Overview of the Europe fintech market

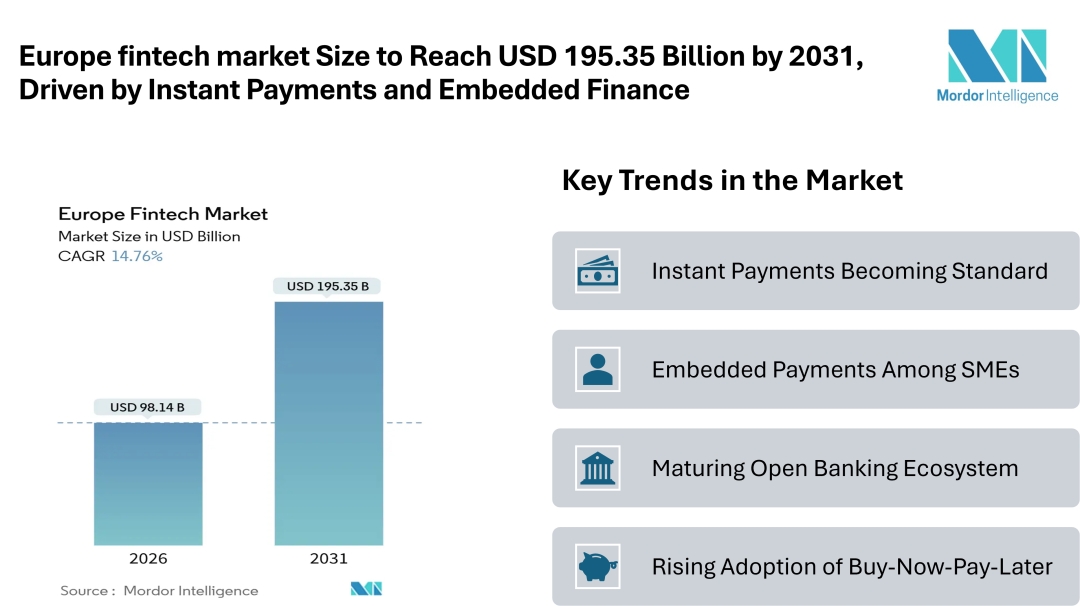

According to Mordor Intelligence, the Europe fintech market size is projected to grow from USD 98.14 billion in 2026 to USD 195.35 billion by 2031, registering a CAGR of 14.76% during the forecast period. The Europe fintech market is expanding steadily as digital adoption deepens across banking, payments, lending, and insurance services. Regulatory support, real-time payment infrastructure, and strong consumer demand for digital financial tools are shaping the direction of the European fintech industry.

The introduction of the Instant Payments Regulation across the European Union has strengthened the foundation of the Europe fintech market growth. By mandating round-the-clock instant credit transfers and verification-of-payee requirements, the regulation enhances transaction speed, security, and trust. Businesses benefit from improved liquidity management, while consumers experience faster settlements and safer account-to-account transfers.

Growth Drivers in the Europe fintech market

Instant Payments Becoming Standard

A major driver of the Europe fintech market growth is the rapid implementation of instant account-to-account payments. Under the EU’s Instant Payments Regulation, providers of traditional euro transfers must also offer instant versions at no additional cost. This approach strengthens the European fintech industry by encouraging widespread adoption of real-time transactions. The verification-of-payee mechanism further reduces fraud risk, helping users confirm beneficiary details before funds are transferred

Embedded Payments Among SMEs

Another defining trend in the Europe fintech market is the acceleration of embedded payments among small and mid-sized enterprises. Businesses are increasingly integrating payment acceptance, card issuing, and payouts directly into their accounting, commerce, and SaaS platforms. This shift reduces operational complexity and improves speed to market. By managing online, mobile, and in-store transactions through unified systems, SMEs are strengthening their financial workflows. Embedded finance models are therefore playing a central role in expanding the Europe fintech market size across the business segment.

Maturing Open Banking Ecosystem

Open banking continues to influence Europe fintech market trends. Banks are moving beyond regulatory compliance and using standardized APIs to create revenue-generating services. Through data-sharing frameworks, fintech firms can access customer account information securely and build personalized solutions. API monetization strategies, subscription models, and revenue-sharing arrangements are expanding non-interest income streams for financial institutions. This maturity in open banking strengthens the competitive dynamics within the European fintech industry and supports further digital product development.

Rising Adoption of Buy-Now-Pay-Later

Buy-now-pay-later solutions are expanding across European e-commerce channels. Consumers are increasingly choosing flexible short-term financing integrated directly into checkout processes. Updated consumer credit rules are reinforcing affordability assessments and transparency, supporting sustainable growth in this segment. AI-driven underwriting tools improve approval accuracy and repayment performance. As regulatory clarity increases, BNPL providers are broadening merchant partnerships, contributing to overall Europe fintech market growth in digital lending services.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/europe-fintech-market?utm_source=abnewswire

Europe Fintech Market Segmentation

By Service Proposition

-

Digital Payments

-

Digital Lending and Financing

-

Digital Investments

-

Insurtech

-

Neobanking

By End-User

-

Retail

-

Businesses

-

By User Interface

-

Mobile Applications

-

Web/Browser

-

POS/IoT Devices

By Country

-

United Kingdom

-

Germany

-

France

-

Spain

-

Italy

-

Benelux (Belgium, Netherlands, and Luxembourg)

-

Nordics (Sweden, Norway, Denmark, Finland, and Iceland)

-

Rest of Europe

Explore Our Full Library of Financial Services and Investment Intelligence Research https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=abnewswire

Key Players in the European Fintech Industry

-

Adyen N.V.

-

Klarna Bank AB

-

Revolut Ltd

-

Checkout.com Group

-

Wise plc

Explore more insights on European fintech competitive landscape: https://www.mordorintelligence.com/industry-reports/europe-fintech-market/companies?utm_source=abnewswire

Conclusion

The Europe fintech market is entering a phase of structured and regulation-backed expansion. Instant payment mandates, embedded finance adoption, open banking maturity, and consumer demand for flexible digital services are shaping the Europe fintech market trends over the coming years.

While challenges such as venture capital caution and fragmented licensing regimes remain, harmonization efforts across Europe are gradually improving cross-border scalability. The Europe fintech market growth outlook remains positive as businesses and consumers continue shifting toward real-time, mobile-first, and API-enabled financial solutions.

For more insights on the Europe fintech market, please visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/europe-fintech-market?utm_source=abnewswire

Industry Related reports

K-12 Testing and Assessment Market

The K-12 testing and assessment market was valued at USD 10.95 billion in 2025 and is projected to reach USD 15.71 billion by 2030, growing at a 7.51% CAGR. Growth is driven by increasing adoption of digital assessment platforms, integration of AI-based evaluation tools, remote learning expansion, and rising emphasis on standardized performance tracking in schools.

Get more insights: https://www.mordorintelligence.com/industry-reports/k-12-testing-and-assessment-market?utm_source=abnewswire

Embedded Finance Market Size

The Embedded Finance Market is expected to grow from USD 155.98 billion in 2025 to USD 155.96 billion in 2026, reaching USD 454.48 billion by 2031 at a robust 23.84% CAGR. This rapid expansion is fueled by the integration of financial services into non-financial platforms, rising digital payments adoption, growth of e-commerce ecosystems, and increasing demand for seamless in-app lending, insurance, and payment solutions.

Get more insights: https://www.mordorintelligence.com/industry-reports/embedded-finance-market?utm_source=abnewswire

India Fintech Market Share

The India fintech market is estimated at USD 51.30 billion in 2026 and is forecast to reach USD 109.06 billion by 2031, expanding at a 16.27% CAGR during 2026–2031. Strong digital infrastructure, government initiatives supporting cashless transactions, rapid smartphone penetration, UPI adoption, and increased investor funding are key drivers accelerating fintech innovation across payments, lending, insurtech, and wealth management segments.

Get more insights: https://www.mordorintelligence.com/industry-reports/india-fintech-market?utm_source=abnewswire

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana – 500032, India.

Media Contact

Company Name: Mordor Intelligence Private Limited

Contact Person: Jignesh Thakkar

Email:Send Email

Phone: +1 617-765-2493

Address:11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli

City: Hyderabad

State: Telangana 500008

Country: India

Website: https://www.mordorintelligence.com/