Wealth Management Platform Market Overview

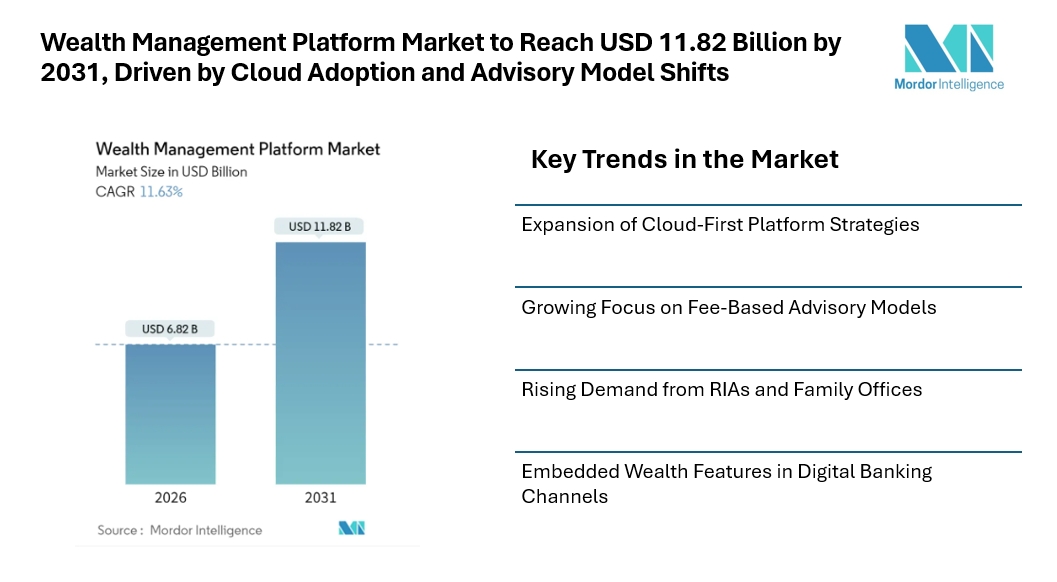

The wealth management platform market continues to gain steady attention as financial institutions modernize advisory operations and respond to changing investor expectations. According to Mordor Intelligence, the wealth management platform market size stood at USD 6.82 billion in 2026 and is projected to reach USD 11.82 billion by 2031.

As competition intensifies, the wealth management platform industry is witnessing growing interest from banks, registered investment advisors, family offices, and digital-first financial firms. Cloud-based deployment, embedded analytics, and compliance-focused design are shaping platform selection decisions, reinforcing the role of technology as a core pillar of modern wealth management operations.

Key Trends Shaping the Wealth Management Platform Market

Expansion of Cloud-First Platform Strategies

One of the most visible wealth management platform market trends is the preference for cloud-based deployment. Institutions value platforms that allow remote access, faster updates, and easier collaboration across advisory teams.

Growing Focus on Fee-Based Advisory Models

Regulatory emphasis on transparency and client-first advisory practices is influencing platform demand. Fee-based advisory models require accurate billing, performance reporting, and audit-ready documentation. As a result, wealth management platforms that automate these functions are seeing higher adoption, particularly among advisors transitioning away from transaction-based revenue structures.

Rising Demand from RIAs and Family Offices

While large banks remain key buyers, independent advisors and family offices are emerging as fast-growing user groups. These firms seek institutional-grade analytics without complex deployment cycles. Platforms that support multi-asset reporting, goal-based planning, and fiduciary compliance are gaining traction within this segment, contributing to overall wealth management platform market growth.

Embedded Wealth Features in Digital Banking Channels

Digital banks and financial super-apps are increasingly integrating wealth modules into everyday financial experiences. This trend is expanding platform usage beyond traditional advisory settings. Vendors offering flexible application programming interfaces are well positioned to serve this demand, supporting broader market participation and new distribution models.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/wealth-management-platform-market?utm_source=abnewswire

Wealth Management Platform Market Segmentation Analysis

-

By Deployment Type

-

On-Premise

-

Cloud

-

By End-User Industry

-

Banks

-

Trading Firms

-

Brokerage Firms

-

Investment Management Firms

-

Family Offices and RIAs

-

By Application

-

Portfolio, Accounting and Trading

-

Financial Planning and Goal-Based Advice

-

Compliance and Risk Reporting

-

Client On-Boarding and KYC

-

By Enterprise Size

-

Large Enterprises

-

Small and Mid-Sized Enterprises (SME)

-

By Geography

-

North America

-

United States

-

Canada

-

Mexico

-

Europe

-

Germany

-

United Kingdom

-

France

-

Italy

-

Spain

-

Russia

-

Rest of Europe

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

ASEAN

-

Australia and New Zealand

-

Rest of Asia Pacific

-

South America

-

Brazil

-

Argentina

-

Rest of South America

-

Middle East

-

Saudi Arabia

-

UAE

-

Turkey

-

Rest of Middle East

-

Africa

-

South Africa

-

Nigeria

-

Rest of Africa

Explore Our Full Library of Technology, Media and Telecom Research Industry Reports - https://www.mordorintelligence.com/market-analysis/technology-media-and-telecom?utm_source=abnewswire

Key Players in the Wealth Management Platform Industry

-

Avaloq Group AG

-

Fidelity National Information Services (FIS)

-

Temenos AG

-

Prometeia SpA

-

Backbase BV

Conclusion

The outlook for the wealth management platform market remains positive as advisory firms prioritize efficiency, transparency, and client engagement. Future wealth management platform market growth will be shaped by continued cloud migration, rising demand from independent advisors, and the integration of wealth services into broader digital finance ecosystems

As competition evolves, the wealth management platform market forecast points to sustained investment in flexible, scalable solutions that help advisors manage complexity while delivering consistent value to clients.

For more insights on the wealth management platform market, please visit the Mordor Intelligence Page: https://www.mordorintelligence.com/industry-reports/wealth-management-platform-market?utm_source=abnewswire

Industry Related Reports:

Application Platform Market Size

The report covers Global Application Platform Market Growth and it is segmented by Type (Software, Services), Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), and Geography (North America, Europe, and Asia-Pacific).

Data Management Platform Market Share

Data Management Platform Market Report is Segmented by Functionality (First-Party, Second-Party, Third-Party), Data Source (Web Analytics Tools, Mobile Web and Apps, CRM Data, POS Data, Social Networks), Deployment (Cloud, On-Premise), Enterprise Size (Large Enterprises, Smes), Industry Vertical (Retail and E-Commerce, Media and Entertainment, and More), and Geography.

Data Science Platform Market is Segmented by Offering (Platform, Services), Deployment (On-Premise, Cloud), Enterprise Size (Small and Medium Enterprises, Large Enterprises), End-User Industry (IT and Telecom, BFSI, Retail and E-Commerce, Manufacturing, and More), and Geography (North America, Europe, and More).

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Media Contact

Company Name: Mordor Intelligence Private Limited

Contact Person: Jignesh Thakkar

Email:Send Email

Phone: +1 617-765-2493

Address:11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli

City: Hyderabad

State: Telangana 500008

Country: India

Website: https://www.mordorintelligence.com/