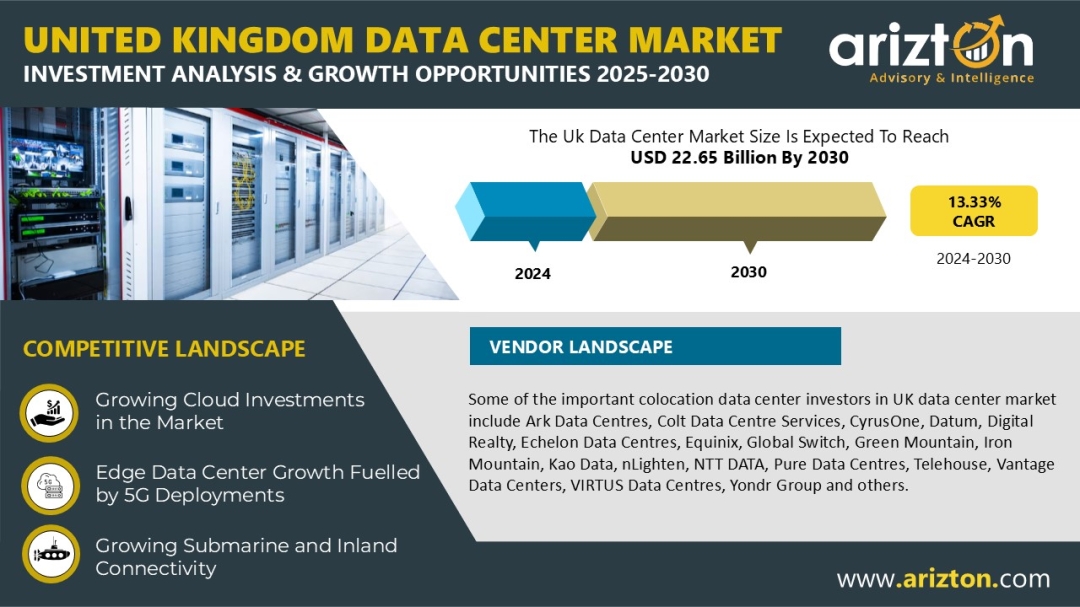

According to Arizton’s latest research report, the United Kingdom data center market is growing at a CAGR of 13.33% during 2025-2030.

Looking for More Information? Click: https://www.arizton.com/market-reports/uk-data-center-market-investment-analysis

Report Scope:

Market Size – Investment (2030): $22.65 Billion

Market Size – Area (2030): 2.19 Million Sq. Ft.

Market Size - Power Capacity (2030): 462 MW

CAGR – Investment (2024-2030): 13.33%

Colocation Market Size – Revenue (2030): $8.84 Billion

Historic Year: 2021-2023

Base Year: 2024

Forecast Year: 2025-2030

UK Data Center Market Overview

The UK is emerging as a leading hub for data center investments in Europe, driven by the increasing adoption of cloud services, rising internet penetration, and strong government support. Significant investments are being made by both local and international data center providers, including hyperscale operators like AWS, Microsoft, Google, and others, who are establishing new cloud regions in the country. The UK's data protection laws, such as the Data Protection Act and GDPR, have further encouraged local data storage compliance, boosting data center growth.

Key developments include large-scale investments in infrastructure, like AWS’s planned $10.45 billion investment in data centers over the next five years, and Google’s $1 billion investment in a new data center in Waltham Cross. There are also notable partnerships, such as Vodafone and Microsoft's $1.5 billion collaboration to enhance cloud services and AI.

The UK's connectivity is bolstered by 56 existing submarine cables, with new cables like the Beaufort and IOEMA cables set to expand global connectivity. Additionally, the government is focused on enhancing broadband infrastructure and supporting digital access nationwide.

Technological advancements, particularly in AI, IoT, big data, and 5G networks, are driving demand for data centers, as is the rapid growth of mobile and social media use. These trends are accelerating the digital transformation across sectors such as healthcare, finance, and government, positioning the UK as a major player in the data center market.

The UK Pioneers Renewable Energy and Data Center Growth

The UK is progressing towards generating 95% of its electricity from renewables by 2030, with 43% of energy already sourced from renewables as of September 2024. London aims for over 15% renewable energy by 2030 to support its carbon neutrality target by 2050. This renewable shift is fostering the growth of data centers, as companies adopt sustainable energy solutions. Notable examples include Amazon’s deal to acquire 159 MW of energy from the East Anglia Three offshore wind farm, and Iron Mountain’s plan to source 5 MW of rooftop solar for its LON-1 data center.

The demand for renewable power is driving the expansion of data centers across the country, with major projects like VIRTUS Data Centres, DC01UK, and Kao Data developing facilities with significant IT capacities. These efforts, alongside grid improvements by Octopus Energy and Global Switch, support the UK’s dual goals of sustainability and enhanced digital infrastructure.

Growth of Colocation Data Centers in the UK

The UK is a prominent hub for colocation data centers in Europe, with a strong concentration of facilities, particularly in London. Major operators like Digital Realty, Equinix, CyrusOne, and Telehouse are key players in the market, and the growing demand for cloud services and the expansion of hyperscale operations are expected to significantly increase colocation capacity in the coming years. In recent times, several companies have made substantial investments to develop new data centers across the country. Notable examples include major US-based firms, which have poured billions into the UK's data center infrastructure. The demand for colocation services is primarily driven by the cloud and IT sectors, with additional interest from industries like banking, finance, and government. While the high-end colocation market continues to grow, the lower-end segment, offering smaller-scale services, is expected to shrink as consolidation within the industry progresses.

London: A Prime Hub for Data Center Development

London is a major hub for data center development in the UK, driven by its strong financial sector, dynamic digital economy, and advanced infrastructure. With more than 50 data center facilities in the city, London hosts leading providers like Digital Realty, Equinix, and CyrusOne, catering to sectors like finance, media, and entertainment. The city’s adoption of cloud-based services and advanced technologies such as AI, big data, and IoT continues to accelerate.

In 2024, London saw the development of around 22 new data centers, mostly in the colocation sector. Key investors like VIRTUS Data Centres, Vantage Data Centers, and Echelon Data Centres are contributing to this growth. Notable initiatives include Queen Mary University of London’s collaboration with Schneider Electric to implement a heat recovery system, repurposing waste heat for campus buildings. The city is also exploring supercomputing technologies, with plans to deploy Nvidia GPUs in data centers.

Why Should You Buy this Research?

- Market size available in the investment, area, power capacity, and UK colocation market revenue.

- An assessment of the data center investment in the UK by colocation, hyperscale, and enterprise operators.

- Data center investments in the area (square feet) and power capacity (MW) across counties in the country.

- A detailed study of the existing UK data center market landscape, an in-depth industry analysis, and insightful predictions about the UK data center market size during the forecast period.

- Snapshot of existing and upcoming third-party data center facilities in the UK

- Facilities Covered (Existing): 227

- Facilities Identified (Upcoming): 39

- Coverage: 34+ Counties

- Existing vs. Upcoming (Data Center Area)

- Existing vs. Upcoming (IT Load Capacity)

- Data center colocation market in the UK

- Colocation Market Revenue & Forecast (2021-2030)

- Retail vs Wholesale Colocation Market Revenue & Forecast (2021-2030)

- Retail & Wholesale Colocation Pricing

- The UK data center landscape market investments are classified into IT, power, cooling, and general construction services with sizing and forecast.

- A comprehensive analysis of the latest trends, growth rate, potential opportunities, growth restraints, and prospects for the industry.

- Business overview and product offerings of prominent IT infrastructure providers, construction contractors, support infrastructure providers, and investors operating in the industry.

- A transparent research methodology and analysis of the demand and supply aspects of the industry.

Book the Free Sample Now: https://www.arizton.com/market-reports/uk-data-center-market-investment-analysis

The Report Includes the Investment in the Following Areas:

IT Infrastructure

- Servers

- Storage Systems

- Network Infrastructure

Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches & Switchgears

- PDUs

- Other Electrical Infrastructure

Mechanical Infrastructure

- Cooling Systems

- Rack Cabinets

- Other Mechanical Infrastructure

Cooling Systems

- CRAC & CRAH Units

- Chiller Units

- Cooling Towers, Condensers & Dry Coolers

- Other Cooling Units

General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression Systems

- Physical Security

- Data Center Infrastructure Management (DCIM)

Tier Standard

- Tier I & Tier II

- Tier III

- Tier IV

Geography

- Greater London

- Other Counties

Vendor Landscape

IT Infrastructure Providers

- Arista Networks

- Atos

- Broadcom

- Cisco Systems

- Dell Technologies

- Fujitsu

- Hewlett Packard Enterprise

- Huawei Technologies

- IBM

- Juniper Networks

- NetApp

Data Center Construction Contractors & Sub-Contractors

- 2bm

- AECOM

- Arup

- ARC:MC

- AtkinsRéalis

- BladeRoom Data Centres

- Bouygues Construction

- Deerns

- Future-tech

- HDR Architecture

- INFINITI IT

- ISG

- JCA Engineering

- Kirby Group Engineering

- ACIES Civil and Structural

- Mace Group

- Mercury

- MiCiM

- StudioNWA

- Sweet Projects

- RED Engineering Design

- SPIE

- Skanska

- STO Building Group

- Sudlows

- TTSP

- Waldeck

Support Infrastructure Providers

- ABB

- Airedale

- Caterpillar

- Cummins

- Delta Electronics

- Eaton

- Kohler

- Legrand

- Mitsubishi Electric

- Pillar Power Systems

- Rittal

- Rolls-Royce

- Riello Elettronica Group

- Schneider Electric

- Siemens

- Socomec

- STULZ

- Vertiv

- AF Switchgear

- AVK

Data Center Investors

- Amazon Web Services

- Ark Data Centres

- Colt Data Centre Services

- CyrusOne

- Datum

- Digital Realty

- Echelon Data Centres

- Equinix

- Global Switch

- Green Mountain

- Iron Mountain

- Kao Data

- Microsoft

- nLighten

- NTT DATA

- Pure Data Centres

- Telehouse

- Vantage Data Centers

- VIRTUS Data Centres

- Yondr Group

New Entrants

- Ada Infrastructure

- CloudHQ

- Digital Reef

- Global Technical Realty

- Humber Tech Park

- J Mould Reading

- SEGRO

- Latos

- QTS Data Centers

- EdgeNebula

Key Questions Answered in the Report:

How many existing and upcoming data center facilities exist in the UK?

How big is the UK data center market?

How much MW of power capacity will be added across the UK during 2025-2030?

What factors are driving the UK data center market?

Who are the key investors in the UK data center market?

Check Out Some of the Top Selling Research Reports:

Spain Data Center Market - Investment Analysis & Growth Opportunities 2025-2030

https://www.arizton.com/market-reports/spain-data-center-market-investment-analysis-report

Germany Data Center Market - Investment Analysis & Growth Opportunities 2024-2029

https://www.arizton.com/market-reports/germany-data-center-market-2025

Why Arizton?

100% Customer Satisfaction

24x7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton's report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email:Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/uk-data-center-market-investment-analysis