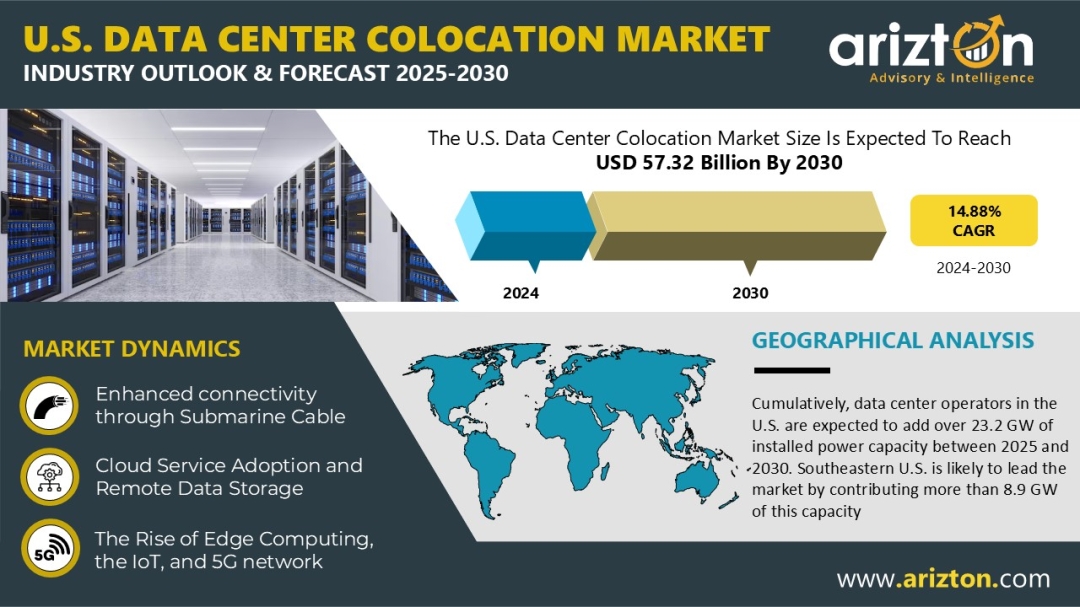

According to Arizton latest research report, U.S. data center colocation market is growing at a CAGR of 14.88% during 2024-2030.

Looking for More Information? Click: https://www.arizton.com/market-reports/us-data-center-colocation-market

Report Scope:

Market Size – Investment (2030): USD 57.32 Billion

Market Size – Investment (2024): USD 24.94 Billion

CAGR – Investment (2024-2030):14.88%

Market Size – Area (2030):18.20 Million Square Feet

Market Size – Power Capacity (2030):4,520 Mw

Market Size – Colocation Revenue (2030): USD 47.50 Billion

Historic Year:2021-2023

Base Year:2024

Forecast Year:2025-2030

Market Segmentation: Colocation Type, Infrastructure, Electrical Infrastructure, Mechanical Infrastructure, Cooling Systems, Cooling Techniques, General Construction, Tier Standard, And Geography

Largest Region by Investment: South-Eastern U.S.

Fastest Growing Region by Investment: North-Eastern U.S.

Geographical Analysis: South-Eastern U.S., South-Western U.S., Western U.S., Mid-Western U.S., And North-Eastern U.S.

U.S. Data Centers: World’s Established Colocation Market worldwide

The U.S. data center colocation market is witnessing strong growth, driven by surging demand for AI, cloud computing, and digital services across industries. As public and private sectors accelerate digital transformation, the need for high-performance computing, low-latency operations, and secure data storage is intensifying.

Leading operators, including Aligned Data Centers, Digital Realty, Equinix, CyrusOne, and STACK Infrastructure, are investing billions nationwide. The Southeastern U.S., led by Virginia, Georgia, and North Carolina, dominates with over 50% of installed power capacity, while the Northeastern U.S. is emerging as a key growth region. Notable expansions include Aligned’s Maryland Quantum Frederick Park campus, set to add 72 MW of capacity.

Construction costs remain high, with Silicon Valley reporting the highest at $12.80 per watt in 2024, a 5.35% increase from 2023, reflecting ongoing land, labor, and infrastructure challenges. Despite these challenges, strong demand and continued investment are set to drive robust growth and innovation across the U.S. colocation market.

Tracking U.S. Data Center Growth: Top Players’ Strategic Moves in 2025

- TierPoint Expansion: In April 2025, U.S.-based data center company TierPoint secured $500 million through an asset-backed securities issuance to fuel ongoing growth and expansion.

- Macquarie Investment: In January 2025, investment firm Macquarie announced plans to invest up to $5 billion in Applied Digital’s AI data center operations, starting with a $900 million injection into the Ellendale campus in North Dakota.

U.S. Data Centers Revolutionize Cooling with Smart Tech

U.S. data centers are embracing innovative power and cooling solutions to keep pace with the rapid growth of high-density AI and cloud workloads. As rack densities climb beyond 20–30 kW, traditional air-cooling falls short, prompting operators to adopt liquid cooling, modular power architectures, and energy reuse systems that balance performance, cost efficiency, and sustainability.

Leading the way, Compass Data centers is investing in HVO-fueled generators, which enhance reliability, extend fuel life, and cut greenhouse gas emissions without altering existing infrastructure. Meanwhile, Prometheus Hyperscale is rolling out long-duration energy storage (LDES) across its portfolio, offering over 20 years of sustainable, rare-earth-free power. These advancements are reshaping the U.S. data center colocation market, enabling smarter, more energy-efficient, and AI-ready infrastructure for the digital era.

How AI Workloads Are Empowering U.S. Data Centers

AI adoption is accelerating across the U.S., driving a surge in demand for AI-ready data centers and advanced digital infrastructure. In January 2025, the government launched the Stargate AI infrastructure initiative in collaboration with private partners, including OpenAI, to strengthen the country’s AI capabilities. Leading operators are responding by developing purpose-built, sustainable data centers, such as Edged’s facility in Mesa, Arizona, designed for highly efficient AI model training and inference.

As organizations increasingly rely on large volumes of high-quality, structured data to power automation and machine learning, the need for advanced, scalable, and energy-efficient infrastructure is reshaping the U.S. data center colocation market and creating new opportunities for innovation and investment.

Book the Free Sample @: https://www.arizton.com/market-reports/us-data-center-colocation-market

Prominent Data Center Investors

- Aligned Data Centers

- Compass Datacenters

- CyrusOne

- DataBank

- Digital Realty

- Equinix

- NTT DATA

- QTS Realty Trust

- STACK Infrastructure

- Vantage Data Centers

Other Data Center Investors

- Applied Digital

- American Tower

- AUBix

- Centersquare

- CloudHQ

- Cologix

- COPT Data Center Solutions

- Core Scientific

- Corscale Data Centers

- DartPoints

- DC BLOX

- DigiPowerX

- EdgeConneX

- EdgeCore Digital Infrastructure

- Element Critical

- Flexential

- Fifteenfortyseven Critical Systems Realty (1547)

- H5 Data Centers

- HostDime

- HUT 8

- Iron Mountain

- Netrality Data Centers

- Novva Data Centers

- PheonixNAP

- PowerHouse Data Centers

- Prime Data Centers

- Sabey Data Centers

- Skybox Datacenters

- Stream Data Centers

- Switch

- T5 Data Centers

- TierPoint

- Yondr

- 365 Data Centers

- 5C Data Centers

New Entrants

- Ardent Data Centers

- CloudBurst Data Center

- Colovore

- Crane Data Centers

- Edged

- NE Edge

- Prometheus Hyperscale

- Quantum Loophole

- Rowan Digital Infrastructure

- Tract

Market Segmentation & Forecast

Colocation Type

- Retail Colocation

- Wholesale Colocation

Infrastructure

- Electrical Infrastructure

- Mechanical Infrastructure

- General Construction

Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches & Switchgear

- PDUs

- Other Electrical Infrastructure

Mechanical Infrastructure

- Cooling Systems

- Racks

- Other Mechanical Infrastructure

Cooling Systems

- CRAC & CRAH Units

- Chiller Units

- Cooling Towers, Condensers & Dry Coolers

- Other Cooling Units

Cooling Techniques

- Air-based Cooling

- Liquid-based Cooling

General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression

- Physical Security

- DCIM

Tier Standard

- Tier I & II

- Tier III

- Tier IV

Geography

- Southeastern US

- Southwestern US

- Western US

- Midwestern US

- Northeastern US

Other Related Reports that Might be of Your Business Requirement

U.S. Data Center Market Landscape 2025-2030

https://www.arizton.com/market-reports/us-data-center-market-analysis

U.S. Data Center Construction Market - Industry Outlook & Forecast 2025-2030

https://www.arizton.com/market-reports/united-states-data-center-construction-market-2024

What Key Findings Will Our Research Analysis Reveal?

- How big is the U.S. data center colocation market?

- What is the estimated market size in terms of area in the U.S. data center colocation market by 2030?

- What is the growth rate of the U.S. data center colocation market?

- How many MW of power capacity is expected to reach the U.S. data center colocation market by 2030?

- What are the key trends in the U.S. data center colocation market?

Why Arizton?

100% Customer Satisfaction

24x7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton's report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email:Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/us-data-center-colocation-market