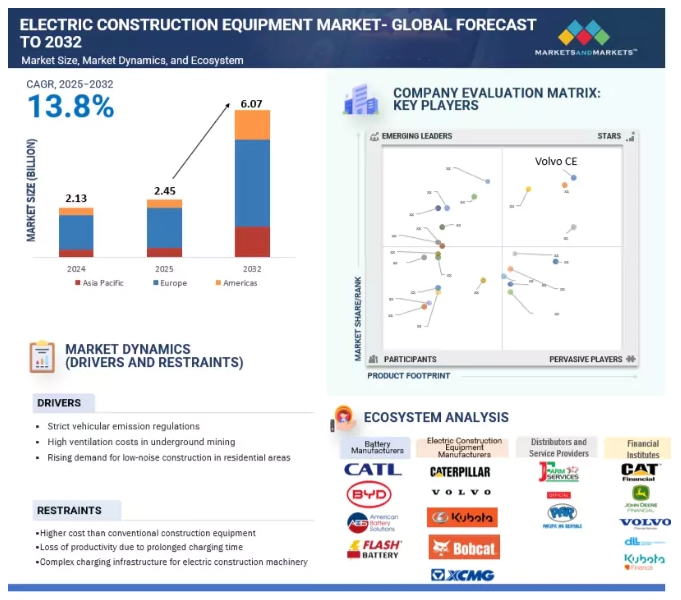

The electric construction equipment market is projected to reach USD 6.07 billion by 2032, from USD 2.45 billion in 2025, with a CAGR of 13.8%.

The adoption of electric construction and mining equipment faces several challenges, restraining the market and slowing its growth. The higher initial purchase price of electric models compared to traditional diesel-powered equipment (approximately 1.75 times more) hinders adoption, especially in emerging markets like India and Indonesia, where price sensitivity is high. Lack of adequate charging infrastructure, particularly in remote or rural construction sites, further reduces adoption in the Asia Pacific region. Moreover, current battery technology limits the operating range and battery life of electric equipment, especially for heavy-duty applications. Earlier models of electric excavators and loaders from Komatsu and Volvo required frequent recharging, decreasing productivity. Despite these hindrances, the electric construction equipment market holds substantial potential for growth in the coming years. As battery technology advances, infrastructure improves, and regulatory incentives for clean energy adoption increase, the market is expected to experience accelerated global adoption.

Electric excavators are expected to be the largest segment by type during the forecast period.

Electric excavators are experiencing significant growth due to several factors, including economic efficiency, environmental regulations, and advancements in battery technology. Excavators contribute to over 50% of greenhouse gas emissions on construction sites, making them a key focus for decarbonization efforts. Stricter emission regulations, such as the EU Stage V, impose tight limits on particulate matter and nitrogen oxide emissions from non-road mobile machinery (NRMM), creating challenges for contractors who rely on traditional diesel-powered equipment. By switching to electric excavators, operators can benefit from significantly lower fuel and maintenance costs, which can be reduced by up to 50% compared to diesel machines.

In urban areas, municipal governments and local authorities are enforcing strict noise regulations. For instance, many European cities set daytime outdoor noise limits for construction equipment between 50 and 70 dB(A), with even stricter limits at night, sometimes as low as 35 dB(A) in Germany and 50 dB(A) in Finland. This has led construction companies to adopt electric mini excavators, which produce significantly lower noise levels, often operating at least 10 dB below their diesel counterparts (e.g., the Volvo ECR25 Electric generates 84 dB compared to 93 dB for diesel). Additionally, smaller and compact excavators are easier to convert to electric, as their size makes them suitable for battery or cable use, and their work tasks are often short and repetitive.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=129288251

Li-NMC is expected to be the fastest-growing segment by battery chemistry in Asia Pacific during the forecast period.

The lithium nickel manganese cobalt oxide (Li-NMC) segment is rapidly expanding in Asia Pacific. This growth is driven by the increasing demand for high-performance, energy-dense power sources in electric vehicles, energy storage systems, and construction and mining equipment. In Asia Pacific, significant investments in battery manufacturing, government incentives for green technology, and the rapid electrification of various industrial sectors contribute to this trend, with China, South Korea, and Japan leading the way by opening new battery plants and research centers throughout 2024 and 2025. Li-NMC batteries provide several advantages over traditional lithium-ion chemistries, particularly in construction and mining equipment. They offer higher energy density, allowing longer runtimes, more power for heavy-duty tasks, better thermal stability, and an extended cycle life. These factors contribute to reduced downtime and lower total ownership costs. As a result, the adoption of Li-NMC batteries is increasing rapidly, with OEMs incorporating them into new models to comply with stricter emission standards and meet the growing demand for more efficient and reliable equipment.

Though Li-NMC batteries are typically 10–20% more expensive than standard Li-ion batteries, primarily due to the cost of raw materials like cobalt and nickel, their superior performance and durability make them a preferred option for high-end construction and mining machinery. Major OEMs such as Komatsu, Hitachi, SANY, and Volvo have started to offer excavators and haul trucks powered by Li-NMC batteries in their latest product lines, with several models launched in 2024 and early 2025 specifically tailored for the Asia Pacific market. For instance, Komatsu introduced its new electric excavator featuring a Li-NMC battery system in late 2024, while SANY unveiled a line of mining dump trucks powered by advanced NMC batteries in early 2025.

Europe is estimated to be the leading market for electric construction equipment in 2025.

Europe is the global leader in the electric construction equipment market. The demand for electric excavators and wheel loaders in this region is particularly high, with these two categories estimated to account for over 80% of the market in 2025. This demand is driven by rapid adoption rates, especially in compact and urban environments. Europe’s leadership in this sector is supported by stringent emission and noise regulations, along with ambitious decarbonization goals established by the European Union and individual countries. For instance, Oslo has mandated that all public construction sites be zero-emission by 2025 and all city construction sites by 2030. Additionally, since 2017, fossil-free work has been a minimum procurement requirement. Copenhagen requires all public construction sites to be carbon neutral by 2030, with a target for its fleet of non-road mobile machinery to be fossil-free by 2025; machines weighing up to 2.5 tons must also be electric. Helsinki aims for all public construction sites to be fossil-free by 2025, extending this requirement to machinery and heavy vehicles by 2030, while conducting pilot projects with electric machines under strict emission standards.

Stockholm is targeting fossil-fuel-free construction by 2040, implementing life-cycle analyses and environmental impact assessments for all building processes. Other cities, such as Vienna and Munich, are also pursuing climate neutrality, with Vienna aiming for 2040 and Munich focusing on district heating and geothermal energy alongside tougher construction regulations. Major OEMs, including Volvo, Caterpillar, JCB, Liebherr, Komatsu, Hitachi, and Kubota, are responding to this trend by expanding their electric portfolios. They frequently unveil new models at leading industry exhibitions such as Bauma and Intermat. In addition to city-level mandates, country-specific regulations like Germany’s Stage V emission standards and France’s Climate and Resilience Law further reinforce the push toward electrification. The EU’s Big Buyers initiative and new battery regulations also promote sustainable procurement and innovation in battery technology.

Key Market Players

Major players operating in the electric construction equipment market are Caterpillar Inc. (US), Komatsu Ltd. (Japan), Volvo Construction Equipment (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), JCB (UK), Epiroc AB (Sweden), Sandvik AB (Sweden), Liebherr (Germany), Doosan Group (South Korea), Soletrac Inc. (US), and Dana Limited (US).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=129288251

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Rohan Salgarkar

Email:Send Email

Phone: 18886006441

Address:1615 South Congress Ave. Suite 103, Delray Beach, FL 33445

City: Florida

State: Florida

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/off-highway-electric-vehicle-market-129288251.html