Myocardial Infarction Market Summary

In 2023, the United States accounted for the largest myocardial infarction market, valued at approximately USD 16,300 million, driven by high disease prevalence and elevated treatment costs. Pharmacologic management focuses on improving survival, reducing recurrent ischemic events, and alleviating symptoms, often through multimodal therapy regimens. The treatment landscape is segmented into key therapeutic classes, including antiplatelet agents, anticoagulants, vasodilators, beta-blockers, lipid-lowering drugs, ACE inhibitors, ARBs, and calcium channel blockers, reflecting a diverse approach to managing myocardial infarction and associated complications.

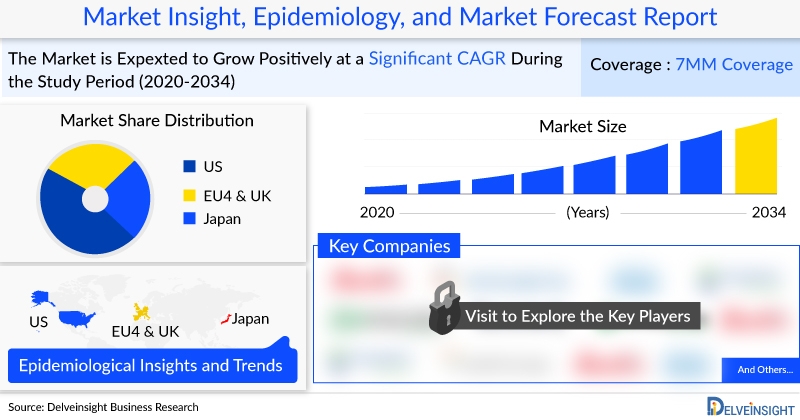

DelveInsight’s report, “Myocardial Infarction Market Insights, Epidemiology, and Market Forecast – 2034,” provides a comprehensive analysis of myocardial infarction, covering both historical and projected epidemiology as well as market trends across the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan. The report examines current treatment paradigms, emerging therapeutic candidates, and the market share of individual interventions. It also presents the current and forecasted market size for myocardial infarction from 2020 to 2034 across seven major markets. Additionally, the analysis addresses treatment algorithms, market drivers and constraints, and unmet clinical needs, offering strategic insights into key growth opportunities and evaluating the overall potential of the global myocardial infarction market.

Access DelveInsight’s Myocardial Infarction report for key market insights, treatment trends, and growth opportunities across major global regions through 2034 @ Myocardial Infarction Market Forecast

Some facts of the Myocardial Infarction Market Report are:

- The Myocardial Infarction market size was valued approximately USD 21,750 million in 2023 and is anticipated to grow with a significant CAGR during the study period (2020-2034)

- In August 2025, Aspire Biopharma Announces Positive Top-Line Results from Clinical Trial of Investigational New Sublingual Aspirin Product for Treatment of Suspected Acute Myocardial Infarction (Heart Attack)

- In March 2025, Powerful Medical, a leader in AI-driven cardiovascular diagnostics, announced that its PMcardio STEMI AI ECG model has received Breakthrough Device Designation from the US FDA. This recognition highlights PMcardio's innovation in detecting ST-elevation myocardial infarction (STEMI) and STEMI equivalents, conditions that require urgent intervention.

- In August 2024, CellProthera announced a successful pre-investigational new drug (IND) meeting with the US Food and Drug Administration (FDA), bringing the company closer to launching a pivotal Phase III trial for its cell therapy targeting myocardial infarction. The France-based company stated that the FDA supported the trial design, which includes a two-year follow-up. The trial will assess the therapy's effectiveness in preventing future heart diseases.

- In February 2024, Australian CSL announced the topline results from the Phase III AEGIS-II trial of CSL112 in patients after an acute myocardial infarction (MI). The results revealed that the drug did not achieve its primary endpoint of reducing the risk of major adverse cardiovascular events (MACE) within 90 days.

- Estimates suggest that the United States will hold the largest share of the Myocardial Infarction Market, with a value of approximately USD 16,300 million in 2023, driven by a higher number of cases and relatively higher treatment costs.

- In 2023, the total number of diagnosed prevalent cases of Myocardial Infarction across the 7MM was approximately 15.5 million, with expectations of growth during the forecast period.

- In 2023, the United States had approximately 8 million diagnosed prevalent cases of Myocardial Infarction.

- In 2023, the United States represented the largest share of the Myocardial Infarction prevalent population, accounting for approximately 55% of the 7MM. Meanwhile, EU4 and the UK contributed around 35%, and Japan made up about 10% of the total population share.

- DelveInsight estimates indicate that in 2023, the United States had approximately 3.2 million cases of STEMI and 5 million cases of NSTEMI. The prevalence is expected to rise throughout the forecast period.

- Key Myocardial Infarction Companies: Novartis, AstraZeneca, Recardio, Idorsia Pharmaceuticals, Eli Lilly and Company, Boehringer Ingelheim, Pfizer, Bayer, Mesoblast, Inc., The Medicines Company, Mitsubishi Tanabe Pharma, Athera Biotechnologies, Hoffmann-La Roche, Idorsia Pharmaceuticals, and others

- Key Myocardial Infarction Therapies: JARDIANCE (empagliflozin), Pelacarsen, FARXIGA(dapagliflozin), Dutogliptin, Selatogrel, abciximab, Empagliflozin, Aliskiren, Eplerenone, Fulacimstat (BAY1142524), Prochymal®, Angiomax (bivalirudin) anticoagulant, TNK-tPA, MCC-135, ATH3G10, RO4905417, Selatogrel, and others

- The Myocardial Infarction epidemiology based on gender analyzed that the prevalence of myocardial infarction (MI) is more common among males as compared to females

- The Myocardial Infarction market is expected to surge due to the disease's increasing prevalence and awareness during the forecast period. Furthermore, launching various multiple-stage Myocardial Infarction pipeline products will significantly revolutionize the Myocardial Infarction market dynamics.

Myocardial Infarction Overview

Myocardial infarction, commonly known as a heart attack, occurs when blood flow to a part of the heart muscle is blocked, typically due to a blood clot in a coronary artery. Myocardial infarction causes often include coronary artery disease, high cholesterol, smoking, hypertension, diabetes, and a sedentary lifestyle. Myocardial infarction symptoms can vary but commonly involve chest pain or discomfort, shortness of breath, nausea, sweating, and pain radiating to the arm, jaw, or back.

Myocardial infarction diagnosis is usually confirmed through ECG tests, blood markers like troponin, and imaging techniques. Prompt myocardial infarction treatment is critical and may involve medications such as antiplatelets, thrombolytics, and beta-blockers, as well as procedures like angioplasty or coronary artery bypass surgery. Myocardial infarction recovery depends on the extent of heart damage and timely medical intervention.

Myocardial infarction prevention strategies focus on lifestyle modifications, including regular exercise, a heart-healthy diet, smoking cessation, and effective management of risk factors. Myocardial infarction complications can include heart failure, arrhythmias, and recurrent attacks. Continued advancements in myocardial infarction research and myocardial infarction awareness programs are essential for improving outcomes and reducing the global burden of this life-threatening condition.

Learn more about Myocardial Infarction treatment algorithms in different geographies, and patient journeys. Contact to receive a sample @ Myocardial Infarction Treatment Market

Myocardial Infarction Market Outlook

The total Myocardial Infarction market in the 7MM was USD 21,750 million in 2023, with the US leading at USD 16,300 million. Lipid-lowering drugs generated the highest revenue, while Germany had the largest market share in the EU4 and UK, and Spain the lowest.

The pharmacologic management of myocardial infarction (MI) involves medications aimed at improving survival, preventing recurrent ischemic events, and providing symptomatic relief. Treatment typically begins with rapid diagnostics, biomarker analysis, and risk assessment using TIMI and GRACE models, followed by antithrombotic therapy, sublingual nitroglycerin, high-intensity statins, ACE inhibitors/ARBs, and beta-blockers. The Myocardial Infarction market is segmented by therapeutic classes including antiplatelet agents, anticoagulants, vasodilators, beta-blockers, lipid-lowering drugs, ACE inhibitors/ARBs, and calcium channel blockers. Emerging lipid-lowering therapies, such as PCSK9 inhibitors, along with early patient screening and integration of new clinical protocols, are driving market evolution. Key pipeline candidates under development include pelacarsen, dutogliptin, selatogrel, JARDIANCE, olpasiran, and CL2020.

According to DelveInsight, the Myocardial Infarction market in 7MM is expected to witness a major change in the study period 2020-2034.

Myocardial Infarction Market Drivers

- Rising Prevalence of Cardiovascular Diseases: Increasing incidence of MI globally, particularly in aging populations, drives demand for effective treatments.

- Advancements in Therapeutics: Introduction of innovative drugs, including lipid-lowering therapies (e.g., PCSK9 inhibitors), antiplatelets, and novel anticoagulants, improves patient outcomes and expands treatment options.

- Improved Diagnostics and Early Detection: Widespread use of biomarkers, imaging, and risk-assessment tools (TIMI, GRACE) enables timely intervention and better disease management.

- Growing Awareness: Enhanced awareness among healthcare professionals and patients increases diagnosis rates and adherence to treatment protocols.

- Expansion of Healthcare Infrastructure: Better access to hospitals and cardiac care centers supports the delivery of advanced MI therapies.

Myocardial Infarction Market Barriers:

- High Treatment Costs: Advanced pharmacologic and interventional therapies are expensive, limiting patient access in certain regions.

- Complexity of Disease Management: MI often requires multimodal treatment regimens, complicating adherence and patient monitoring.

- Side Effects and Safety Concerns: Long-term use of certain drugs (anticoagulants, statins, antiplatelets) can cause adverse effects, affecting compliance.

- Limited Access in Low-Income Regions: Shortage of specialized cardiac centers restricts timely care.

Myocardial Infarction Epidemiology

In 2023, the 7MM diagnosed prevalence of myocardial infarction was approximately 15.5 million cases, with the United States representing the largest share at around 8 million cases (~55% of the 7MM). The EU4 and the UK accounted for roughly 35%, while Japan contributed 10% of the total cases. Within the EU4 and the UK, Germany had the highest number of diagnosed cases, followed by France, with Spain reporting the lowest. In the US, STEMI cases numbered approximately 3.2 million, and NSTEMI cases around 5 million in 2023. The overall prevalence across all regions is projected to rise steadily during the forecast period.

Myocardial Infarction Epidemiology Segmentation:

- Myocardial Infarction diagnosed prevalent cases

- Myocardial Infarction gender-specific prevalence cases

- Myocardial Infarction type-specific cases

Explore more about Myocardial Infarction Epidemiology @ Myocardial Infarction Prevalence

Myocardial Infarction Drugs Uptake

FARXIGA (dapagliflozin) – AstraZeneca

Dapagliflozin is an oral, once-daily SGLT2 inhibitor shown to protect heart and kidney function and delay cardiorenal disease. It is being evaluated in the DAPA-MI Phase III trial for patients without type 2 diabetes following acute myocardial infarction. The trial, conducted with UCR and MINAP in the UK, explores FARXIGA’s potential to reduce hospitalization for heart failure and cardiovascular death. The FDA granted Fast Track Designation for this indication in July 2022.

JARDIANCE (empagliflozin) – Boehringer Ingelheim & Eli Lilly

Empagliflozin, an SGLT2 inhibitor, reduces blood glucose by preventing renal glucose reabsorption. It is the first diabetes drug labeled with cardiovascular death risk reduction in multiple countries. The FDA granted Fast Track Designation in 2020 for preventing heart failure hospitalization and reducing mortality post-acute MI in patients with or without diabetes.

Olpasiran – Amgen

Olpasiran is a small interfering RNA targeting apolipoprotein(a) to lower Lp(a) and cardiovascular risk. Phase II OCEAN-DOSE study data in patients with elevated Lp(a) and ASCVD history were presented at the 2022 AHA Late-Breaking Science Session.

Myocardial Infarction Pipeline Development Activities

The Myocardial Infarction report provides insights into different therapeutic candidates in Phase II, and Phase III stages. It also analyses Myocardial Infarction key players involved in developing targeted therapeutics.

- INSPRA (eplerenone): Pfizer

- PLAVIX (clopidogrel bisulfate): Sanofi-Aventis/Bristol-Myers Squibb

- BRILINTA (ticagrelor): AstraZeneca

- PRALUENT (alirocumab): Regeneron/Sanofi

- FARXIGA/FORXIGA (dapagliflozin): AstraZeneca

- JARDIANCE (empagliflozin): Boehringer Ingelheim and Eli Lilly and Company

- Olpasiran: Amgen

- And Many Others.

Request for a sample report to understand more about the Myocardial Infarction pipeline development activities @ Myocardial Infarction Medication and Companies

Myocardial Infarction Therapeutics Assessment

Major key companies are working proactively in the Myocardial Infarction Therapeutics market to develop novel therapies which will drive the Myocardial Infarction treatment markets in the upcoming years are Novartis (SWX: NOVN), AstraZeneca (LSE: AZN), Recardio, Idorsia Pharmaceuticals (SWX: IDIA), Eli Lilly and Company (NYSE: LLY), Boehringer Ingelheim, Pfizer (NYSE: PFE), Bayer (ETR: BAYN), Mesoblast, Inc. (ASX: MSB), The Medicines Company (Acquired by Novartis), Mitsubishi Tanabe Pharma (TSE: 4508), Athera Biotechnologies, Hoffmann-La Roche (SWX: ROG), and others.

Learn more about the emerging Myocardial Infarction therapies & key companies @ Myocardial Infarction Clinical Trials and FDA Approvals

Myocardial Infarction Report Key Insights

1. Myocardial Infarction Patient Population

2. Myocardial Infarction Market Size and Trends

3. Key Cross Competition in the Myocardial Infarction Market

4. Myocardial Infarction Market Dynamics (Key Drivers and Barriers)

5. Myocardial Infarction Market Opportunities

6. Myocardial Infarction Therapeutic Approaches

7. Myocardial Infarction Pipeline Analysis

8. Myocardial Infarction Current Treatment Practices/Algorithm

9. Impact of Emerging Therapies on the Myocardial Infarction Market

Table of Contents

1. Key Insights

2. Executive Summary

3. Myocardial Infarction Competitive Intelligence Analysis

4. Myocardial Infarction Market Overview at a Glance

5. Myocardial Infarction Disease Background and Overview

6. Myocardial Infarction Patient Journey

7. Myocardial Infarction Epidemiology and Patient Population

8. Myocardial Infarction Treatment Algorithm, Current Treatment, and Medical Practices

9. Myocardial Infarction Unmet Needs

10. Key Endpoints of Myocardial Infarction Treatment

11. Myocardial Infarction Marketed Products

12. Myocardial Infarction Emerging Therapies

13. Myocardial Infarction Seven Major Market Analysis

14. Attribute Analysis

15. Myocardial Infarction Market Outlook (7 major markets)

16. Myocardial Infarction Access and Reimbursement Overview

17. KOL Views on the Myocardial Infarction Market

18. Myocardial Infarction Market Drivers

19. Myocardial Infarction Market Barriers

20. Appendix

21. DelveInsight Capabilities

22. Disclaimer

About DelveInsight

DelveInsight is a leading Life Science market research and business consulting company recognized for its off-the-shelf syndicated market research reports and customized solutions to firms in the healthcare sector.

Media Contact

Company Name: DelveInsight Business Research LLP

Contact Person: Ankit Nigam

Email:Send Email

Phone: +14699457679

Address:304 S. Jones Blvd #2432

City: Albany

State: New York

Country: United States

Website: https://www.delveinsight.com/consulting/competitive-intelligence-services