Asset Tokenization Market Overview

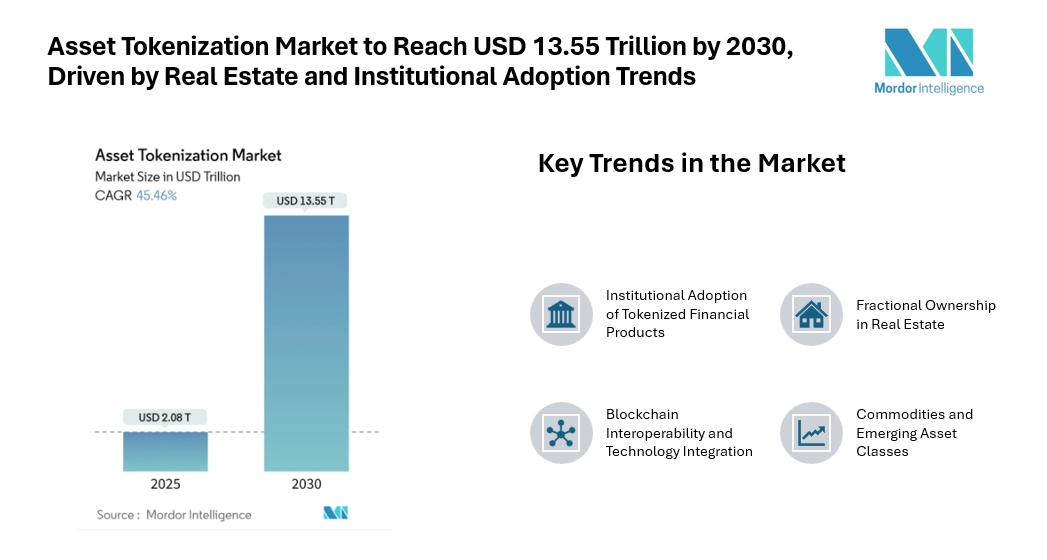

The Asset Tokenization Market is valued at USD 2.08 trillion in 2025 and is forecast to climb to USD 13.55 trillion by 2030 at a 45.46% CAGR, underscoring how digital representations of real-world assets are reshaping global capital formation. Key drivers include regulatory clarity, rising institutional adoption, fractional ownership models, and the integration of blockchain interoperability protocols, all contributing to the Asset Tokenization Market share.

In addition to growth in market size, evolving Asset Tokenization Market trends are shaping investor behavior and industry dynamics.

Key Trends in the Asset Tokenization Market

1. Institutional Adoption of Tokenized Financial Products Institutional investors are shifting capital to tokenized money-market and fixed-income products, driving adoption and prompting custodians and asset managers to support infrastructure, boosting Asset Tokenization Market share.

2. Fractional Ownership in Real Estate Fractional ownership in real estate tokenization lowers entry barriers, boosts participation, enhances transparency, promotes secondary liquidity, and benefits from crowdfunding regulations, supporting growth in retail-accessible tokenized properties.

3. Blockchain Interoperability and Technology Integration Blockchain interoperability and ISO-20022 integration enable seamless cross-chain transactions, improve reconciliation, reduce settlement risk, increase efficiency, and support wider adoption of tokenized assets in the market.

4. Commodities and Emerging Asset Classes Commodities tokenization, including carbon credits and precious metals, offers new investment opportunities, helping companies hedge ESG obligations and inflation, with compliant platforms favored by top banks and institutions.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/asset-tokenization-market?utm_source=abnewswire

Asset Tokenization Market Segmentation

-

By Asset Class:

-

Real Estate

-

Debt Instruments

-

Investment Funds

-

Private Equity

-

Public Equity

-

Commodities

-

By Investor Type:

-

Institutional Investors

-

Accredited Retail Investors

-

Retail Investors

-

By Tokenization Platform Type:

-

Permissioned (Private) Blockchains

-

Permissionless (Public) Blockchains

-

Hybrid Models

-

By Offering:

-

Tokenization Platforms / Middleware

-

Smart-Contract Development and Audit

-

Custody and Wallet Services

-

Compliance and Legal-Tech Services

-

Secondary Trading and Exchanges

-

By Geography:

North America:

-

United States

-

Canada

-

Mexico

South America:

-

Brazil

-

Argentina

-

Rest of South America

Europe:

-

Germany

-

United Kingdom

-

France

-

Italy

-

Spain

-

Russia

-

Rest of Europe

Asia-Pacific:

-

China

-

Japan

-

India

-

South Korea

-

Australia and New Zealand

-

Rest of Asia-Pacific

Middle East and Africa:

-

Middle East

-

Saudi Arabia

-

United Arab Emirates

-

Turkey

-

Rest of Middle East

-

Africa

-

South Africa

-

Nigeria

-

Egypt

-

Rest of Africa

Explore Our Full Library of Technology, Media and Telecom Research Industry Reports - https://www.mordorintelligence.com/market-analysis/technology-media-and-telecom?utm_source=abnewswire

Key Players in the Asset Tokenization Market

-

Securitize Markets, LLC – Provides end-to-end solutions for issuing and managing digital securities, enabling compliant tokenization of various asset classes.

-

tZERO Technologies – Offers a blockchain-based trading platform for tokenized securities, focusing on enhancing liquidity and transparency in digital asset markets.

-

Tokensoft Inc. – Delivers secure token issuance and management platforms for institutional and accredited investors, supporting compliance and secondary trading.

-

Polymath Research Inc. – Specializes in blockchain-based security token creation, providing tools for regulatory compliance and digital asset management.

-

Tokeny Solutions SA – Provides tokenization platforms for financial institutions, enabling compliant issuance, transfer, and management of digital securities.

Conclusion

The Asset Tokenization Market is set for continued growth, driven by technological integration, regulatory clarity, and rising institutional interest. Fractional ownership, cross-chain interoperability, and ISO-20022 adoption are key enablers that improve accessibility and efficiency, creating a favorable environment for both institutional and retail investors. These developments are reflected in current Asset Tokenization Market statistics, highlighting the expanding adoption and increasing liquidity of tokenized assets.

For more insights on Asset Tokenization Market, please visit the Mordor Intelligence Page: https://www.mordorintelligence.com/industry-reports/asset-tokenization-market?utm_source=abnewswire

Industry Related Reports:

Crypto Asset Management Market

The Crypto Asset Management Market is projected to grow from USD 1.66 billion in 2025 to USD 4.68 billion by 2030, at a CAGR of 23.03%. Growth is driven by increasing institutional adoption of digital assets and rising demand for secure, compliant portfolio management solutions. Enhanced regulatory clarity and innovative crypto investment products are also supporting market expansion.

The Blockchain Technology Market is expected to grow from USD 24.46 billion in 2025 to USD 299.54 billion by 2030, at a CAGR of 65.0%. Key drivers include the adoption of blockchain for secure financial transactions and supply chain transparency, along with increasing enterprise investments in decentralized applications and digital infrastructure.

Digital Currency Market

The Digital Currency Market is projected to grow from USD 34.38 billion in 2025 to USD 60.78 billion by 2030, at a CAGR of 12.07%. Growth is driven by increasing adoption of blockchain-based payment systems and the rising interest of institutional investors. Expanding use cases in cross-border payments and regulatory clarity are also supporting market expansion.

Get more insights: https://www.mordorintelligence.com/industry-reports/digital-currency-market?utm_source=abnewswire

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Media Contact

Company Name: Mordor Intelligence Private Limited

Contact Person: Jignesh Thakkar

Email:Send Email

Phone: +1 617-765-2493

Address:11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli

City: Hyderabad

State: Telangana 500008

Country: India

Website: https://www.mordorintelligence.com/