Project Overview & Research Background

As the global maternal and infant industry expands, Central Asia’s five countries emerge as promising growth markets. Home to over 83 million people, the region has a 0-14 age group accounting for 28%-36% of the population—well above the global average—providing a solid demand base. Local industry underdevelopment leaves a 60% supply gap in high-end and intelligent products (domestic enterprises meet only 40% of demand), creating opportunities for overseas brands. This analysis focuses on maternal and infant small appliances, examining market differences across Kazakhstan, Uzbekistan, Kyrgyzstan, Tajikistan, and Turkmenistan to guide Chinese enterprises’ market entry strategies.

Ⅰ. Basic Market Environment in Central Asia

1.1 Population Structure: Sustained Fertility Dividend

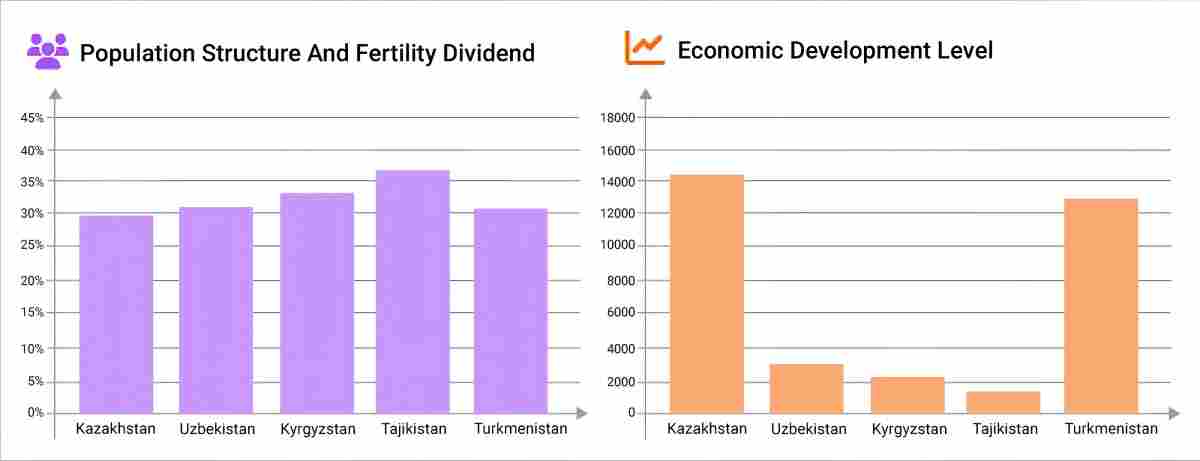

Central Asia’s youthful population drives long-term maternal and infant market demand. The 0-14 age group accounts for over 30% of the population in most countries: Tajikistan (36.26%), Kyrgyzstan (32.34%), Turkmenistan (31.51%), Uzbekistan (31.1%), and Kazakhstan (29.37%). With a 2025 average fertility rate of 2.7-3.3 (Tajikistan 3.3, Uzbekistan 2.7, well above the 2.1 replacement level), the women of childbearing age base will expand, sustaining this dividend until 2050. [Data source: The Global Economy (https://www.theglobaleconomy.com)]

1.2 Economic Disparities & Consumption Capacity

Economic differences shape distinct consumption patterns across Central Asia:

| Country | 2024 GDP (Billion USD) | Per Capita GDP (USD) | Growth Rate | Middle-Class Proportion |

| Kazakhstan | 288.113 | 14,301 | 4.8% | 31% |

| Uzbekistan | 114.984 | 3,093 | 6.5% | ~25% |

| Turkmenistan | 90.9 | 12,713 | - | - |

| Kyrgyzstan | 17.48 | 2,419 | 9.0% | - |

| Tajikistan | 13.9 | 1,350 | - | - |

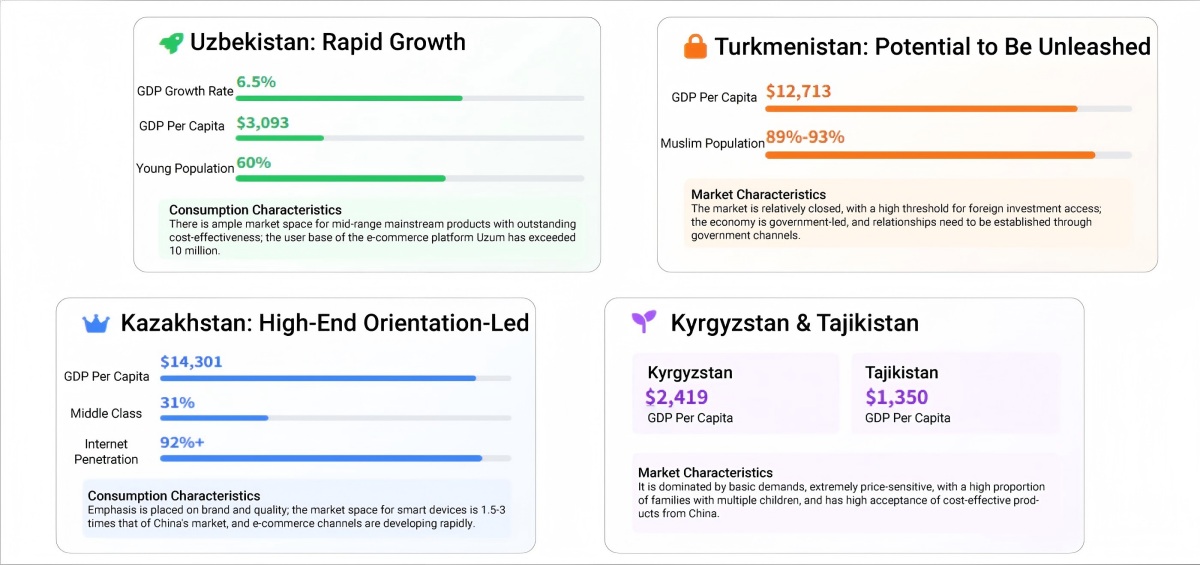

Kazakhstan (regional economic leader) has strong demand for high-end products, with 1.5-3x premiums for smart appliances. Uzbekistan’s growing middle class drives mid-range product demand. Kyrgyzstan’s 9.0% growth boosts market vitality, while Tajikistan and Turkmenistan focus on basic, low-cost products.

1.3 Geographical, Climatic & Cultural Influences

Extreme continental climate (winter lows -40°C to -50°C, summer highs 50°C) drives demand for heating appliances, cold-resistant products, and temperature regulators. Kazakhstan’s long winters, for example, make Russian-language controlled, cold-resistant appliances top sellers.

Islam dominates most countries (Tajikistan 85%, Turkmenistan 89%-93%, Uzbekistan 90% Muslim). Products need halal certification, alcohol/fragrance-free ingredients, and Islamic cultural elements in design. Multi-language (Russian, Kazakh, Uzbek) packaging is essential, even in relatively secular Kazakhstan (72% Kazakh, 14.9% Russian).

Ⅱ. Market Differences Across Five Central Asian Countries

2.1 Kazakhstan: High-End & Intelligent Product Leader

Kazakhstan’s $1B+ maternal and infant market saw Chinese children’s product exports double in 2023 (temperature-controlled bottles, smart diapers top sellers). With 92%+ internet penetration, e-commerce (Ozon, Kaspi.kz, Wildberries) thrives (2024 e-commerce: 3.2T tenge/$4.9B, 14.1% of retail). Consumers value international brands, quality, and smart features (baby monitors, smart climate control), with traditional channels (supermarkets 30%-35%, pharmacies 5%-8%) still important.

2.2 Uzbekistan: Cost-Effectiveness Focused Growth Market

Uzbekistan’s large, young population drives diverse, fast-growing demand. Mid-range, cost-effective products dominate. Consumers prioritize practicality/durability (portable food processors, sterilizers). Local e-commerce (Uzum: 10M+ users) and social commerce (Instagram, Telegram) grow rapidly, with traditional retail still dominant.

2.3 Kyrgyzstan & Tajikistan: Basic Needs-Driven Markets

Weak economies mean these markets focus on basic, low-cost products (feeding supplies, simple sterilizers). High fertility and multi-child families drive demand for large-capacity, durable items; second-hand products are widely accepted. Border trade, local bazaars, and small stores are key channels.

2.4 Turkmenistan: Policy-Driven Potential Market

Closed market with high entry barriers but strong high-end purchasing power ($12,713 per capita GDP). Government procurement is key; products need strict quality control and Islamic compliance. Offline and government channels are critical; joint ventures with local enterprises help reduce risks.

Ⅲ. Core Market Trends

3.1 Intelligence & Technologization

Smart products (health-monitoring baby monitors, app-controlled food processors) grow fast, especially in Kazakhstan. Intelligence enhances premiums and brand differentiation.

3.2 Green & Sustainable Development

Eco-friendly demands rise: non-toxic, BPA-free, biodegradable materials; energy-saving designs; recyclable components; and EU CE certification are key selling points.

3.3 Specialization & Segmentation

Market segments by function (multi-in-one appliances), age (0-3 months, 3-6 months), scenario (home, travel), and special needs (premature infants). Fast-growing categories: food preparation, health care, environmental regulation, safety protection.

3.4 Channel Integration & Digital Transformation

Online-offline integration accelerates. Traditional retail (65% in 2024) dominates, but online sales (45% by 2025) grow fast. Cross-border e-commerce, O2O, social commerce (TikTok, Instagram KOLs), and membership models gain traction.

3.5 Supply Chain Localization

Localization (imported components + local assembly, regional warehouses in Almaty) reduces logistics costs, shortens delivery times, and mitigates policy risks. Local partnerships and supply chain cultivation enhance efficiency.

Conclusion

Central Asia’s maternal and infant small appliance market offers huge potential, fueled by demographic dividends, supply gaps, and consumption upgrading. Success for enterprises lies in understanding market differences, launching adaptive products, building diverse channels, and deepening localization.

(Data Note: All relevant data cited in this article, including market, economic, and demographic data, are sourced from public online information.)

Media Contact

Company Name: Foshan Nanhai Jetway Import and Export Co., Ltd.

Email:Send Email

Country: China

Website: https://www.jetwayfactory.com/