Biliary Tract Cancer Market Summary

In 2023, the United States held the largest share of the biliary tract cancer (BTC) market within the 7MM, accounting for nearly 48%, followed by Italy as the leading EU market and Spain with the smallest share. Japan reported the highest number of BTC incident cases. In the U.S., the disease was most prevalent in patients aged 70–79 years (~30%). Clinically, tumor location influences presentation-extrahepatic tumors often cause painless jaundice, while intrahepatic tumors present with abdominal pain and other symptoms such as pruritus, fatigue, and fever. Diagnosis typically involves imaging modalities (ultrasound, MRI, CT) and biopsy. Treatment strategies vary by disease stage: surgery with adjuvant chemotherapy for early cases, loco-regional therapies for locally advanced disease, and gemcitabine-cisplatin combinations for advanced/metastatic BTC. While chemotherapy dominates, novel therapies-such as FGFR2 inhibitors PEMAZYRE and LYTGOBI, PD-1 inhibitor KEYTRUDA (expanded approval in 2023), and targeted agents like TAFINLAR + MEKINIST, VITRAKVI, and ROZLYTREK-are reshaping the landscape. Despite progress, low survival rates and high mortality remain significant challenges.

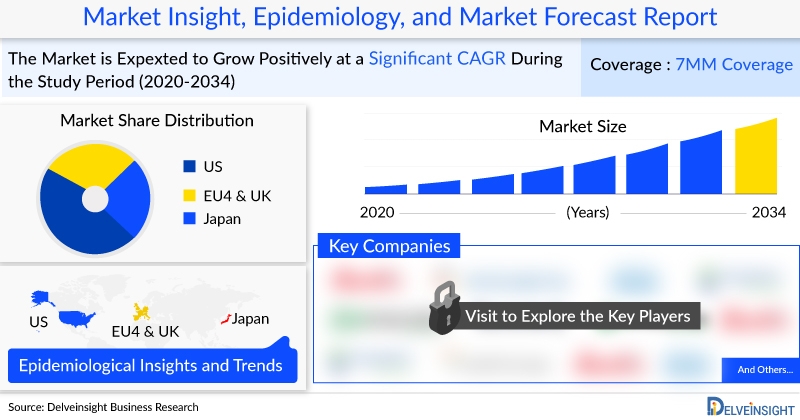

DelveInsight’s report, “Biliary Tract Cancer Market Insights, Epidemiology, and Market Forecast-2034”, provides a comprehensive analysis of biliary tract cancer, including historical trends, epidemiological projections, and market dynamics across the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan. The report evaluates current treatment practices, pipeline therapies, and the market share of existing and emerging interventions. It presents the current and forecasted market size for biliary tract cancer from 2020 to 2034 across the seven major markets (7MM). In addition, it outlines treatment algorithms, key market drivers, barriers, and prevailing unmet needs, thereby identifying growth opportunities and assessing the future potential of the biliary tract cancer market.

Discover in-depth insights into the evolving Biliary Tract Cancer market - explore epidemiology trends, treatment landscapes, and emerging therapies shaping the future. Download sample report @ Biliary Tract Cancer market forecast

Some facts of the Biliary Tract Cancer Market Report are:

- According to DelveInsight, Biliary Tract Cancer market size is expected to grow at a decent CAGR by 2034.

- In the 7MM, the United States accounted for the highest Biliary Tract Cancer market size, with nearly 48% of the market share of the Biliary Tract Cancer market as compared to EU4 and the UK and Japan in 2023.

- Leading Biliary Tract Cancer companies working in the market are Basilea Pharmaceutica, Zymeworks, BeiGene, Incyte Corporation, Loxo Oncology, Bayer, Roche, Genentech, QED Therapeutics, Agios Pharmaceuticals, Servier Pharmaceuticals, Merck Sharp & Dohme, AstraZeneca, Taiho Oncology, Delcath Systems, Eisai, and TransThera Sciences (Nanjing), and others.

- Key Biliary Tract Cancer Therapies expected to launch in the market are PEMAZYRE (pemigatinib), IMFINZI (durvalumab), CTX-009, Zanidatamab, and others.

- In July 2025, FUJIFILM Pharmaceuticals U.S.A., Inc., drug development center and a leading provider of Contract Development and Manufacturing Organization (CDMO) services for drug delivery system (DDS) technologies, today announced that the U.S. Food and Drug Administration (FDA) has granted orphan drug designation to Fujifilm’s FF-10832 — an investigational liposomal formulation of gemcitabine — for the treatment of biliary tract cancer (BTC). FF-10832 is currently being evaluated in phase 2a studies (NCT05318573) as monotherapy or in combination with pembrolizumab for the treatment of solid tumors in the U.S.

- In July 2025, Jazz Pharmaceuticals plc (Nasdaq: JAZZ) today announced that the European Commission (EC) has granted conditional marketing authorization1 for Ziihera® (zanidatamab), a dual human epidermal growth factor receptor 2 (HER2)-targeted bispecific antibody, as monotherapy for the treatment of adults with unresectable locally advanced or metastatic HER2-positive (IHC 3+) biliary tract cancer (BTC) previously treated with at least one prior line of systemic therapy.

- In November 2024, Jazz Pharmaceuticals announced the FDA's accelerated approval of Ziihera® (zanidatamab-hrii) 50mg/mL for intravenous use, for the treatment of adults with previously treated, unresectable or metastatic HER2-positive biliary tract cancer (BTC), as detected by an FDA-approved test.

- In November 2024, the FDA approved a label expansion for Roche’s PATHWAY anti-HER2/neu (4B5) test to include biliary tract cancer (BTC).

- On March 2024, Genome & Company announced results of a Phase II Study to Evaluate the Safety and the Efficacy of GEN-001 in Combination with Pembrolizumab for Patients with Advanced Refractory Biliary Tract Cancer.

- On March 2024, AstraZeneca announced results of a Phase IIIb, Single Arm, Open-label, Multi-center Study on Durvalumab in Combination With Gemcitabine-based Chemotherapy as First Line Treatment for Chinese Patients With Unresectable Biliary Tract Cancers.

- On April 25, 2023, Jazz and Zymeworks entered into a Stock and Asset Purchase Agreement to, among other things, transfer to Jazz certain assets, contracts, and employees associated with the development of zanidatamab.

Biliary Tract Cancer Overview

Biliary Tract Cancer (BTC) is a rare but aggressive malignancy that arises from the epithelial lining of the biliary system, including intrahepatic and extrahepatic bile ducts as well as the gallbladder. The disease is often classified into intrahepatic cholangiocarcinoma, extrahepatic cholangiocarcinoma, and gallbladder cancer. Clinical presentation depends on tumor location: extrahepatic tumors commonly cause painless jaundice due to biliary obstruction, whereas intrahepatic tumors often present with abdominal pain. Other symptoms may include pruritus, malaise, fever, and weight loss.

Biliary Tract Cancer Diagnosis typically involves abdominal examination, imaging techniques such as ultrasound, computed tomography (CT), or magnetic resonance imaging (MRI), followed by confirmatory biopsy. The disease is frequently detected at advanced stages, limiting curative options. Surgical resection with adjuvant chemotherapy remains the mainstay for early-stage disease, while loco-regional therapies (e.g., trans-arterial chemoembolization, external beam radiation therapy) may be considered for locally advanced cases. For unresectable or metastatic BTC, gemcitabine combined with cisplatin is the standard first-line regimen.

Emerging targeted therapies and immunotherapies are expanding treatment possibilities. FGFR2 inhibitors (PEMAZYRE, LYTGOBI) and PD-1 inhibitors (KEYTRUDA) represent key recent advances, while other agents targeting mutations such as KRAS, BRAF, and NTRK fusions are under development. Despite progress, BTC continues to be associated with poor prognosis and high mortality.

Explore Biliary Tract Cancer treatment algorithm and patient journeys across geographies. Get your free sample report here @ Biliary Tract Cancer Treatment Market

Biliary Tract Cancer Market

The Biliary Tract Cancer (BTC) market is projected to grow significantly between 2024–2034, driven by the launch of emerging therapies and increased healthcare spending. In 2023, the BTC market size across the 7MM was approximately USD 1 billion, with the United States leading, followed by Japan. By 2034, chemotherapy regimens are expected to generate the largest market share in the U.S. (~USD 360 million).

Current treatments include surgery with adjuvant chemotherapy for early-stage disease and gemcitabine plus cisplatin for advanced or metastatic cases. Recent FDA approvals have reshaped the treatment landscape:

IMFINZI (AstraZeneca) in Sept 2022 and KEYTRUDA (Merck) in Nov 2023 (both with gemcitabine + cisplatin) improved first-line outcomes.

LYTGOBI (2022) competes with PEMAZYRE (2020) for FGFR2-positive patients.

Other approved therapies include ROZLYTREK, TIBSOVO, and TAFINLAR + MEKINIST.

Several late-stage pipeline therapies, such as Tinengotinib (TransThera Sciences), Rilvegostomig (AstraZeneca/Compugen), Zanidatamab (Jazz/Zymeworks), CX-4945, and CTX-009, are expected to further expand options.

Overall, the BTC treatment landscape is evolving rapidly, with emerging targeted and immunotherapies expected to transform patient outcomes and drive substantial market growth through 2034.

According to DelveInsight, the Biliary Tract Cancer market in 7MM is expected to witness a major change in the study period 2020-2034.

Biliary Tract Cancer Market Drivers

- Rising Incidence and Prevalence: Increasing global cases of biliary tract cancer, particularly in aging populations, drive demand for advanced therapies.

- Advances in Diagnostics: Improved imaging, molecular profiling, and biomarker identification enhance early detection and enable personalized treatment approaches.

- Emergence of Targeted Therapies: Approvals of drugs like PEMAZYRE, LYTGOBI, and FGFR/IDH inhibitors expand treatment options for biomarker-driven patient subsets.

- Immunotherapy Approvals: Checkpoint inhibitors such as IMFINZI and KEYTRUDA (with chemotherapy) demonstrate survival benefits in first-line settings, fueling adoption.

- Strong R&D Pipeline: Promising candidates (e.g., Tinengotinib, Zanidatamab, Rilvegostomig) are in late-stage development, expected to reshape the treatment paradigm.

- Increasing Healthcare Spending: Rising investments in oncology and broader access to advanced therapies stimulate market growth across the 7MM.

Biliary Tract Cancer Market Barriers

- High Treatment Costs: Targeted and immunotherapies are expensive, limiting accessibility in certain markets.

- Tumor Heterogeneity: Genetic diversity in BTC complicates treatment response and restricts broad applicability of targeted drugs.

- Late Diagnosis: Most patients present with advanced disease, reducing eligibility for curative interventions like surgery.

- Limited Awareness: Low public and clinical awareness in some regions delays diagnosis and timely treatment initiation.

- Regulatory and Reimbursement Challenges: Lengthy approval timelines and restrictive reimbursement policies hinder therapy uptake002E

- Adverse Effects and Resistance: Chemotherapy toxicity and resistance to targeted agents reduce long-term effectiveness.

Biliary Tract Cancer Epidemiology

The Biliary Tract Cancer epidemiology section provides insights into the historical and current Biliary Tract Cancer patient pool and forecasted trends for seven individual major countries. It helps to recognize the causes of current and forecasted trends by exploring numerous studies and views of key opinion leaders. This part of the Biliary Tract Cancer market report also provides the diagnosed patient pool, trends, and assumptions.

Segmented by:

- Total Incident Cases of Biliary Tract Cancer in the 7MM

- Age-specific Cases of Biliary Tract Cancer in the 7MM

- Stage-specific Cases of Biliary Tract Cancer in the 7MM

- Total Incident Cases of Biliary Tract Cancer by tumor location in the 7MM

- Mutation-specific Cases of Biliary Tract Cancer in the 7MM

- Treated Cases of Biliary Tract Cancer in the 7MM

Discover key trends in Biliary Tract Cancer epidemiology across the 7MM. Explore cases by age, stage, tumor location, and mutations—get the full insights now! @ Biliary Tract Cancer Patient Pool

Biliary Tract Cancer Pipeline Outlook and Drugs Uptake

CTX-009 (Compass Therapeutics) CTX-009 (ABL001) is a bispecific antibody targeting DLL4/Notch and VEGF-A signaling pathways, both crucial for angiogenesis and tumor vascularization. By simultaneously blocking these pathways, CTX-009 has shown strong antitumor activity across multiple solid tumors, including colorectal, gastric, pancreatic, cholangiocarcinoma, and non-small cell lung cancer. Clinical studies have reported partial responses in heavily pre-treated patients resistant to existing VEGF therapies, highlighting its potential as an effective treatment option. Compass holds global rights for CTX-009, except in Korea (Handok) and China (Elpiscience Biopharma). Currently, CTX-009 is in Phase III clinical development for the treatment of Biliary Tract Cancer.

Zanidatamab (Jazz Pharmaceuticals/Zymeworks):

Zanidatamab is a late-stage HER2-targeted antibody designed to improve outcomes in HER2-expressing cancers, including biliary tract cancer and gastroesophageal adenocarcinoma. A pivotal Phase II trial is evaluating zanidatamab as monotherapy in patients with advanced or metastatic HER2-amplified biliary tract cancer. The therapy has received several regulatory designations from the US FDA, including Breakthrough Therapy, Fast Track, and Orphan Drug status, as well as Orphan Drug designation from the EMA, allowing access to Accelerated Approval pathways, Priority Review, and expedited regulatory guidance. These recognitions underline its strong potential to address unmet needs in biliary tract cancer. In April 2023, Jazz Pharmaceuticals acquired rights to zanidatamab from Zymeworks through a Stock and Asset Purchase Agreement, further advancing its development.

Gain exclusive insights into the rapidly expanding Biliary Tract Cancer (BTC) market, driven by breakthrough therapies like PEMAZYRE, IMFINZI, CTX-009, Zanidatamab, and more. Download sample report now @ Biliary Tract Cancer Medication and Companies

Biliary Tract Cancer Therapeutics Assessment

Major key companies are working proactively in the Biliary Tract Cancer Therapeutics market to develop novel therapies which will drive the Biliary Tract Cancer treatment markets in the upcoming years are Basilea Pharmaceutica (SIX: BSLN), Zymeworks (NASDAQ: ZYME), BeiGene (NASDAQ: ONC), Incyte Corporation (NASDAQ: INCY), Loxo Oncology (Acquired by Eli Lilly, no longer listed), Bayer (FWB: BAYN), Roche (SIX: ROG), Genentech (Acquired by Roche, no longer listed), QED Therapeutics (Privately held), Agios Pharmaceuticals (NASDAQ: AGIO), Servier Pharmaceuticals (Privately held), Merck Sharp & Dohme (NYSE: MRK), AstraZeneca (LSE: AZN), Taiho Oncology (Subsidiary of Otsuka Holdings, TYO: 4578), Delcath Systems (NASDAQ: DCTH), Eisai (TYO: 4523), TransThera Sciences (Nanjing), and others.

Learn more about the emerging Biliary Tract Cancer therapies & key companies @ Biliary Tract Cancer Clinical Trials and FDA Approvals

Biliary Tract Cancer Report Key Insights

1. Biliary Tract Cancer Patient Population

2. Biliary Tract Cancer Market Size and Trends

3. Key Cross Competition in the Biliary Tract Cancer Market

4. Biliary Tract Cancer Market Dynamics (Key Drivers and Barriers)

5. Biliary Tract Cancer Market Opportunities

6. Biliary Tract Cancer Therapeutic Approaches

7. Biliary Tract Cancer Pipeline Analysis

8. Biliary Tract Cancer Current Treatment Practices/Algorithm

9. Impact of Emerging Therapies on the Biliary Tract Cancer Market

Table of Contents

1. Key Insights

2. Executive Summary

3. Biliary Tract Cancer Competitive Intelligence Analysis

4. Biliary Tract Cancer Market Overview at a Glance

5. Biliary Tract Cancer Disease Background and Overview

6. Biliary Tract Cancer Patient Journey

7. Biliary Tract Cancer Epidemiology and Patient Population

8. Biliary Tract Cancer Treatment Algorithm, Current Treatment, and Medical Practices

9. Biliary Tract Cancer Unmet Needs

10. Key Endpoints of Biliary Tract Cancer Treatment

11. Biliary Tract Cancer Marketed Products

12. Biliary Tract Cancer Emerging Therapies

13. Biliary Tract Cancer Seven Major Market Analysis

14. Attribute Analysis

15. Biliary Tract Cancer Market Outlook (7 major markets)

16. Biliary Tract Cancer Access and Reimbursement Overview

17. KOL Views on the Biliary Tract Cancer Market

18. Biliary Tract Cancer Market Drivers

19. Biliary Tract Cancer Market Barriers

20. Appendix

21. DelveInsight Capabilities

22. Disclaimer

About DelveInsight

DelveInsight is a leading Life Science market research and business consulting company recognized for its off-the-shelf syndicated market research reports and customized solutions to firms in the healthcare sector.

Media Contact

Company Name: DelveInsight Business Research LLP

Contact Person: Ankit Nigam

Email:Send Email

Phone: +14699457679

Address:304 S. Jones Blvd #2432

City: Albany

State: New York

Country: United States

Website: https://www.delveinsight.com/consulting/competitive-intelligence-services