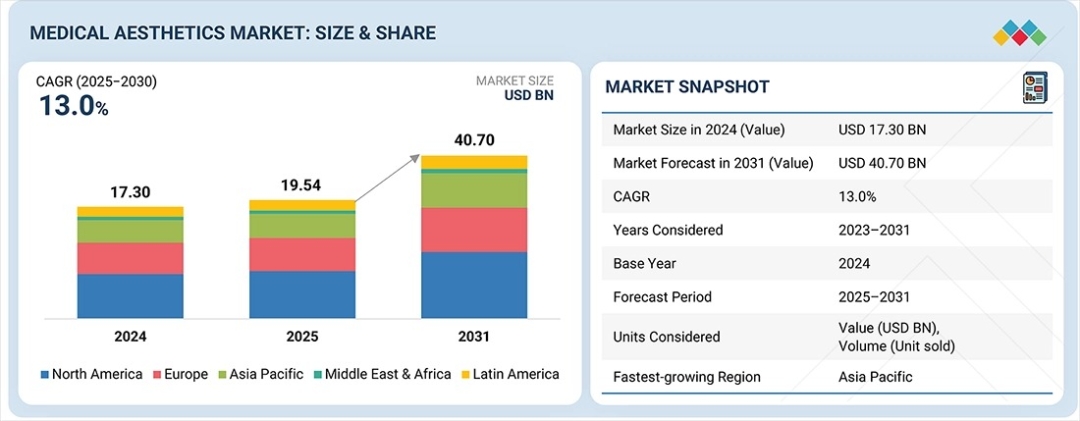

The global medical aesthetics market is experiencing unprecedented expansion, valued at $19.54 billion in 2025 and projected to reach $40.7 billion by 2031, representing a compound annual growth rate (CAGR) of 13.0% throughout the forecast period. This robust growth trajectory signals a fundamental transformation in how medical professionals and healthcare organizations approach aesthetic medicine as a core clinical service rather than a peripheral luxury offering.

Download PDF Brochure:https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=885

Why This Matters Now for Decision-Makers

The medical aesthetics industry stands at an inflection point where non-surgical and minimally invasive treatments have transitioned from consumer novelties to essential revenue-generating services. This evolution directly impacts strategic planning, capital allocation, and competitive positioning for hospital systems, dermatology practices, aesthetic clinics, and medical device manufacturers navigating rapidly shifting market dynamics.

What's Driving This Exceptional Growth?

Consumer Demand and Market Acceleration

The surge in market value reflects converging forces reshaping the aesthetic medicine landscape. Growing consumer preference for minimally invasive procedures with reduced recovery times has accelerated adoption across demographic segments. Social media influence and digital platforms have democratized awareness of aesthetic treatments, transforming patient expectations and clinic utilization patterns. Simultaneously, aging populations across developed markets combined with rising disposable incomes in emerging economies have expanded the addressable patient base substantially.

Facial Aesthetics Dominates, At-Home Devices Accelerate

Facial aesthetic products currently command 55% of the market share in 2025, driven by high procedure volumes, broad patient applicability, and sustained demand for injectable treatments including botulinum toxin and dermal fillers. However, the at-home and self-use device segment represents the fastest-growing category, projected to expand at 22.0% CAGR—a critical trend signal for manufacturers and clinicians evaluating technology adoption strategies. These accessible, consumer-oriented devices—including LED light therapy, radiofrequency, microneedling, and ultrasonic technologies—are reshaping the competitive landscape by extending aesthetic solutions beyond professional settings.

Non-Surgical Procedures Establish Market Leadership

Non-surgical procedures are poised to dominate market activity through 2031, driven by patient preference for natural-looking outcomes, minimal downtime, and lower risk profiles. Injectable aesthetics and energy-based treatments continue to gain traction due to their affordability, safety, repeatability, and superior patient satisfaction metrics. This procedural shift has significant implications for clinic operational models, technology infrastructure investments, and talent requirements.

Where Opportunities and Challenges Intersect

Market Consolidation and Competitive Intensity

Dermatology clinics, hospitals, and medical spas control approximately 95% of the global market, creating a concentrated provider ecosystem vulnerable to rapid technological disruption and consolidation pressures. The rise of organized med-spa chains and corporate clinic networks is dismantling traditional solo-practice models, fundamentally altering procurement behavior, vendor relationships, and competitive dynamics. Decision-makers must evaluate strategic positioning—whether through acquisition, partnership, or independent innovation—to maintain market relevance.

Regulatory Complexity as Strategic Constraint

Complex and evolving regulatory frameworks present operational challenges for multi-state and multi-national providers. Fragmented governance between federal FDA regulations for devices and injectables, combined with state-level licensing and supervision requirements, creates compliance burdens that disproportionately impact smaller operators. This regulatory landscape advantage accrues to well-resourced organizations capable of navigating complex approval timelines and maintaining robust compliance infrastructure.

Male Aesthetic Adoption: Emerging Revenue Stream

The growing acceptance of aesthetic treatments among male consumers represents a largely untapped revenue opportunity. As social standards surrounding masculine appearance evolve, practitioners report increased patient acquisition in this demographic segment. Organizations prioritizing education, specialized marketing, and targeted service development can capture disproportionate share in this emerging category.

Technology Innovation Reshaping Clinical Capabilities

Regenerative aesthetics innovations including platelet-rich plasma (PRP), exosomes, and combination therapies are expanding treatment efficacy and patient outcomes. AI-enabled treatment planning systems are enabling personalized aesthetic solutions at scale. Organizations investing in next-generation technology platforms will establish sustainable competitive advantages in patient satisfaction, clinical results, and operational efficiency.

Market Structure: Key Dynamics Shaping Competition

Leadership Position and Strategic Excellence

AbbVie Inc. (US) maintains market leadership through superior product portfolios including Botox Cosmetic, Juvéderm Dermal Fillers, and CoolSculpting—each commanding strong physician confidence, clinical validation, and established patient recognition. The company's acquisition-driven strategy, combined with continuous R&D investment and lifecycle management, enables sustained competitive differentiation. Emerging competitors including Ipsen (France), through its botulinum toxin product Dysport and strategic distribution partnerships, are capturing meaningful market share and advancing innovative next-generation treatments.

Competitive Landscape and Provider Strategies

Principal market participants include Galderma (Switzerland), Johnson & Johnson (US), Merz Pharma (Germany), Cynosure (US), Cutera (US), Alma Lasers (Israel), Lumenis (Israel), Revance Therapeutics (US), and Sinclair Pharma (UK). Emerging innovators such as Venus Concept (Canada), Jeisys Medical (South Korea), Fotona (Slovenia), Sciton (US), Sofwave Medical (Israel), Medytox (South Korea), and PhotoMedex (US) are building market presence through targeted focus on at-home devices and non-invasive treatments, leveraging collaborative relationships with local distributors, beauty centers, and independent medispas.

Request Sample Pages - https://www.marketsandmarkets.com/requestsampleNew.asp?id=885

Strategic Implications for Market Participants

Who Should Monitor This Trend?

Healthcare executives, dermatology practice leaders, aesthetic clinic operators, medical device manufacturers, pharmaceutical companies, hospital administrators, and investors evaluating healthcare expansion opportunities must recognize the escalating importance of aesthetic medicine within overall clinical portfolios.

Market Validation and Professional Acceptance

The transition of medical aesthetics from luxury service to mainstream healthcare reflects deeper market maturation. Stronger safety profiles, clinical validation through rigorous research, and normalization of aesthetic procedures as routine self-care and wellness activities have fundamentally altered professional and consumer perceptions. This acceptance creates sustainable demand tailwinds and positions the sector for continued expansion even amid economic uncertainty.

Key Performance Indicators and Market Metrics

Market Size and Forecast

- 2024 Valuation: $17.30 billion

- 2025 Valuation: $19.54 billion

- 2031 Projected Valuation: $40.7 billion

- Growth Rate: 13.0% CAGR (2025–2031)

- Market Coverage: 380 pages, 406 market data tables

Segment Performance

- Facial Aesthetics: 55% market share (2025)

- At-Home/Self-Use Devices: 22.0% CAGR (fastest growth category)

- Non-Surgical Procedures: Dominant segment through forecast period

- Professional Provider Settings: 95% market concentration

Geographic Scope Comprehensive market analysis across North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, with granular assessment of emerging markets and developed healthcare systems.

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Rohan Salgarkar

Email:Send Email

Phone: 18886006441

Address:1615 South Congress Ave. Suite 103, Delray Beach, FL 33445

City: Florida

State: Florida

Country: United States

Website: https://www.marketsandmarkets.com/