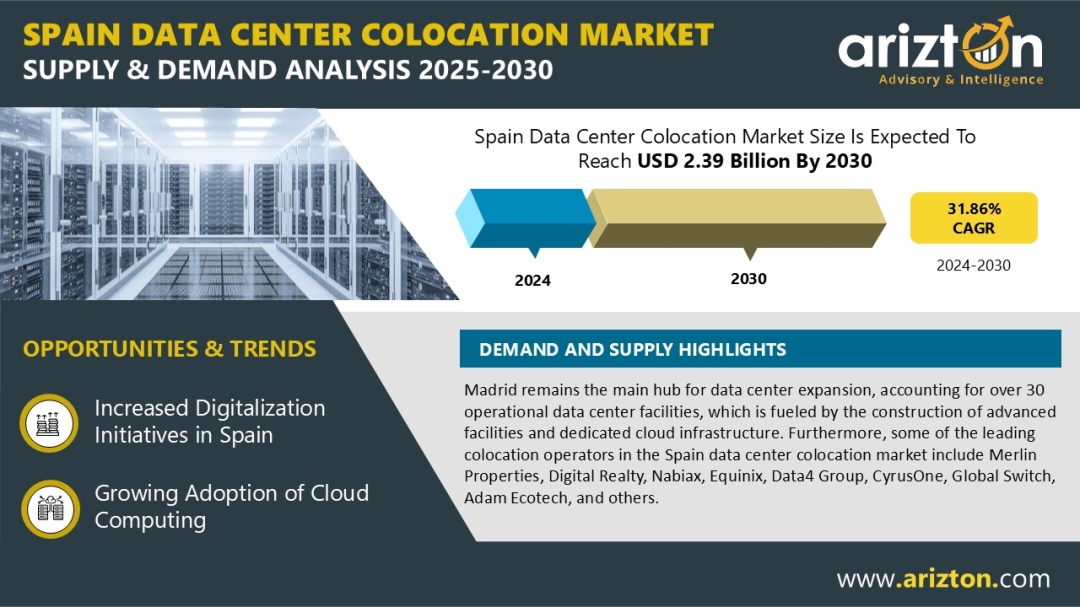

According to Arizton research, the Spain data center colocation market size was valued at USD 455 million in 2024 and is expected to reach USD 2.39 billion by 2030, growing at a CAGR of 31.86% during the forecast period.

Explore the Full Market Insights: https://www.arizton.com/market-reports/spain-data-center-colocation-market

Report Summary:

MARKET SIZE - COLOCATION REVENUE: USD 2.39 Billion (2030)

CAGR - COLOCATION REVENUE: 31.86% (2024-2030)

MARKET SIZE - UTILIZED WHITE FLOOR AREA: 5,378.9 thousand sq. feet (2030)

MARKET SIZE - UTILIZED RACKS: 113.88 thousand units (2030)

MARKET SIZE - UTILIZED IT POWER CAPACITY: 1,280 MW (2030)

BASE YEAR: 2024

FORECAST YEAR: 2025-2030

Spain Advances Role in Europe Digital Future with Accelerating Colocation Growth

Spain is rapidly positioning itself as a leading hub for data center colocation in Europe, with 63 operational facilities as of December 2024. Madrid remains the core market, hosting over 30 centers supported by advanced infrastructure and cloud investments. Established operators such as Merlin Properties, Digital Realty, Nabiax, Equinix, Data4 Group, CyrusOne, and Global Switch dominate the landscape, while new players including Prime Data Centers, QTS Data Centers, and Global Technical Realty are fueling further growth and competition.

This momentum is reinforced by Europe’s push for digital sovereignty and sustainable cloud infrastructure. A landmark example was Oracle’s USD 1 billion investment in 2024, expanding AI and cloud services through a third Madrid cloud region with Telefónica España. Market dynamics are also evolving, retail colocation, which accounted for 69% in 2024, is projected to drop to 22% by 2030, as wholesale colocation surges to 78%, reflecting rising demand for large-scale, AI-driven infrastructure.

Spain Strengthens Position as a Strategic Destination for Data Center Investments

- 5G Rollout: Government initiatives like the UNICO program are expanding nationwide broadband and 5G coverage, enhancing digital readiness for enterprises and service providers.

- Robust Energy Infrastructure & Grid Stability: High power availability, smart grid integration, and renewable energy ensure reliable operations for data centers.

- Government Incentives & Support: Tax incentives and regulatory benefits make Spain attractive for data center development. For example, operators in Special Economic Zones benefit from reduced corporate tax rates and VAT advantages.

- Strategic Location in Western Europe: Spain offers a favorable environment for data center expansion, with moderate environmental risks compared to other European regions, despite exposure to floods, droughts, and storms linked to climate change.

Net-Zero Ambitions: Spain Data Centers Lead the Way in Sustainable Infrastructure

Spain is moving steadily toward its 2050 net-zero target, backing the transition with new policies, incentives, and regulations that encourage a cleaner, greener economy. Data centers are becoming a key part of this shift. In January 2024, Edged Energy opened its Merlin Edged Barcelona facility, adding more than 16 MW of IT capacity powered entirely by renewable energy. The site uses waterless cooling and connects directly to major global networks, setting a benchmark for sustainable operations. To further support green infrastructure, Microsoft signed several power purchase agreements (PPAs) in June 2024. These agreements allow the company to obtain renewable energy from wind and solar projects in Spain. Six sites will be supported by Repsol, which highlights the industry's commitment to sustainable growth and reliable cloud infrastructure.

Spain Bold Move to Lead in Digital Innovation and Connectivity

Spain is actively advancing its digital transformation through government-led initiatives that strengthen innovation, digital skills, and public sector services across key sectors such as education, cybersecurity, and smart cities. The Digital Spain 2025 strategy aims to boost the digital economy by improving e-government services, expanding 5G networks, achieving 100 Mbps broadband coverage, and increasing mobile digital service usage by over 50% by 2025. Building on this, the Digital Spain 2026 strategy prioritizes nationwide digital connectivity to bridge the divide between urban and rural areas.

Complementing these efforts, Spain’s 5G Strategy includes significant public and EU-backed investments to strengthen mobile coverage and support the rollout of next-generation services. Thus, these initiatives are positioning Spain as a digitally advanced, connected, and innovation-driven market, attracting both local and international tech investments.

Explore full insights and investment opportunities in Spain data center colocation market: https://www.arizton.com/market-reports/spain-data-center-colocation-market

Vendor Landscape

Existing Colocation Operators

- Merlin Properties

- Digital Realty

- Nabiax

- Equinix

- DATA4 Group

- CyrusOne

- Global Switch

- Adam Ecotech

- AtlasEdge

- NTT DATA

- EdgeConneX

- Others

Upcoming Colocation Operators

- AQ Compute

- Form8tion Data Centers

- Ingenostrum

- Nethits’ Telecom

- Global Technical Realty

- Panattoni

- Prime Data Centers

- QTS Data Centers

- Pure Data Centres

- AVAIO Digital

- Azora

- ACS Group

- DAMAC Digital

- Echelon Data Centres

- Edged Energy & MERLIN Properties

- Nostrum Group

- Sarenet

- Solaria

- Valencia Digital Port Connect (VDPC)

- VDR Group & Colliers

- Box2Bit

Related Reports That May Align with Your Business Needs

Spain Data Center Market - Investment Analysis & Growth Opportunities 2025-2030

https://www.arizton.com/market-reports/spain-data-center-market-investment-analysis-report

Finland Data Center Colocation Market - Supply & Demand Analysis 2025-2030

https://www.arizton.com/market-reports/finland-data-center-colocation-market

What Key Findings Will Our Research Analysis Reveal?

- What is the count of existing and upcoming colocation data center facilities in Spain?

- Who are the new entrants in the Spanish data center industry?

- What factors are driving the Spain data center colocation market?

- How much MW of IT power capacity is likely to be utilized in Spain by 2030?

Why Arizton?

100% Customer Satisfaction

24x7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton's report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email:Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/spain-data-center-colocation-market