Introduction

The automotive wheel market plays a crucial role in the global automotive industry, as wheels are not just functional components but also influence safety, performance, fuel efficiency, and vehicle aesthetics. The market is evolving rapidly with changes in propulsion technologies, material adoption, and consumer preferences.

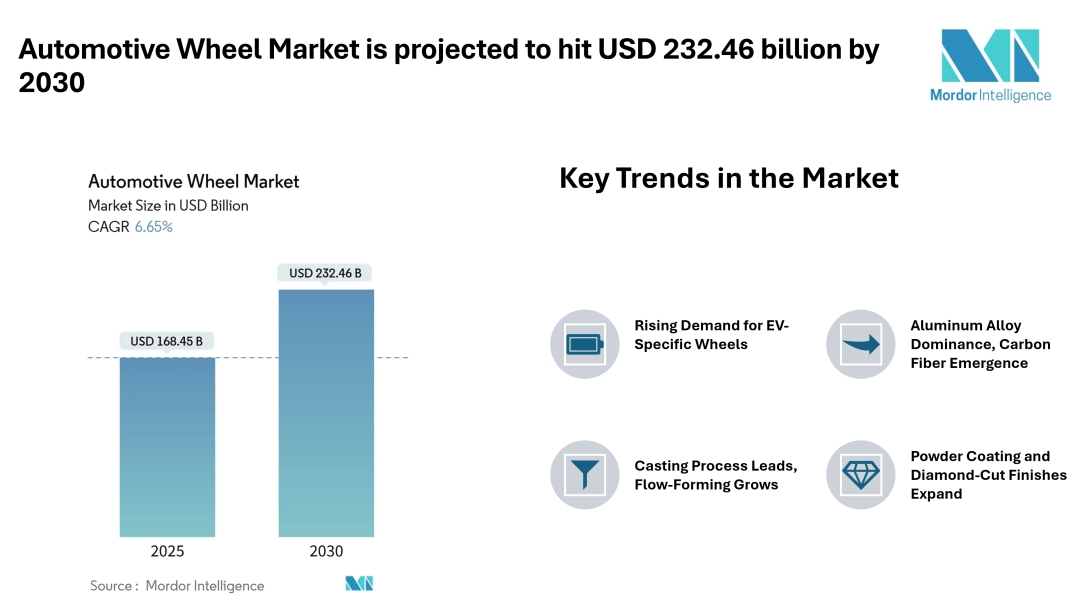

Key Market Trends

Rising Demand for EV-Specific Wheels - Battery electric vehicle (BEV) wheels are growing at the fastest rate as EV adoption expands worldwide. These wheels are engineered for lighter weight and improved aerodynamics to maximize battery efficiency.

Aluminum Alloy Dominance, Carbon Fiber Emergence - Aluminum alloy remains the most widely used material, offering strength and cost-effectiveness. At the same time, carbon fiber wheels are gaining attention for high-performance and premium vehicles, driven by their lightweight advantages.

Casting Process Leads, Flow-Forming Grows - Casting continues to dominate wheel manufacturing, but flow-forming is increasingly adopted for its balance of reduced weight and high durability. This reflects industry focus on performance and fuel economy.

Shift Toward Larger Rim Sizes - Mid-size rims (16–18 inches) hold the largest share today, but consumer preference is moving toward larger rims (over 21 inches), especially in luxury and performance vehicle segments.

Powder Coating and Diamond-Cut Finishes Expand - Powder-coated wheels remain the most popular for their durability and affordability. However, diamond-cut finishes are growing rapidly due to their premium look and rising demand in aftermarket customization.

Market Segmentation

By Vehicle Type

-

Passenger Cars – The largest consumer of wheels, driven by high sales of sedans, SUVs, and luxury cars.

-

Light Commercial Vehicles (LCVs) – Demand supported by logistics, last-mile delivery, and fleet expansion.

-

Heavy Commercial Vehicles (HCVs) – Includes trucks and buses, where wheels must withstand heavy loads.

-

Off-Highway Vehicles – Used in agriculture, mining, and construction equipment, requiring durable and specialized wheels.

By Material Type

-

Steel – Traditional and cost-effective, widely used in mass-market and commercial vehicles.

-

Aluminum Alloy – Popular for its lightweight, strength, and better performance, especially in passenger cars.

-

Magnesium Alloy – Lighter than aluminum, used in high-performance and racing applications.

-

Carbon Fiber – Premium, ultra-lightweight wheels, growing in luxury and sports segments.

-

Hybrid Composites – Blend of materials like aluminum and carbon fiber to balance cost, durability, and weight reduction.

By Manufacturing Process

-

Casting – Most common and cost-efficient process, dominating the mass market.

-

Forging – Produces stronger and more durable wheels, often used in premium and performance vehicles.

-

Flow-Forming – Combines casting and forging benefits, offering lighter yet durable wheels.

-

Other Processes – Includes niche methods like 3D printing for advanced prototypes or custom wheels.

By Rim Size

-

13–15 inch – Common in entry-level passenger cars and compact vehicles.

-

16–18 inch – Widely used in mid-segment cars, balancing performance and cost.

-

19–21 inch – Popular in premium, sports, and luxury models for style and performance.

-

Over 21 inch – Expanding among SUVs, luxury cars, and aftermarket customization enthusiasts.

By Finishing / Coating

-

Powder-Coated – Durable and affordable, widely used across all vehicle categories.

-

Diamond-Cut / Machined – Stylish, premium look increasingly popular in mid- and high-end cars.

-

Chrome / Polished – Reflective and aesthetic finish, often seen in luxury and aftermarket wheels.

-

Painted – Basic and versatile option, offering cost efficiency and variety of colors.

By Vehicle Propulsion

-

Internal Combustion Engine (ICE) – Still dominates global demand, accounting for most wheel sales.

-

Hybrid Vehicles (HEV/PHEV) – Growing steadily with focus on efficiency and balanced performance.

-

Battery Electric Vehicle (BEV) – Fastest-growing segment, with demand for lightweight and aerodynamic wheels.

-

Fuel-Cell Electric Vehicle (FCEV) – Niche but emerging, requiring specialized wheel designs.

By End-Use / Sales Channel

-

OEM (Original Equipment Manufacturer) – Wheels supplied for new vehicle production, ensuring high volumes.

-

Aftermarket – Covers replacement demand and performance/customization upgrades, expanding rapidly with consumer personalization trends.

By Geography

-

North America – Strong aftermarket demand and SUV popularity drive growth.

-

South America – Brazil and Argentina lead adoption, with growing mid-size vehicle market.

-

Europe – Home to luxury and premium automakers, strong demand for alloy and larger rim wheels.

-

Asia-Pacific – Largest market due to high vehicle production in China, India, and Japan.

-

Middle East – Fastest-growing region, with demand for aftermarket upgrades and premium wheels.

-

Africa – Demand led by commercial and entry-level vehicles, with a rising aftermarket sector.

Major Players

-

Maxion Wheels A leading global wheel manufacturer with operations in more than a dozen countries. Maxion Wheels supplies both steel and aluminum wheels to OEMs and has a strong presence in passenger, commercial, and off-highway vehicle segments.

-

Topy Industries Ltd A Japan-based manufacturer known for its wide portfolio of steel and aluminum wheels. Topy serves global OEMs and maintains a strong footprint in Asia, North America, and Europe.

-

Zhejiang Wanfeng Auto Wheel One of China’s largest wheel producers, specializing in aluminum alloy wheels. The company serves both domestic and international automakers, focusing on lightweight wheel technologies for passenger cars.

-

Steel Strips Wheels Limited (SSWL) An India-based manufacturer with expertise in steel wheels for passenger cars, commercial vehicles, and two-wheelers. SSWL has expanded its international presence by exporting to major automotive markets.

-

BORBET GmbH A Germany-based company recognized for its premium alloy wheels. BORBET is a major supplier to European automakers and is known for its emphasis on design, quality, and advanced finishing processes.

Conclusion

The automotive wheel market is positioned for steady growth as global vehicle production, consumer preferences, and technological shifts reshape demand across materials, sizes, and finishes. With the market expected to expand from USD 168.45 billion in 2025 to USD 232.46 billion by 2030, wheels are increasingly becoming a focus area for both performance and aesthetics.

Get More insights: https://www.mordorintelligence.com/industry-reports/automotive-wheel-market?utm_source=abnewswire

Industry Related Reports

Automotive Steering Wheel Market: The Automotive Steering Wheel Market is segmented by Technology (Conventional Column-Steer and others), Material Type (Aluminum Rim, Magnesium Rim, and additional categories), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and others), Sales Channel (Original Equipment Fitment and Aftermarket Replacement), Propulsion Type (Internal Combustion Engine and others), and Geography. Market forecasts are presented in terms of value (USD).

Off-Highway Wheels Market: The Off-Highway Wheel Market is segmented by Product Type (Alloy Wheels and Steel Wheels), Application Type (Agriculture, Construction including Earth-Moving Machinery, Material Handling such as Mobile Cranes and Forklift Trucks, and Mining with Mobile Mining Equipment), and Geography (North America, Europe, Asia-Pacific, and Rest of the World). The report provides market size and forecast data in terms of value (USD) for all the mentioned segments.

Get More insights: https://www.mordorintelligence.com/industry-reports/off-highway-wheels-market?utm_source=abnewswire

Automotive All-wheel-drive Market: The Automotive All-Wheel Drive Market is segmented by Vehicle Type (Passenger Cars and Commercial Vehicles), Propulsion Type (Internal Combustion Engine (ICE), Hybrid Electric Vehicles (HEV), and others), System Type (Part-Time/Manual AWD, Full-Time/Automatic AWD, and others), Component (Transfer Case and additional components), Sales Channel, and Geography. The report presents market size and forecasts in terms of value (USD) for all segments.

About Mordor Intelligence: Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:media@mordorintelligence.com

https://www.mordorintelligence.com/

Media Contact

Company Name: Mordor Intelligence Private Limited

Contact Person: Jignesh Thakkar

Email:Send Email

Phone: +1 617-765-2493

Address:5th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli

City: Hyderabad

State: Telangana 500008

Country: India

Website: https://www.mordorintelligence.com/