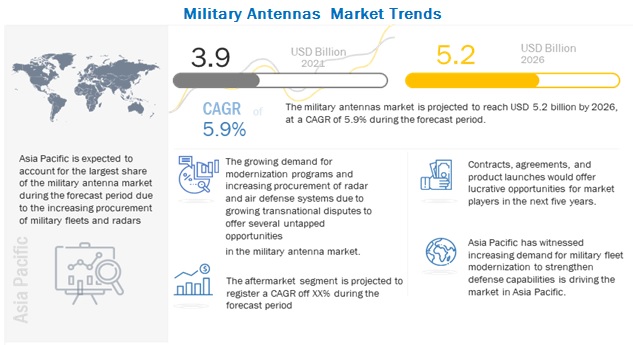

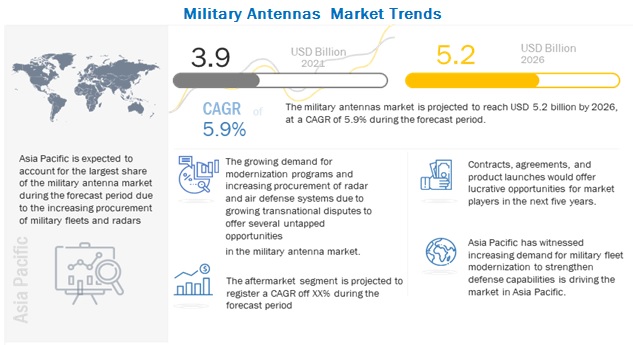

[281 Pages] Military antennas market is Expected to reach USD 5.2 billion by 2026 from USD 3.9 billion in 2021, at a CAGR of 5.9% during the forecast period.

According to a research report "Military Antennas Market by Component (Reflectors, Feed Horn, Feed Networks, Low Noise Block Converter (LNB)), Frequency Band (HF, VHF, UHF SHF, AND EHF), End Use (OEM and Aftermarket), Type, Application, Platform and Region – Global Forecast to 2026" published by MarketsandMarkets, Military antennas market is projected to grow from USD 3.9 billion in 2021 to USD 5.2 billion by 2026, at a CAGR of 5.9% during the forecast period. Military antennas refers any device that converts electronic signals to electromagnetic waves (and vice versa) effectively with minimum loss of signals. Military antennas are more ruggedized than regular commercial antennas to withstand harsh conditions. The military antennas market is expected to grow at a significant rate in the coming years, owing to the adoption of various electronic systems for communication, intelligence, surveillance & reconnaissance (ISR), and command and control in the defense industry. These military systems require antennas for transmitting and receiving data. Antennas should be rugged to withstand harsh environmental conditions. Defense modernization programs and increasing procurement of radar and air defense systems are also expected to fuel the growth of the military antennas market.

• Informational PDF Brochure :- https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=217007639

Browse 314 market data Tables and 39 Figures spread through 281 Pages and in-depth TOC on "Military Antennas Market by Application, Platform and Region – Global Forecast to 2026"View detailed Table of Content here - https://www.marketsandmarkets.com/Market-Reports/military-antenna-market-217007639.html

Growing investments by several governments particularly in developed and developing economies such as the US, India, and China, among others. COVID-19 has affected the Military antennas market growth to some extent, and this varies from country to country. Industry experts believe that the pandemic has not affected the demand for Military antennas.

Based on component, reflectors segment is estimated to witness the largest share of the military antennas market from 2021 to 2026.

Based on component, reflectors segment of the military antennas market is estimated to held the dominant market share in 2021. This is due to the innovation in reflector design to decrease the assemble time. Reflectors are integrated into antenna assembly to modify the radiation pattern of the antenna so that the signal gain can be improved in target direction. Various manufacturers are focusing on improving the reflector design so that the assembly time can be decreased.

For instance, in 2021, Airbus selected Ariane Group as the supplier of the satellite antenna reflectors for OneSat, its new satellite product, which is fully reconfigurable in orbit. OneSat will be fitted with the latest generation of ultra-light SPRINT antenna reflectors, which can be assembled in only 11 weeks compared with 24 weeks for ultra-light reflector technology.

Based on frequency band, super-high frequency segment of the military antennas market is projected to witness the largest share in 2021.

Based on frequency band, super-high frequency segment is projected to lead the military antennas market during the forecast period. The growing demand for reliable military satellite communication is primarily driving this segment. The small wavelength of this band permits transmission of narrow beams by aperture antennas such as parabolic dish antennas and horn antennas. This band is used for point-to-point satellite communication and data links. The SHF band is used in airborne radar for airborne ground mapping. This band is used for point-to-point communication and data links. This frequency range is used for most radar transmitters, wireless LANs, satellite communication, microwave radio relay links, and numerous short-range terrestrial data links.

Based on type, array antenna segment is estimated to account for the fastest growth of the military antennas market from 2021 to 2026.

Based on type, array antenna segment of the military antennas market is projected to grow at the highest CAGR during the forecast period. This growth is driven due to Phased-array antenna systems are used in naval and airborne platforms. In 2020, the Defense Innovation Unit (DIU) (US) awarded a contract to ThinKom Solutions to test and evaluate one of the company’s commercial off-the-shelf (COTS) aeronautical phased-array antenna systems as a solution for next-generation communications on the US Navy ships. Under the seven-month contract, ThinKom delivered a ThinAir Ka2517 antenna system for on-board testing to meet the requirements for multi-domain tactical communications (MDTC) by the US Navy. The Ka-band antenna, based on the company’s patented VICTS technology, will demonstrate the capability to be integrated onto a US Navy ship.

Based on platform, ground segment is estimated to account for the largest share of the military antennas market from 2021 to 2026.

Based on platform, ground segment is estimated to account for the largest share of the military antennas during the forecast period. This growth is driven due to need for on-the-walk and on-the-move SATCOM capabilities for voice and data transmission, grounds stations use SATCOM to collect and stream remote sensing satellite data to a variety of users and applications, predominantly use manpack antennas in military operations, and UGVs antennas are used to carry out ground surveillance missions. In 2021, ARLINGTON, Va. FLIR Systems won an additional USD 30.1-million contract from the US Army for sustainment efforts connected to the service’s Man Transportable Robotic System Increment II (MTRS Inc. II) and Common Robotic System-Heavy (CRS-H) unmanned ground vehicle (UGV) programs.

Based on application, electronic warfare segment is estimated to account for the fastest growth of the military antennas market from 2021 to 2026.

Based on application, electronic warfare segment of the military antennas market is projected to grow at the highest CAGR during the forecast period. This growth is driven due to incorporation of effective RF technology in various electronic equipment used in military applications. In January 2021, Raytheon Intelligence & Space (Raytheon Technologies business) received a contract worth USD 12.7 million to build a phased array antenna that will reveal new capabilities in the millimeter-wave part of the radiofrequency spectrum for small, mobile platforms such as aircraft. Millimeter-wave is less overcrowded than other parts of the RF spectrum on the battleground.

Based on end use, OEM segment is estimated to account for the largest share of the military antennas market from 2021 to 2026.

Based on end use, OEM segment is estimated to account for the largest share of the military antennas during the forecast period. This growth is driven due to increasing upgradation of military antennas and procurement of military vehicles across the globe. The OEM segment is expected to lead the market during the forecast period due to the increasing inventory of newly inducted airborne platforms, including unmanned aerial vehicles, fourth-, fifth-, and sixth-generation fighter aircraft, and helicopters. The use of these airborne platforms is increasing in anti-submarine warfare, air-to-ground support, and air defense roles. The development of new missiles such as beyond-visual-range missiles and anti-radiation missiles for newly inducted platforms has further propelled the demand for military antennas.

The Asia Pacific market is projected to contribute the largest share from 2021 to 2026 in the Military antennas market

Based on region, Asia Pacific is expected to lead the Military antennas market from 2021 to 2026 in terms of market share. An increase in the instances of terror attacks in the Asia Pacific region has led countries of the region to enhance their surveillance and anti-terrorism capabilities. In addition, the increase in defense expenditures of India and China, among others, and the expansion of military commands in emerging economies have accelerated the demand for military antennas in the Asia Pacific region. In 2019, Gilat Satellite Networks Ltd, a worldwide leader in satellite networking technology, solutions, and services, and China Satellite Communications Co., Ltd. (China Satcom) announced a strategic partnership to jointly provide advanced satellite communication services for aero, land, and maritime fixed and mobility applications.

In 2021, China launched the Tiantong 1-03 communications satellite, which operates in the S-band frequency, providing mobile communication services. Once in its orbit, the satellite will be networked with Tiantong 1-01 and 1-02 satellites to improve resource efficiency and system service capabilities.

Contracts were the main strategy adopted by leading players to sustain their position in the Military antennas market, followed by new product developments with advanced technologies. Many companies also collaborated to set up special centers for the research & development of advanced Military antennas.

The Military antennas market is dominated by a few globally established players such as L3Harris Technologies (US), Airbus (Netherlands), General Dynamics (US), Maxar Technologies (US), and Honeywell International Inc. (US), among others.

Don’t miss out on business opportunities in Military Antennas Market. Speak to our analyst and gain crucial industry insights that will help your business grow.

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies’ revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model – GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets’s flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

Media Contact

Company Name: Marketsandmarkets pvt ltd

Contact Person: Mr. Aashish Mehra

Email:Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: India

Website: https://www.marketsandmarkets.com/Market-Reports/military-antenna-market-217007639.html