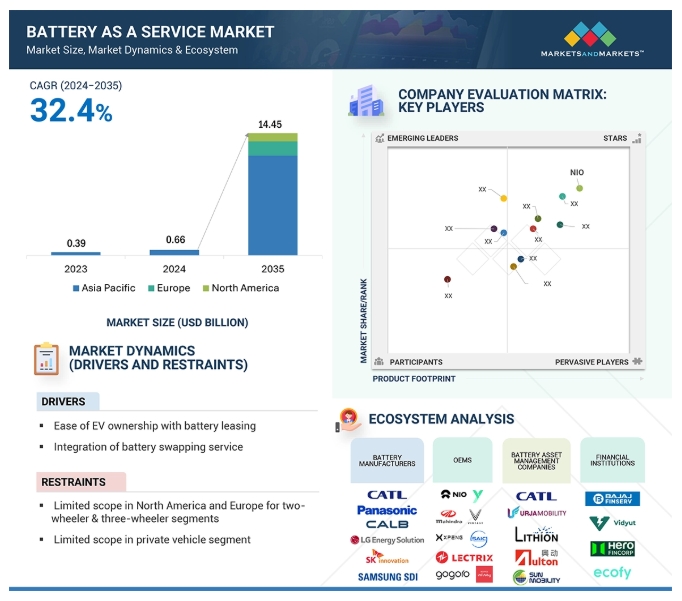

The global battery as a service market is projected to reach from USD 0.66 Billion in 2024 to USD 14.45 Billion in 2035, at a CAGR of 32.4%.

The battery as a service market is gaining momentum due to the increasing adoption of EVs, as part of the global shift toward sustainable transportation. Additionally, government policies, such as subsidies and tax incentives, are encouraging the development of battery leasing infrastructure, driving the adoption of battery as a service model by automakers, fleet operators, and consumers. Advancements in battery technology, improved lifecycle management, and the increasing focus on reducing battery-related concerns like degradation and replacement costs are also driving the market. Further, partnerships among automakers, energy companies, and battery as a service providers are fostering the development of this market.

Passenger Cars is estimated to hold the largest share during the forecast period.

Passenger Cars are expected to dominate the battery as a service market over the forecast period due to the increasing adoption of EVs, supportive government incentives, advancements in battery technologies, and a growing preference for flexible ownership models among consumers. Major EV manufacturers such as NIO (China), Changan (China), FAW (China), XPENG INC (China), Beijing Automotive Group Co., Ltd. (China), MG Motor India, Renault group (France), and VinFast (Vietnam) provide battery leasing solutions in their passenger vehicle models. Since 2020, NIO has been offering battery leasing solutions for its ET5 model since 2023, the company expanded the service to its ET5, ET7, EL6, and EL7 models in Germany. Similarly, VinFast introduced its battery leasing solutions for its VF8 and VF9 models in the US and Canada starting in 2023. Likewise, since 2022, XPENG INC (China) has been offering g battery leasing solutions for its G3 and P7 vehicle models in China.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=164666806

The Private segment is estimated to lead the battery as a service market during the forecast period.

The private segment is projected to dominate the battery as a service market during the forecast period. There is an increase in growth in the private usage of battery leasing solutions driven by the increasing adoption of EVs among consumers seeking affordable and flexible alternatives to traditional vehicle ownership. This is particularly prevalent in regions with strong EV infrastructure and supportive government policies. Several Chinese OEMs are offering battery leasing solutions with their new models. For example, NIO (China) offers premium passenger EVs with battery leasing options. These options are particularly favorable for people looking for high-end electric vehicles without paying the hefty cost of purchasing a battery. In India, the growth of the private usage of battery leasing solutions is driven by government incentives and the increased capacity of individuals and families to buy EV models. This is seen as an opportunity by major OEMs in the region. In December 2024, MG Motor India’s Windsor EV accounted for 70% of the company’s total sales. The model, featuring battery leasing solutions, sold 3,785 units of this model. Similarly, Bounce Infinity (India) has been providing Infinity E1X, a two-wheeler equipped with battery leasing service since 2024 in India.

North America is expected to grow significantly during the forecast period

The North American battery as a service market is projected to grow significantly during the forecast period, due to the rising consumer demand for environmentally friendly electric vehicles. As more individuals opt for EVs due to their lower emissions and running costs, the demand for battery as a service solution is expected to grow in the region. Additionally, government incentives at federal and state levels are making EVs more affordable, encouraging greater adoption, which is also driving growth. As automakers rapidly expand their EV portfolios to cater to diverse consumer needs, the battery as a service model is expected to gain significant traction. Companies such as VinFast (Vietnam) already offer battery leasing services in the US and Canada, providing cost-effective solutions that reduce the upfront costs of EVs enhancing their accessibility. In April 2019, Proterra (US) partnered with MITSUI & CO., LTD. (Japan) to establish a credit facility valued at USD 200 million for a battery lease program. This credit facility, aimed to reduce the upfront costs of zero-emission buses, making Proterra electric buses approximately the same price as diesel buses. With supportive policies, technological advancements, and increasing investments in EV infrastructure, the North American battery as a service market is poised for significant growth in the years to come.

Key Players

The major players in the battery as a service market include NIO (China), Gogoro (Taiwan), XPENG INC. (China), SAIC Motor Corporation Limited (China), and Vinfast (Vietnam). These companies are capitalizing on the current EV shift, adopting expansion strategies, and undertaking partnerships/collaborations with battery asset management companies and financial institutions to gain traction in the battery as a service market. Companies are also actively launching new and customized services to expand their market presence. In July 2024, Hyundai Motor Company (South Korea) plans to launch a new subscription service for the batteries of its electric vehicles, known as battery as a service. This service is expected to be introduced in 2025 for its KIA Niro Plus vehicle model, initially limited to South Korea. Currently, in the demonstration phase, the company aims to proceed with full implementation once testing is complete.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=164666806

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Rohan Salgarkar

Email:Send Email

Phone: 18886006441

Address:1615 South Congress Ave. Suite 103, Delray Beach, FL 33445

City: Florida

State: Florida

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/battery-as-a-service-market-164666806.html