DelveInsight’s “Bone Graft and Substitutes Market Insights, Competitive Landscape, and Market Forecast - 2032” report delivers a comprehensive analysis of the Bone Graft and Substitutes market globally.

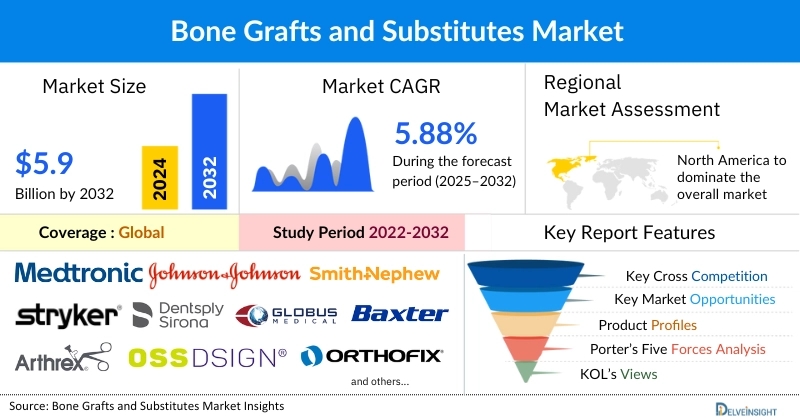

The global Bone Graft and Substitutes Market, segmented by source, product type, application, end-user, and geography, is poised for consistent growth through 2032. According to recent market analyses, the market was valued at USD 3,786.25 million in 2024 and is projected to reach USD 5,957.71 million by 2032, exhibiting a steady compound annual growth rate (CAGR) of 5.88% during the forecast period from 2025 to 2032.

This expansion is being primarily driven by the increasing prevalence of bone-related disorders such as osteoporosis, a surge in trauma cases globally, an aging population, and growing adoption of bone grafts in dental and spinal procedures. Additionally, significant advancements in synthetic and biologically derived materials are enhancing treatment efficacy and broadening product accessibility across markets worldwide.

Discover the latest trends and growth opportunities in the global Bone Graft and Substitutes Market - download the full report now @ Bone Graft and Substitutes Market Analysis

Rising Burden of Bone Disorders and Trauma Cases

The global rise in bone-related disorders continues to play a crucial role in driving market growth. The International Osteoporosis Foundation (2023) reports that over 8.9 million fractures occur annually due to osteoporosis—a degenerative disease that weakens bones and increases fracture risk. With age-related bone degeneration and joint complications becoming increasingly common, there is heightened demand for effective bone repair and regenerative solutions worldwide.

In parallel, trauma cases, especially those resulting from road traffic accidents, are significantly fueling demand for bone grafts and substitutes. According to the World Health Organization (2023), road injuries are the leading cause of death among individuals aged 5–29 years, while 20–50 million people suffer non-fatal injuries annually. Many of these cases involve severe fractures requiring bone reconstruction, often necessitating graft materials for restoring functionality and promoting healing.

Expanding Role of Bone Grafts in Dentistry

The dental sector’s adoption of bone graft and substitute materials has expanded rapidly, driven by the increasing prevalence of tooth loss, periodontal disease, and a greater preference for dental implants. According to a global study titled "Bone Graft and Substitutes in Dentistry: A Review of Current Trends and Developments" (2021), an estimated 2.2 million bone transplant surgeries were performed worldwide in 2021, valued at approximately USD 664 million, with annual surgical volumes projected to grow by around 13%.

Rising cosmetic dental awareness and advancements in grafting techniques have further boosted market momentum in dental applications. Manufacturers are introducing innovative graft materials that provide enhanced biocompatibility, structural stability, and improved patient outcomes, helping clinicians address an ever-widening spectrum of dental and maxillofacial conditions.

Stay ahead of innovation in orthopedic and dental biomaterials – request your sample report today @ Bone Graft and Substitutes Market

Product Innovation and Industry Collaborations

Leading companies are accelerating research and strategic partnerships to expand their clinical portfolios. Recent examples include:

- ZimVie (April 2023): Launched RegenerOss CC Allograft Particulate and RegenerOss Bone Graft Plug for periodontal and socket preservation applications.

- Orthofix Medical and CGBio (August 2022): Entered a partnership to commercialize Novosis rhBMP-2 bone graft technologies, enhancing their offerings in regenerative medicine.

- Ivory Dentin Graft (September 2022): Secured CE mark approval for the world’s first dentin graft material, signaling growing regulatory acceptance of novel graft sources.

These strategic activities are reinforcing competition, advancing product efficacy, and setting new standards for regenerative bone care innovation globally.

Explore detailed forecasts, key players, and emerging technologies shaping the Bone Graft and Substitutes Market - get expert insights here @ Bone Graft and Substitutes Companies and Approvals

Bone Graft and Substitutes Market Segmentation Overview

The Bone Graft and Substitutes Market is structured based on multiple parameters, including source, product type, application, and end-user, which together provide a comprehensive view of market trends and growth prospects.

1. Bone Graft and Substitutes Market By Source

- Natural

- Synthetic

In 2024, the natural category dominated the market with a 66.85% share. Natural bone grafts—derived through autografts or allografts—have gained preference due to their inherent biocompatibility, lower risk of immune rejection, and long-term integration benefits. These materials also exhibit lower infection rates than synthetic alternatives, ensuring durable skeletal reinforcement after surgery.

2. Bone Graft and Substitutes Market By Product Type

- Allograft (Demineralized Bone Matrix, Bone Morphogenetic Proteins, and Cell-Based Matrices)

- Xenograft

- Others

Allografts lead the segment due to their availability, structural compatibility, and versatility in orthopedic and dental applications. Furthermore, ongoing advancements in demineralized bone matrix (DBM) formulations and BMP-based grafts are significantly improving their clinical performance and shelf life.

3. Bone Graft and Substitutes Market By Application

- Craniomaxillofacial

- Dental

- Joint Reconstruction

- Spinal Fusion

- Others

Among applications, spinal fusion remains a critical driver of global demand. The prevalence of degenerative disc disease, spinal deformities, fractures, and spinal stenosis continues to necessitate graft-based interventions. Similarly, the dental and craniomaxillofacial categories are seeing increased adoption, especially fueled by aging populations and restorative procedures in developed markets.

4. Bone Graft and Substitutes Market By End-User

- Hospitals and Clinics

- Specialty Clinics

- Others

Hospitals and clinics dominate end-user adoption due to their access to advanced surgical infrastructure, skilled orthopedic surgeons, and a steady influx of trauma and elective surgical cases.

Identify investment opportunities and competitive strategies driving the next phase of bone regeneration solutions - access the market analysis now @ Bone Graft and Substitutes Competitive Landscape

Regional Landscape: North America Leads Global Bone Graft and Substitutes Market Growth

North America Bone Graft and Substitutes Market is anticipated to maintain market leadership through 2032, holding a 47.92% share in 2024 and registering a CAGR of 5.54% during the forecast period. Several factors contribute to this lead, including the region’s increasing prevalence of spinal disorders, tooth loss among the geriatric population, and robust healthcare infrastructure that supports cutting-edge orthopedic and dental procedures.

According to the United Spinal Association (2022), approximately 17,700 new spinal cord injuries occur annually in the U.S., with vehicle accidents accounting for nearly 40%. Conditions such as degenerative disc disease and spinal fracture repairs frequently require bone grafting to ensure proper spinal fusion, making North America a major consumer of graft materials.

Additionally, the Centers for Disease Control and Prevention (2024) reports that 11% of adults aged 65–74 in the U.S. have lost all their teeth. The significant rise in tooth loss and alveolar bone degradation has led to higher utilization of bone grafts in dental reconstruction, enabling secure implant placement and improved patient outcomes.

Recent regulatory and product approvals further solidify the region’s position. In September 2024, Cerapedics Inc. received FDA clearance for expanded use of its i-FACTOR P-15 Peptide Enhanced Bone Graft in anterior cervical discectomy fusion (ACDF) procedures, a milestone underscoring the regulatory focus on innovation and safety in regenerative grafting.

Empower strategic planning with in-depth market intelligence on bone grafts and substitutes - connect with our research team to learn more @ Bone Graft and Substitutes Market Dynamics

Key Bone Graft and Substitutes Companies in Market

Major companies operating in the global Bone Graft and Substitutes space include: Medtronic plc., Johnson & Johnson, Smith & Nephew, Stryker, Dentsply Sirona Inc., Globus Medical Inc., Baxter, Arthrex Inc., OssDsign, Orthofix Medical Inc., Xtant Medical Holdings Inc., Halma, B. Braun Melsungen AG, Exactech Inc., Zimmer Biomet, Institut Straumann AG, Southern Implants, MedBone Biomaterials, Noraker, and BioHorizons.

Key Takeaways

- Bone Graft and Substitutes Market size was USD 3.79 billion in 2024 and is projected to reach USD 5.96 billion by 2032.

- CAGR forecast for the period 2025–2032: 5.88%.

- Natural bone grafts lead the market due to superior compatibility and biological performance.

- North America expected to maintain market dominance through 2032.

- Spinal and dental applications remain the two fastest-growing segments.

- Product innovation, research collaborations, and regulatory approvals are key growth accelerators.

Table of Contents

1. Bone Graft and Substitutes Market Report Introduction

2. Bone Graft and Substitutes Market Executive Summary

3. Competitive Landscape

4. Regulatory Analysis

4.1. The United States

4.2. Europe

4.3. Japan

4.4. China

5. Bone Graft and Substitutes Market Key Factors Analysis

6. Bone Graft and Substitutes Market Porter’s Five Forces Analysis

7. Bone Graft and Substitutes Market Assessment

8. Bone Graft and Substitutes Market Company and Product Profiles

9. KOL Views

10. Project Approach

11. About DelveInsight

12. Disclaimer & Contact Us

About DelveInsight

DelveInsight is a leading business consulting and market research company focused on the healthcare and life sciences sectors, providing comprehensive market intelligence, competitive landscape analysis, and strategic insights to support decision-making across the pharmaceutical industry.

Media Contact

Company Name: DelveInsight Business Research LLP

Contact Person: Ankit Nigam

Email:Send Email

Phone: +14699457679

Address:304 S. Jones Blvd #2432

City: Albany

State: New York

Country: United States

Website: https://www.delveinsight.com/consulting/competitive-intelligence-services