed), and 126.5 MW (Utilized). Around 96% utilization shows efficient use and limited room for expansion.

- Kwai Chung: Stands at 124.2 MW (Core & Shell), 94.6 MW (Installed), and 70.5 MW (Utilized), with 74% of installed power used, highlighting scope for further ramp-up as demand grows.

Big Data and IoT Push Reinforces Its Position as Asia’s Smart Tech Hub

Hong Kong is strengthening its digital economy with accelerated adoption of big data analytics, IoT, and AI across core sectors such as logistics, manufacturing, and healthcare. Enterprises and government agencies are deploying connected technologies to generate real-time data, driving smarter decisions, operational efficiency, and better customer outcomes. Notable initiatives include the Hong Kong Industrial Artificial Intelligence & Robotics Centre (FLAIR), which integrates AI and IoT for real-time insights and automation in industries from advanced manufacturing to waste management.

Meanwhile, Cyberport continues to expand Hong Kong’s innovation ecosystem, backing over 200 start-ups specializing in AI, big data, and IoT solutions. The upcoming AI Supercomputing Centre (AISC), launching in December 2024, will further boost Hong Kong’s capabilities, delivering high-performance computing for research in AI, life sciences, and smart manufacturing.

Book the Free Sample Now: https://www.arizton.com/market-reports/hong-kong-data-center-colocation-market

Vendor Landscape

Existing Colocation Operators

- AirTrunk

- China Mobile International

- DayOne (GDS Services)

- Equinix

- Goodman

- iAdvantage

- iTech Towers Data Centre Services

- Chinachem Group

- BDx Data Centers

- China Unicom

- Digital Realty

- Global Switch

- NTT DATA

- Vantage Data Centers

- Telehouse

- Towngas Telecom

- Other Operators

New Operators

- ESR

- Mapletree Investments

- TPG Angelo Gordon

Other Related Reports that Might be of Your Business Requirement

Norway Data Center Market - Investment Analysis & Growth Opportunities 2025-2030

https://www.arizton.com/market-reports/norway-data-center-market-investment-analysis

Finland Data Center Market - Investment Analysis & Growth Opportunities 2025-2030

https://www.arizton.com/market-reports/finland-data-center-market

Key Questions Answered in the Report:

- How much MW of IT power capacity is likely to be utilized in Hong Kong by 2030?

- What is the count of existing and upcoming colocation data center facilities in Hong Kong?

- What factors are driving the Hong Kong data center colocation market?

- Who are the new entrants in the Hong Kong data center industry?

What's Included in theHong Kong Data Center Colocation Market Report?

This report offers a clear view of Hong Kong’s data center colocation market, covering demand and supply trends, market size by white floor area, IT power capacity, and occupancy. It provides insights on Core & Shell vs. Installed vs. Utilized IT power, investment snapshots, sustainability status, cloud operations, and upcoming submarine cables.

It analyzes 54 existing and 14 upcoming facilities across 6+ cities, with forecasts for retail and wholesale colocation revenue and pricing trends through 2030. The study also examines key growth drivers like Big Data, IoT, and government support, along with a detailed competitive and vendor landscape.

Why Arizton?

100% Customer Satisfaction

24x7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton's report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services. We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email:Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/hong-kong-data-center-colocation-market