REZDIFFRA: A First-in-Class Therapy for MASH

REZDIFFRA is an oral, liver-directed thyroid hormone receptor-β (THR-β) agonist that targets key drivers of MASH, reducing liver fat accumulation and fibrosis progression. In the pivotal Phase III MAESTRO-NASH trial, REZDIFFRA achieved both primary endpoints, fibrosis reduction and MASH resolution, while also improving liver stiffness, liver enzymes, atherogenic lipids, and patient-reported quality of life. At one year, 91% of patients receiving 100 mg of REZDIFFRA showed improvement or stabilization of liver stiffness as measured by non-invasive VCTE.

Initially approved in the US in March 2024, REZDIFFRA’s European approval solidifies Madrigal’s first-to-market leadership in both regions. Madrigal plans a phased European launch starting with Germany in Q4 2025, with market access timelines depending on reimbursement processes in individual countries.

Discover how REZDIFFRA is transforming MASH treatment @ REZDIFFRA Therapy

Significance of REZDIFFRA Approval for the MASH Market

MASH is a progressive form of non-alcoholic fatty liver disease (NAFLD), associated with significant fat accumulation and fibrosis that can progress to cirrhosis and liver-related mortality if untreated. Europe currently has an estimated 370,000 diagnosed patients with moderate to advanced fibrosis, a population with high unmet medical need. With no prior approved therapies in Europe, patients with moderate to advanced fibrosis faced limited options. Despite this milestone, Madrigal’s stock in the US closed 2.2% down at $379.55 per share on 19 August, as investors reacted to unrelated news—Viking’s oral GLP-1RA drug posted disappointing trial results the same day, while Madrigal recently invested $2 billion in an oral GLP-1RA licensing deal.

DelveInsight’s Analytical Overview of REZDIFFRA

Madrigal’s REZDIFFRA has established itself as the first FDA-approved and now EU-approved therapy for MASH, targeting patients with fibrosis stages F2 to F4. The ongoing MAESTRO-NASH OUTCOMES trial in compensated cirrhosis is expected to further strengthen its market position by providing long-term, disease-modifying outcomes data.

Early adoption has been encouraging, with full-year 2024 net sales projected at USD 177–180 million and over 11,800 patients treated by the end of the year. However, the MASH treatment landscape is competitive and rapidly evolving, introducing uncertainties around long-term growth.

European Market Strategy: Madrigal’s decision to independently commercialize REZDIFFRA across Europe provides full value capture but also introduces challenges, including navigating fragmented healthcare systems and country-specific reimbursement processes. EMA approval is expected mid-2025, with the first country launch in Germany planned for late 2025.

Clinical Efficacy and Competitive Landscape: REZDIFFRA has shown robust efficacy in reducing liver inflammation and fibrosis, particularly in patients with advanced fibrosis (F2–F4), and is recognized for its histological benefits. Long-term safety and efficacy, especially in combination with emerging GLP-1 receptor agonists, remain under evaluation.

MASH Patient Pool

According to DelveInsight, there were approximately 215 million prevalent cases of MASLD (formerly NAFLD) in the 7MM in 2024, including ~30 million cases of MASH, of which ~8 million were diagnosed. The US accounted for the highest number of diagnosed cases (~5 million), projected to increase through 2034. In EU4 and the UK, there were ~3 million diagnosed cases, with Germany leading (~795,000), followed by Italy (~630,000) and Spain (~350,000).

Know the full patient pool of MASH @ MASH Epidemiological Trends

Competitive Landscape: REZDIFFRA vs Emerging Therapies

Madrigal now faces emerging competition from Novo Nordisk’s WEGOVY, which was approved by the FDA for MASH with moderate to advanced fibrosis in August 2025 and is currently under EU regulatory review. Unlike WEGOVY, which acts through GLP-1 receptor agonism, REZDIFFRA directly targets liver pathology, potentially offering a differentiated mechanism of action. Experts note that REZDIFFRA’s early approval provides a first-mover advantage in Europe, although patient and physician familiarity with WEGOVY could influence adoption.

Several promising pipeline candidates are well-positioned to gain significant market share by 2034. These late-stage drugs are pegozafermin (89bio), Lanifibranor (Inventiva Pharma), and Efruxifermin (Akero Therapeutics).

Pegozafermin (89bio): Pegozafermin is a targeted FGF21 agonist designed to regulate glucose and lipid metabolism, showing potential therapeutic effects in MASH. The compound is being evaluated in two Phase III trials: ENLIGHTEN-Fibrosis for non-cirrhotic MASH patients (F2-F3) and ENLIGHTEN-Cirrhosis for compensated cirrhotic MASH patients (F4), both initiated in March and May 2024, with global patient enrollment ongoing. In January 2025, 89bio highlighted strong progress in its Phase III programs and expects to report topline data from its first Phase III trial in the second half of 2025.

Lanifibranor (Inventiva): Lanifibranor is an orally available small molecule that simultaneously targets all three PPAR isoforms, PPARα, PPARδ, and PPARγ, delivering combined anti-fibrotic, anti-inflammatory, and metabolic benefits. It is the only clinical-stage candidate with this triple PPAR agonist profile, positioning it uniquely in the MASH pipeline. Currently, Lanifibranor is being evaluated in the Phase III NATiV3 trial for efficacy and safety in adult patients with MASH and fibrosis stages F2-F3, followed by an active treatment extension. In October 2024, Inventiva reported a positive recommendation from the Data Monitoring Committee (DMC) to continue the trial without protocol modifications, confirming Lanifibranor’s favorable safety and tolerability profile.

Efruxifermin (Akero Therapeutics): Efruxifermin (EFX) is Akero Therapeutics’ lead candidate for MASH, a differentiated Fc-FGF21 fusion protein designed to replicate the balanced activity of native FGF21, a hormone that regulates metabolism and reduces cellular stress. EFX offers convenient once-weekly subcutaneous dosing and is being evaluated in pre-cirrhotic MASH (F2-F3) and compensated cirrhosis due to MASH (F4). In May 2025, at the EASL Congress, Phase IIb SYMMETRY data demonstrated that EFX significantly improved fibrosis without worsening MASH in compensated cirrhosis, highlighting its disease-modifying potential. Additionally, in January 2025, Akero completed patient enrollment for the Phase III SYNCHRONY Real-World study (F1-F4), with topline results expected in the first half of 2026.

Future Market Dynamics and Risks:

-

GLP-1 Agonists: Drugs like Eli Lilly’s Zepbound may impact REZDIFFRA’s market share due to off-label metabolic benefits in MASH.

-

Other Pipeline Candidates: Therapies such as Inventiva’s lanifibranor and Akero’s efruxifermin (EFX) provide direct competition with differentiated mechanisms of action.

Other than these, the promising therapies in the pipeline include VK2809 (Viking Therapeutics), efimosfermin alfa (BOS-580, Boehringer Ingelheim), denifanstat (Saniona), icosabutate (Inventiva), and several others. These candidates employ diverse mechanisms of action, targeting different aspects, and are expected to play a key role in shaping the MASH treatment landscape over the next decade.

Discover the latest options shaping the MASH therapy landscape @ MASH Treatments

Where is the MASH Market Headed?

DelveInsight estimates that the MASH market in the 7MM was valued at ~USD 2 billion in 2024 and is projected to grow at a significant CAGR through 2034, reaching a substantial market size by the end of the forecast period. This growth is primarily driven by the emergence of novel therapies, expanding healthcare access, and the rising prevalence of MASLD and MASH, collectively creating increased demand for effective, disease-modifying treatments.

With REZDIFFRA’s EU approval and Novo Nordisk’s blockbuster drug WEGOVY, recently approved by the FDA for MASH with moderate to advanced liver fibrosis, providing direct competition to REZDIFFRA, the market is expected to be highly dynamic and poised for significant expansion.

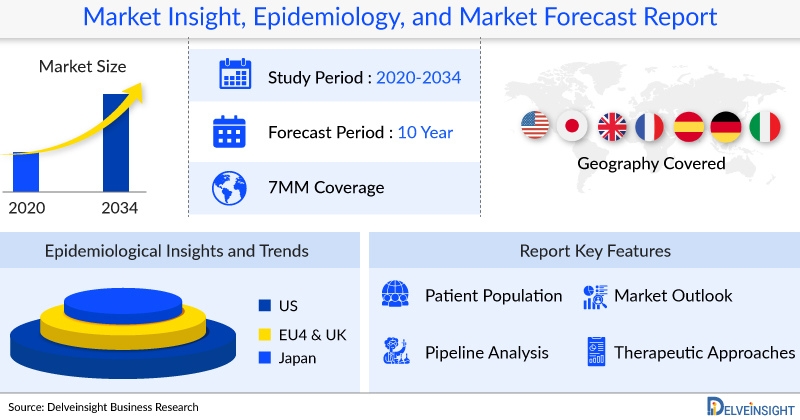

DelveInsight’s latest report, titled MASH Market Insight, Epidemiology, and Market Forecast – 2034, provides a detailed understanding of the market dynamics, competitive landscape, and epidemiological trends shaping the MASH therapeutic space. The report offers comprehensive country-specific insights into MASH treatment guidelines, patient population, and market uptake potential, helping stakeholders identify growth opportunities and assess competitive positioning.

Stay updated on emerging MASH therapies and pipeline innovations @ MASH Research Hub

Epidemiology Segmentation Included in the Report:

-

Total Prevalent Cases of MASLD (formerly NAFLD)

-

Total Prevalent Cases of MASH

-

Total Diagnosed Prevalent Cases of MASH

-

Severity-specific Diagnosed Prevalent Cases of MASH

The report provides an edge while developing business strategies by understanding trends shaping and driving the 7MM MASH market. Highlights include:

-

10-year Forecast

-

7MM Analysis

-

Epidemiology-based Market Forecasting

-

Historical and Forecasted Market Analysis upto 2034

-

Emerging Drug Market Uptake

-

Peak Sales Analysis

-

Key Cross Competition Analysis

-

Industry Expert’s Opinion

-

Access and Reimbursement

By accessing the MASH market report, stakeholders can understand patient journeys, KOL opinions on emerging treatment paradigms, and the factors driving market growth. The report also identifies mitigating factors and strategies to strengthen positioning in the MASH therapeutic space, making it a vital resource for decision-makers aiming to capitalize on this fast-evolving market.

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Media Contact

Company Name: DelveInsight

Contact Person: Jatin Vimal

Email:Send Email

Phone: +14699457679

Address:304 S. Jones Blvd #2432

City: Las Vegas

State: Nevada

Country: United States

Website: https://www.delveinsight.com/